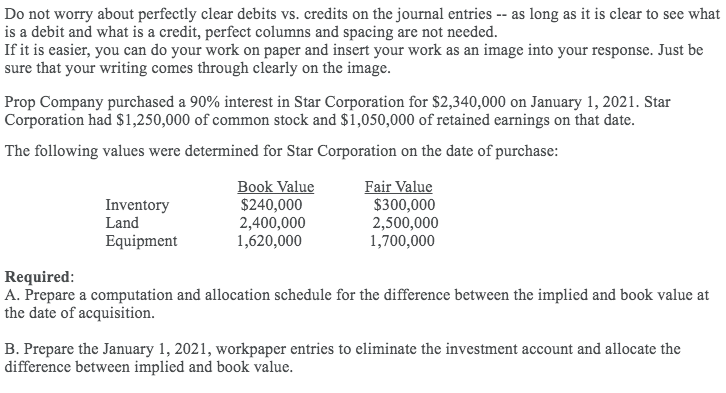

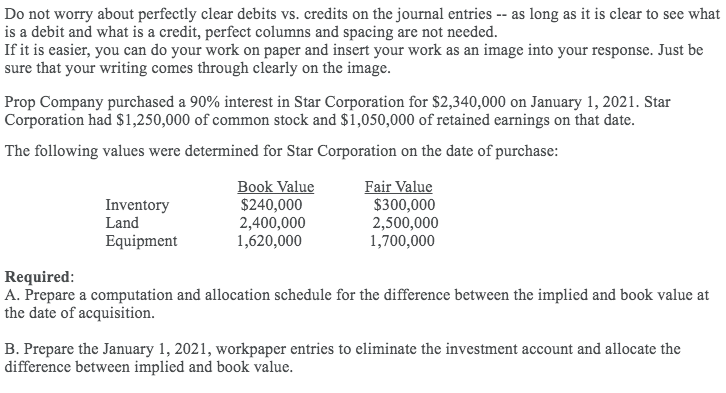

Do not worry about perfectly clear debits vs. credits on the journal entries -- as long as it is clear to see what is a debit and what is a credit, perfect columns and spacing are not needed. If it is easier, you can do your work on paper and insert your work as an image into your response. Just be sure that your writing comes through clearly on the image. Prop Company purchased a 90% interest in Star Corporation for $2,340,000 on January 1, 2021. Star Corporation had $1,250,000 of common stock and $1,050,000 of retained earnings on that date. The following values were determined for Star Corporation on the date of purchase: Book Value Fair Value Inventory $240,000 $300,000 Land 2,400,000 2,500,000 Equipment 1,620,000 1,700,000 Required: A. Prepare a computation and allocation schedule for the difference between the implied and book value at the date of acquisition. B. Prepare the January 1, 2021, workpaper entries to eliminate the investment account and allocate the difference between implied and book value. Do not worry about perfectly clear debits vs. credits on the journal entries -- as long as it is clear to see what is a debit and what is a credit, perfect columns and spacing are not needed. If it is easier, you can do your work on paper and insert your work as an image into your response. Just be sure that your writing comes through clearly on the image. Prop Company purchased a 90% interest in Star Corporation for $2,340,000 on January 1, 2021. Star Corporation had $1,250,000 of common stock and $1,050,000 of retained earnings on that date. The following values were determined for Star Corporation on the date of purchase: Book Value Fair Value Inventory $240,000 $300,000 Land 2,400,000 2,500,000 Equipment 1,620,000 1,700,000 Required: A. Prepare a computation and allocation schedule for the difference between the implied and book value at the date of acquisition. B. Prepare the January 1, 2021, workpaper entries to eliminate the investment account and allocate the difference between implied and book value