do number 2

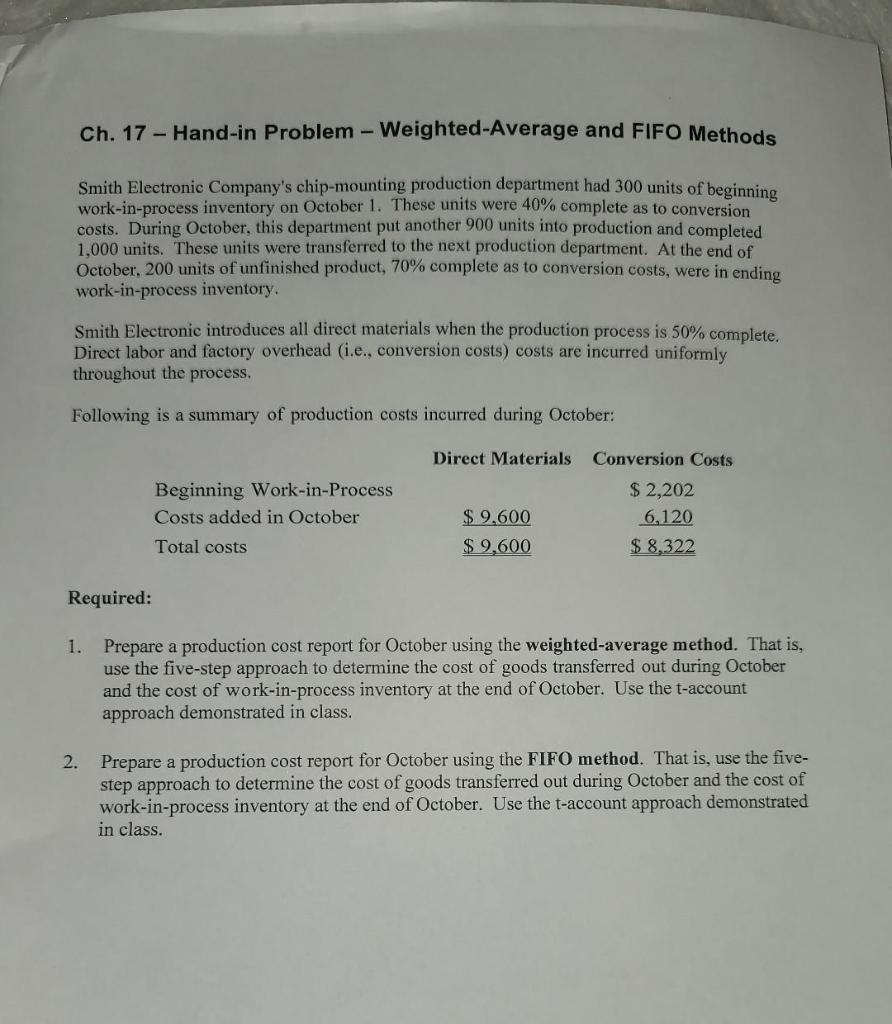

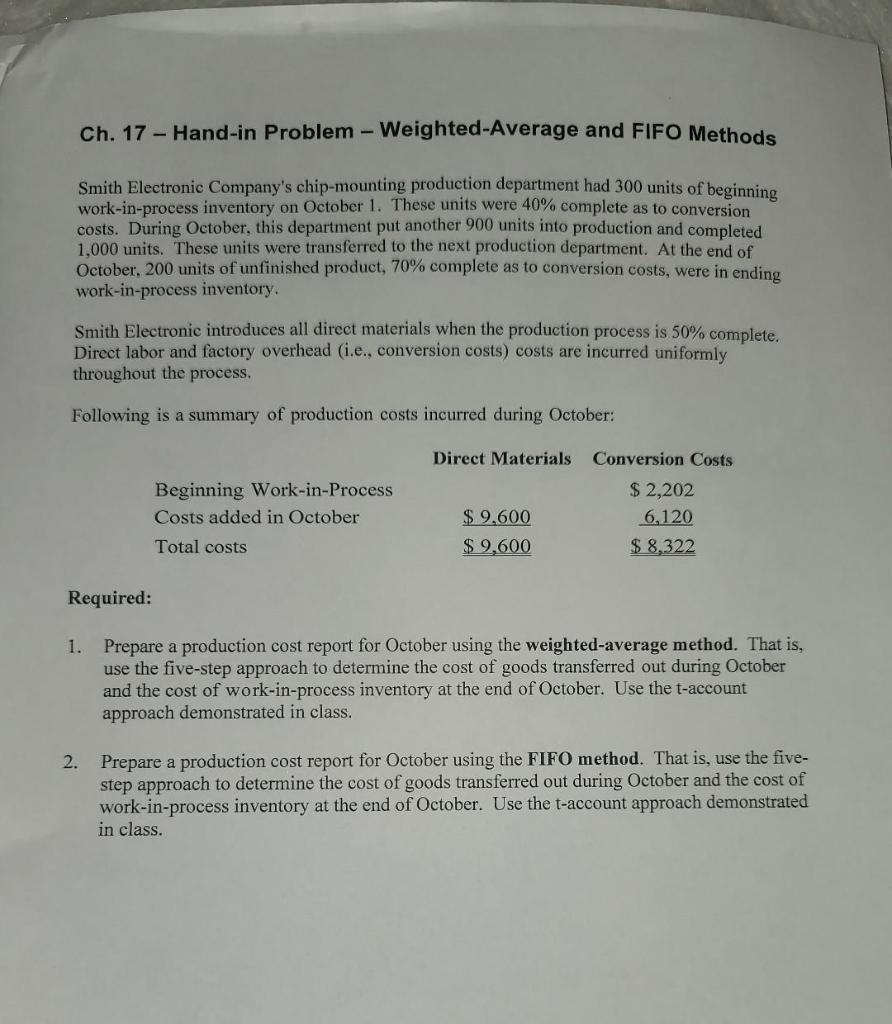

Ch. 17 - Hand-in Problem - Weighted-Average and FIFO Methods Smith Electronic Company's chip-mounting production department had 300 units of beginning work-in-process inventory on October 1. These units were 40% complete as to conversion costs. During October, this department put another 900 units into production and completed 1,000 units. These units were transferred to the next production department. At the end of October, 200 units of unfinished product, 70% complete as to conversion costs, were in ending work-in-process inventory. Smith Electronic introduces all direct materials when the production process is 50% complete. Direct labor and factory overhead (i.e., conversion costs) costs are incurred uniformly throughout the process. Following is a summary of production costs incurred during October: Required: 1. Prepare a production cost report for October using the weighted-average method. That is, use the five-step approach to determine the cost of goods transferred out during October and the cost of work-in-process inventory at the end of October. Use the t-account approach demonstrated in class. 2. Prepare a production cost report for October using the FIFO method. That is, use the fivestep approach to determine the cost of goods transferred out during October and the cost of work-in-process inventory at the end of October. Use the t-account approach demonstrated in class. Ch. 17 - Hand-in Problem - Weighted-Average and FIFO Methods Smith Electronic Company's chip-mounting production department had 300 units of beginning work-in-process inventory on October 1. These units were 40% complete as to conversion costs. During October, this department put another 900 units into production and completed 1,000 units. These units were transferred to the next production department. At the end of October, 200 units of unfinished product, 70% complete as to conversion costs, were in ending work-in-process inventory. Smith Electronic introduces all direct materials when the production process is 50% complete. Direct labor and factory overhead (i.e., conversion costs) costs are incurred uniformly throughout the process. Following is a summary of production costs incurred during October: Required: 1. Prepare a production cost report for October using the weighted-average method. That is, use the five-step approach to determine the cost of goods transferred out during October and the cost of work-in-process inventory at the end of October. Use the t-account approach demonstrated in class. 2. Prepare a production cost report for October using the FIFO method. That is, use the fivestep approach to determine the cost of goods transferred out during October and the cost of work-in-process inventory at the end of October. Use the t-account approach demonstrated in class