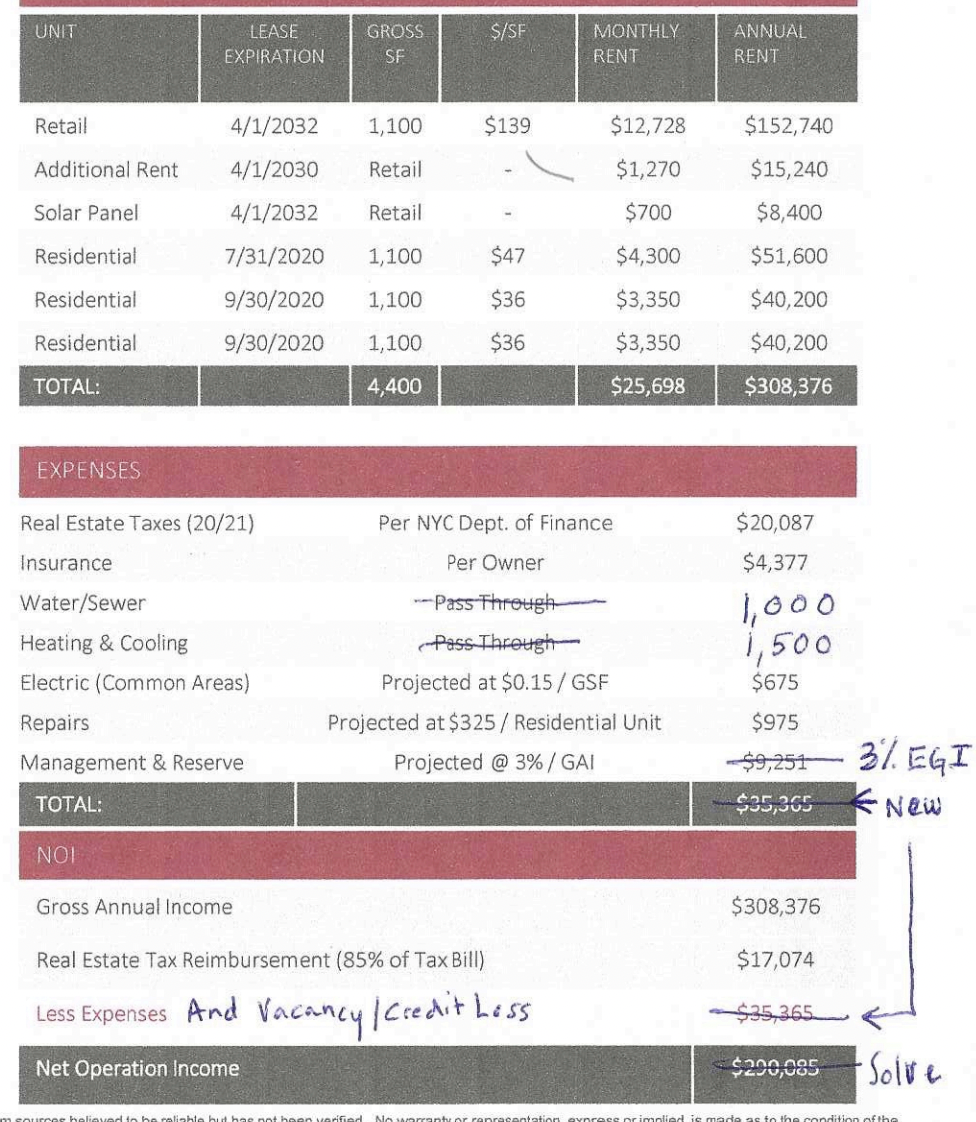

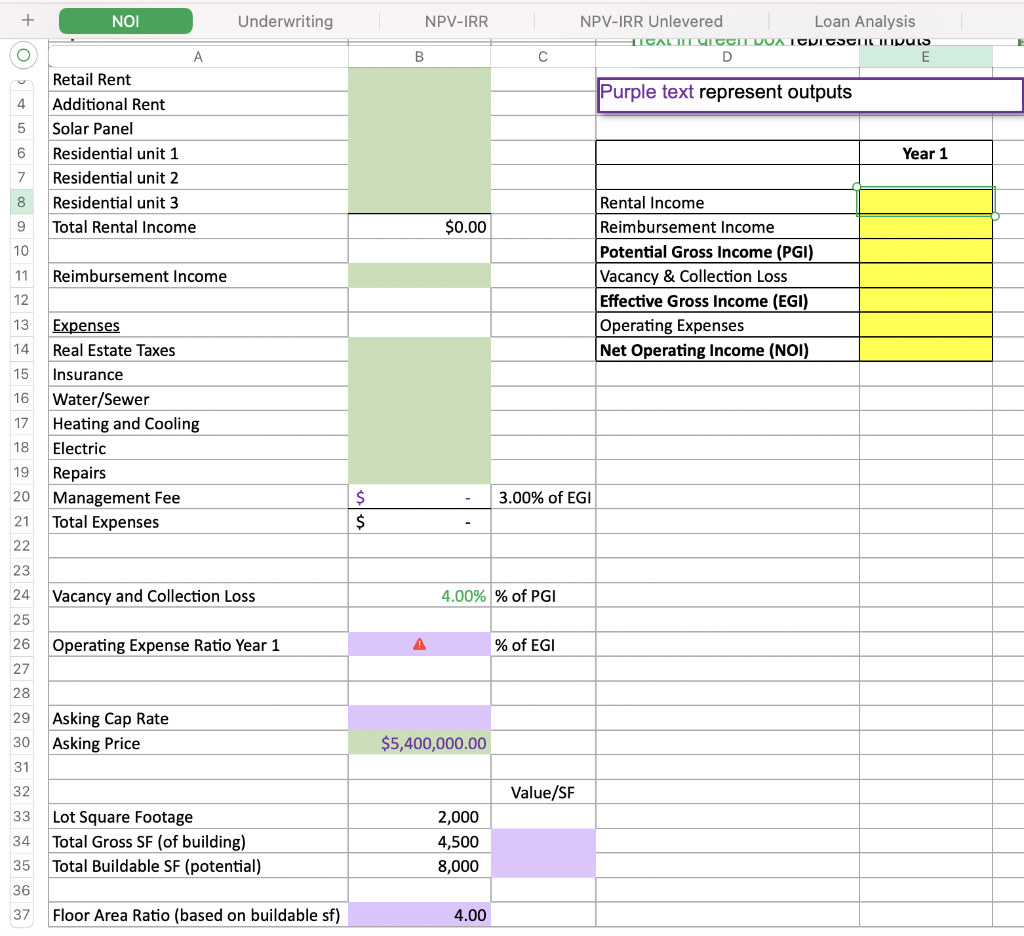

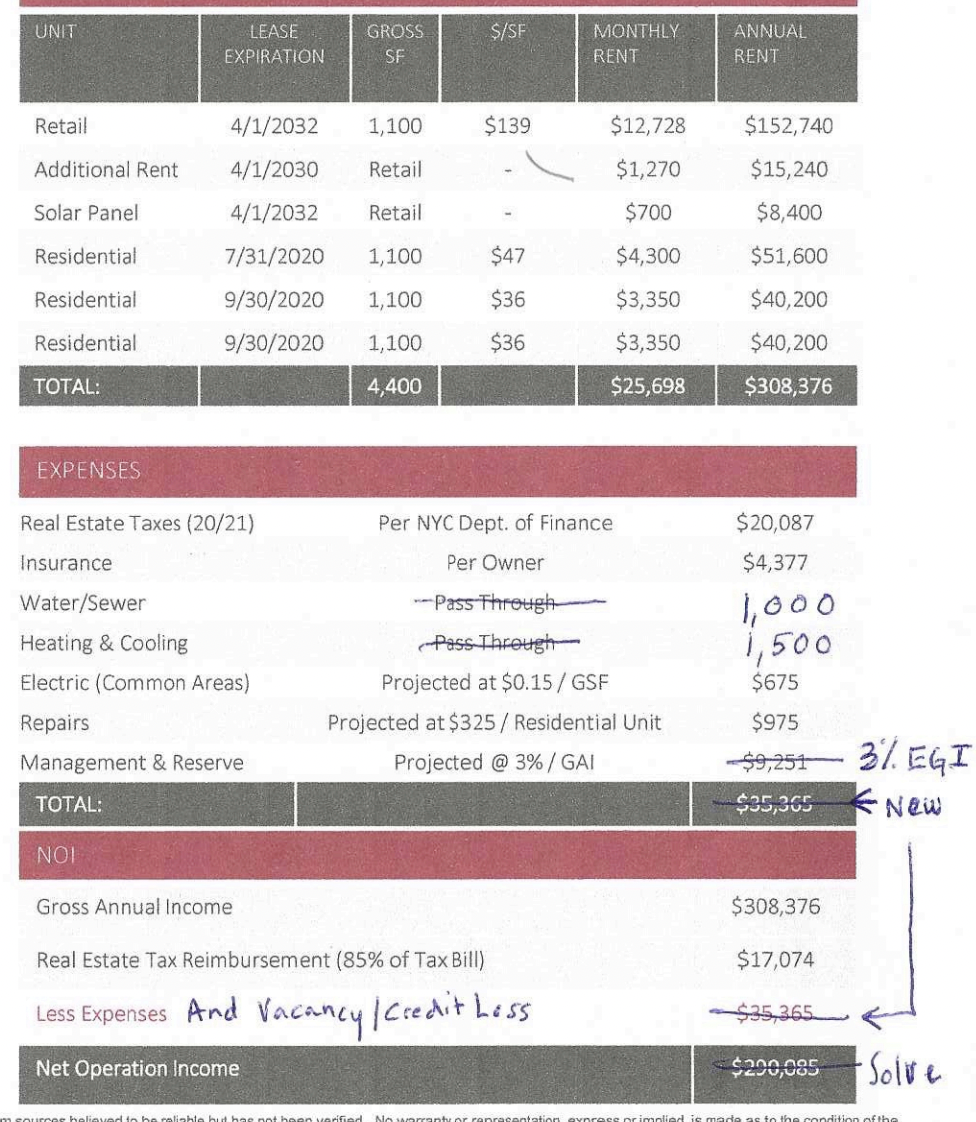

