do on excel please

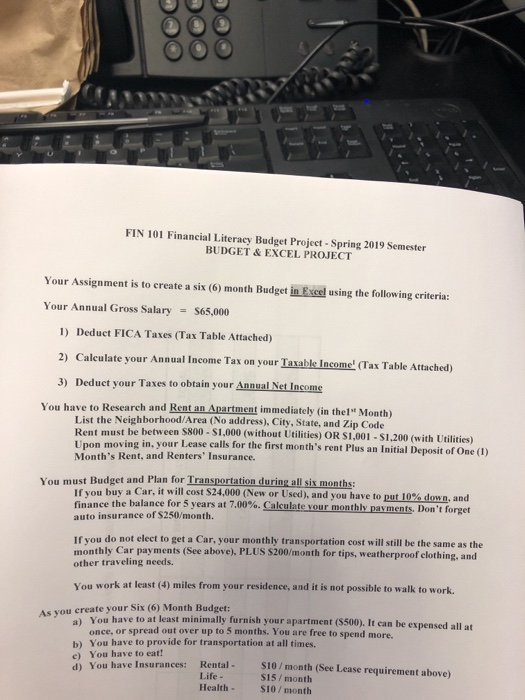

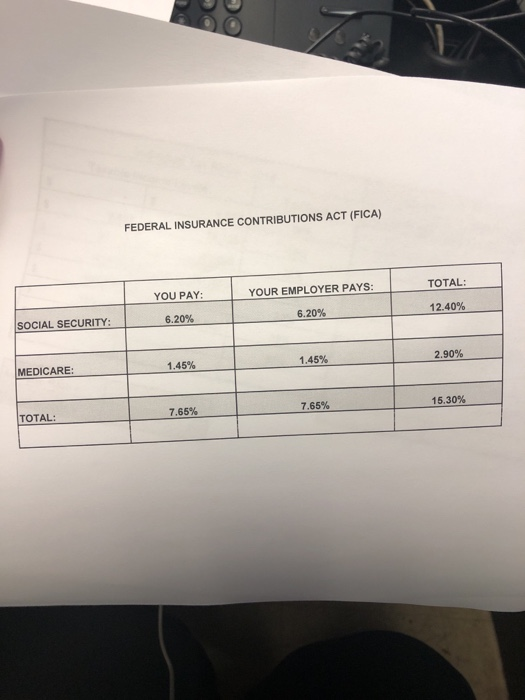

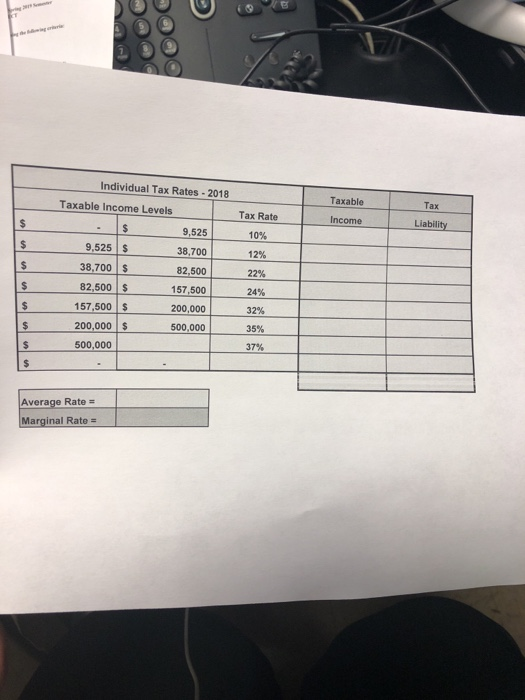

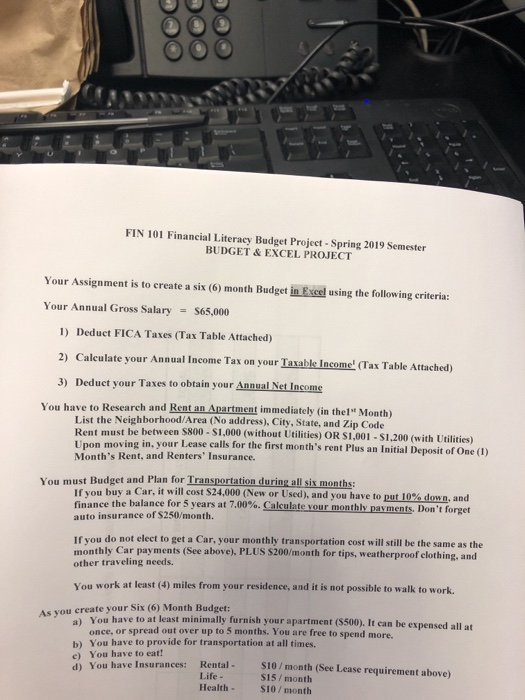

FIN 101 Financial Literacy Budget Project -Spring 2019 Semester BUDGET&EXCEL PROJECT Your Assignment is to create a six (6) month Budget nEud using the following criteria Your Annual Gross Salary S65,000 1) Deduct FICA Taxes (Tax Table Attached) 2) Caleulate your Annual Income Tax on your Taxable Income! (Tax Table Attached) 3) Deduct your Taxes to obtain your Annual Net Income You have to Research and Rent an Apartment immediately (in thel* Month) List the Neighborhood/Area (No address), City, State, and Zip Code Rent must be between S800-S1,000 (without Utilities) OR $1,001-S1.200 (with Utilities) Upon moving in, your Lease calls for the first month's rent Plus an Initial Deposit of One () Month's Rent, and Renters' Insurance. You must Budget and Plan for Transportation during all six months If you buy a Car, it will cost S24.000 (New or Used), and you have to pat 10% down, and finance the balance for 5 years at 7.00%. auto insurance of S250/month. Calculate your monthly payments, Don't forget If you do not elect to get a Car, your monthly transportation cost will still be the same as the monthly Car payments (See above), PLUS $200/month for tips, weatherproof clothing, and other traveling needs. You work at least (4) miles from your residence, and it is not possible to walk to work. As you create your Six (6) Month Budget: a) You have to at least minimally furnish your apartment ($500). It can be expensed all at once, or spread out over up to 5 months. You are free to spend more. You have to provide for transportation at all times. You have to eat! b) c) d) You have Insurances: Rental- Rental$10/month (See Lease requirement above) Life $15/month S10/ month Health - FEDERAL INSURANCE CONTRIBUTIONS ACT (FICA) YOU PAY YOUR EMPLOYER PAYS TOTAL: SOCIAL SECURITY: 6.20% 6.20% 12.40% MEDICARE: 1.45% 1.45% 2.90% TOTAL: 7.65% 7.65% 15.30% Individual Tax Rates -2018 Taxable Tax Taxable Income Levels Tax Rate 10% 12% 22% 24% 32% 35% 37% Liability Income 9,525 38,700 82,500 157.500 