Answered step by step

Verified Expert Solution

Question

1 Approved Answer

DO PART 2 A AND 3 A I NEED THE CORRECT ANSWERS!! a . A suitable location in a large shopping mall can be rented

DO PART A AND A I NEED THE CORRECT ANSWERS!!

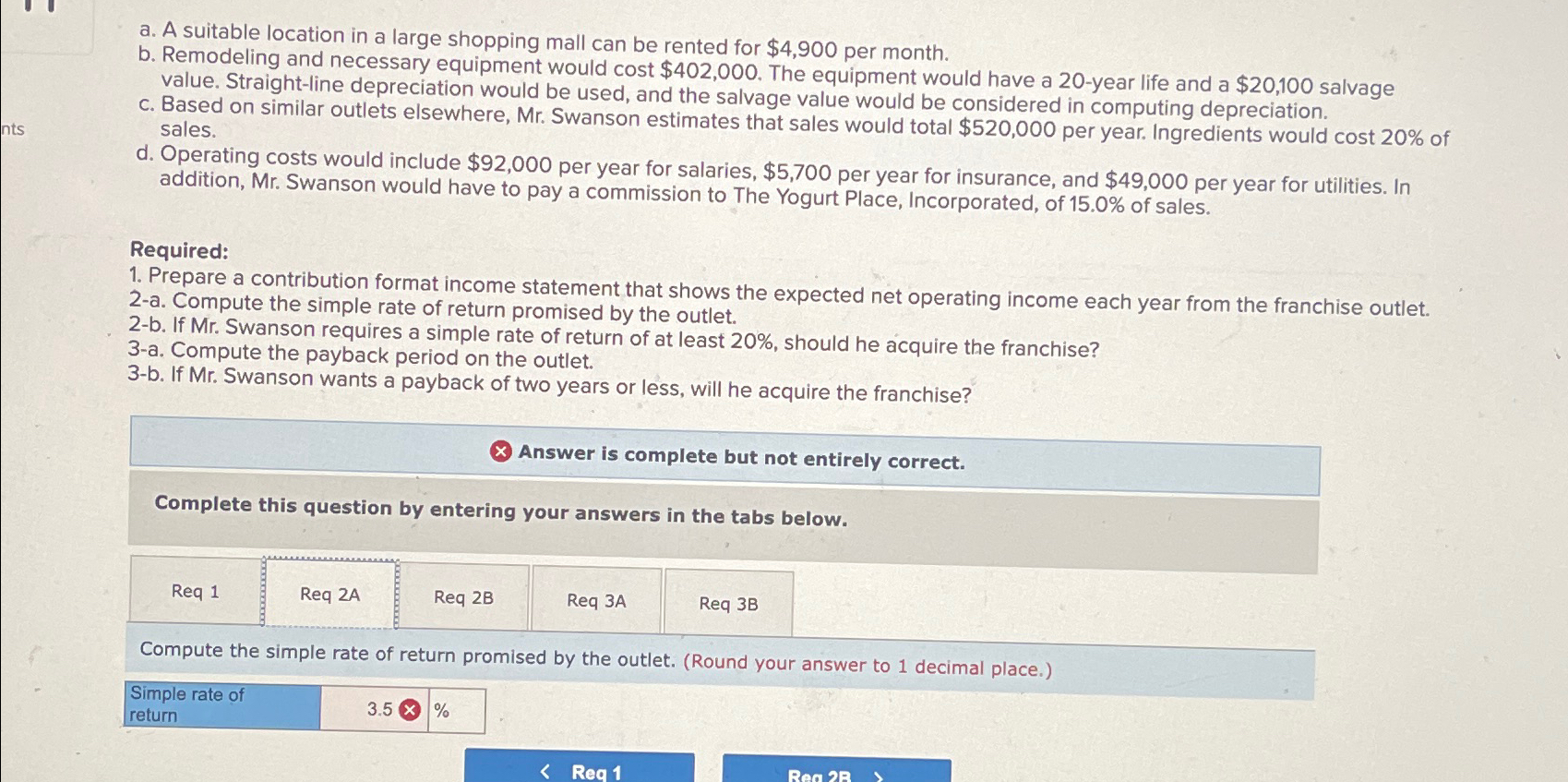

a A suitable location in a large shopping mall can be rented for $ per month.

b Remodeling and necessary equipment would cost $ The equipment would have a year life and a $ salvage value. Straightline depreciation would be used, and the salvage value would be considered in computing depreciation.

c Based on similar outlets elsewhere, Mr Swanson estimates that sales would total $ per year. Ingredients would cost of sales.

d Operating costs would include $ per year for salaries, $ per year for insurance, and $ per year for utilities. In addition, Mr Swanson would have to pay a commission to The Yogurt Place, Incorporated, of of sales.

Required:

Prepare a contribution format income statement that shows the expected net operating income each year from the franchise outlet.

a Compute the simple rate of return promised by the outlet.

b If Mr Swanson requires a simple rate of return of at least should he acquire the franchise?

a Compute the payback period on the outlet.

b If Mr Swanson wants a payback of two years or less, will he acquire the franchise?

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Req Req

Compute the simple rate of return promised by the outlet. Round your answer to decimal place.

tabletableSimple rate ofreturn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started