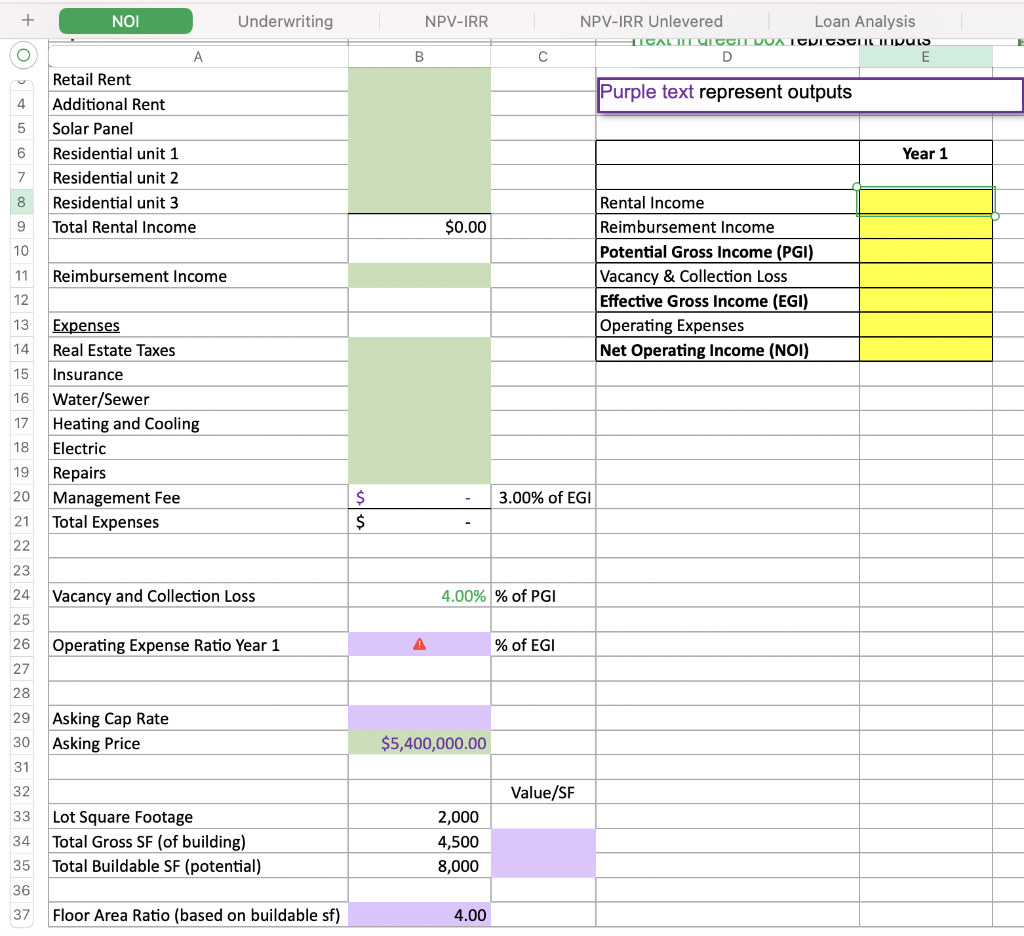

Do not use the management fee amount given, you will calculate the Fee based on 3% of EGI.

Vacancy and Collection loss are estimated to be 4% combined.

What is the NOI for Year 1?