200,000 500,000 9,525 S 38,700 $ 82,500 S 157,500 $ 200,000 $ 500,000 Average Rate Marginal Rate FIN 101 Financial Literacy Budget Project -Spring 2019 Semester BUDGET&EXCEL PROJECT Your Assignment is to create a six (6) month Budget nEud using the following criteria Your Annual Gross Salary S65,000 1) Deduct FICA Taxes (Tax Table Attached) 2) Caleulate your Annual Income Tax on your Taxable Income! (Tax Table Attached) 3) Deduct your Taxes to obtain your Annual Net Income You have to Research and Rent an Apartment immediately (in thel* Month) List the Neighborhood/Area (No address), City, State, and Zip Code Rent must be between S800-S1,000 (without Utilities) OR $1,001-S1.200 (with Utilities) Upon moving in, your Lease calls for the first month's rent Plus an Initial Deposit of One () Month's Rent, and Renters' Insurance. You must Budget and Plan for Transportation during all six months If you buy a Car, it will cost S24.000 (New or Used), and you have to pat 10% down, and finance the balance for 5 years at 7.00%. auto insurance of S250/month. Calculate your monthly payments, Don't forget If you do not elect to get a Car, your monthly transportation cost will still be the same as the monthly Car payments (See above), PLUS $200/month for tips, weatherproof clothing, and other traveling needs. You work at least (4) miles from your residence, and it is not possible to walk to work. As you create your Six (6) Month Budget: a) You have to at least minimally furnish your apartment ($500). It can be expensed all at once, or spread out over up to 5 months. You are free to spend more. You have to provide for transportation at all times. You have to eat! b) c) d) You have Insurances: Rental- Rental$10/month (See Lease requirement above) Life $15/month S10/ month Health - FEDERAL INSURANCE CONTRIBUTIONS ACT (FICA) YOU PAY YOUR EMPLOYER PAYS TOTAL: SOCIAL SECURITY: 6.20% 6.20% 12.40% MEDICARE: 1.45% 1.45% 2.90% TOTAL: 7.65% 7.65% 15.30% Individual Tax Rates -2018 Taxable Tax Taxable Income Levels Tax Rate 10% 12% 22% 24% 32% 35% 37% Liability Income 9,525 38,700 82,500 157.500 200,000 500,000 9,525 S 38,700 $ 82,500 S 157,500 $ 200,000 $ 500,000 Average Rate Marginal Rate