UNIT $/SF LEASE EXPIRATION GROSS SE MONTHLY RENT ANNUAL RENT Retail 4/1/2032 1,100 $139 $12,728 $152,740 Additional Rent 4/1/2030 Retail $1,270 $15,240 Solar Panel 4/1/2032 Retail $700 $8,400 $51,600 Residential 1,100 $47 $4,300 Residential 7/31/2020 9/30/2020 9/30/2020 1,100 $36 $3,350 $40,200 Residential 1,100 $36 $3,350 $40,200 TOTAL: 4,400 $25,698 $308,376 EXPENSES Real Estate Taxes (20/21) Per NYC Dept. of Finance Insurance Per Owner Water/Sewer Heating & Cooling Electric (Common Areas) ---Pass through Pass Through Projected at $0.15/ GSF Projected at $325 / Residential Unit Projected @ 3% / GAI $20,087 $4,377 1,000 1,500 $675 $975 Repairs Management & Reserve $9,251 3%EGI E New TOTAL: $35,365 NOI Gross Annual Income $308,376 Real Estate Tax Reimbursement (85% of Tax Bill) $17,074 Less Expenses And Vacancy, credit Less $35,365 Net Operation Income $290,085 Solve helieved to be a ble hun haethaan verified Moreatv tiaravneserinnlied is made as to the condition the + NOI Underwriting NPV-IRR NPV-IRR Unlevered Loan Analysis HICAL III CICEI DUA IEVIESCI IL PULS D E B Purple text represent outputs 4 5 A Retail Rent Additional Rent Solar Panel Residential unit 1 Residential unit 2 Residential unit 3 Total Rental Income 6 Year 1 7 8 9 $0.00 10 11 Reimbursement Income Rental Income Reimbursement Income Potential Gross Income (PGI) Vacancy & Collection Loss Effective Gross Income (EGI) Operating Expenses Net Operating Income (NOI) 12 13 14 15 16 17 Expenses Real Estate Taxes Insurance Water/Sewer Heating and Cooling Electric Repairs Management Fee Total Expenses 18 19 20 3.00% of EGI $ $ 21 22 23 24 Vacancy and Collection Loss 4.00% % of PGI 25 26 Operating Expense Ratio Year 1 A % of EGI 27 28 29 Asking Cap Rate Asking Price 30 $5,400,000.00 31 32 Value/SF 33 2,000 34 Lot Square Footage Total Gross SF (of building) Total Buildable SF (potential) 4,500 35 8,000 36 37 Floor Area Ratio (based on buildable sf) 4.00 UNIT $/SF LEASE EXPIRATION GROSS SE MONTHLY RENT ANNUAL RENT Retail 4/1/2032 1,100 $139 $12,728 $152,740 Additional Rent 4/1/2030 Retail $1,270 $15,240 Solar Panel 4/1/2032 Retail $700 $8,400 $51,600 Residential 1,100 $47 $4,300 Residential 7/31/2020 9/30/2020 9/30/2020 1,100 $36 $3,350 $40,200 Residential 1,100 $36 $3,350 $40,200 TOTAL: 4,400 $25,698 $308,376 EXPENSES Real Estate Taxes (20/21) Per NYC Dept. of Finance Insurance Per Owner Water/Sewer Heating & Cooling Electric (Common Areas) ---Pass through Pass Through Projected at $0.15/ GSF Projected at $325 / Residential Unit Projected @ 3% / GAI $20,087 $4,377 1,000 1,500 $675 $975 Repairs Management & Reserve $9,251 3%EGI E New TOTAL: $35,365 NOI Gross Annual Income $308,376 Real Estate Tax Reimbursement (85% of Tax Bill) $17,074 Less Expenses And Vacancy, credit Less $35,365 Net Operation Income $290,085 Solve helieved to be a ble hun haethaan verified Moreatv tiaravneserinnlied is made as to the condition the + NOI Underwriting NPV-IRR NPV-IRR Unlevered Loan Analysis HICAL III CICEI DUA IEVIESCI IL PULS D E B Purple text represent outputs 4 5 A Retail Rent Additional Rent Solar Panel Residential unit 1 Residential unit 2 Residential unit 3 Total Rental Income 6 Year 1 7 8 9 $0.00 10 11 Reimbursement Income Rental Income Reimbursement Income Potential Gross Income (PGI) Vacancy & Collection Loss Effective Gross Income (EGI) Operating Expenses Net Operating Income (NOI) 12 13 14 15 16 17 Expenses Real Estate Taxes Insurance Water/Sewer Heating and Cooling Electric Repairs Management Fee Total Expenses 18 19 20 3.00% of EGI $ $ 21 22 23 24 Vacancy and Collection Loss 4.00% % of PGI 25 26 Operating Expense Ratio Year 1 A % of EGI 27 28 29 Asking Cap Rate Asking Price 30 $5,400,000.00 31 32 Value/SF 33 2,000 34 Lot Square Footage Total Gross SF (of building) Total Buildable SF (potential) 4,500 35 8,000 36 37 Floor Area Ratio (based on buildable sf) 4.00