Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do Problem 7 of chapter 5 and answer the following?? (f) Which firm has the highest financial multiplier ? (g) Which firm has the highest

Do Problem 7 of chapter 5 and answer the following??

(f) Which firm has the highest financial multiplier ?

(g) Which firm has the highest operating margin ?

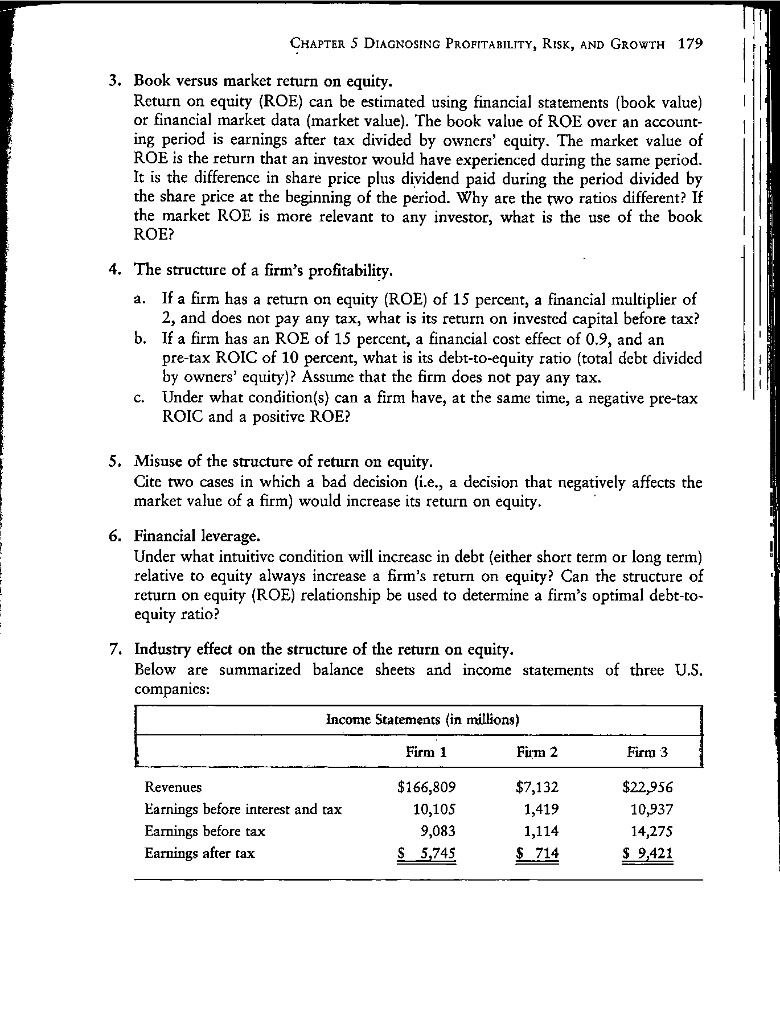

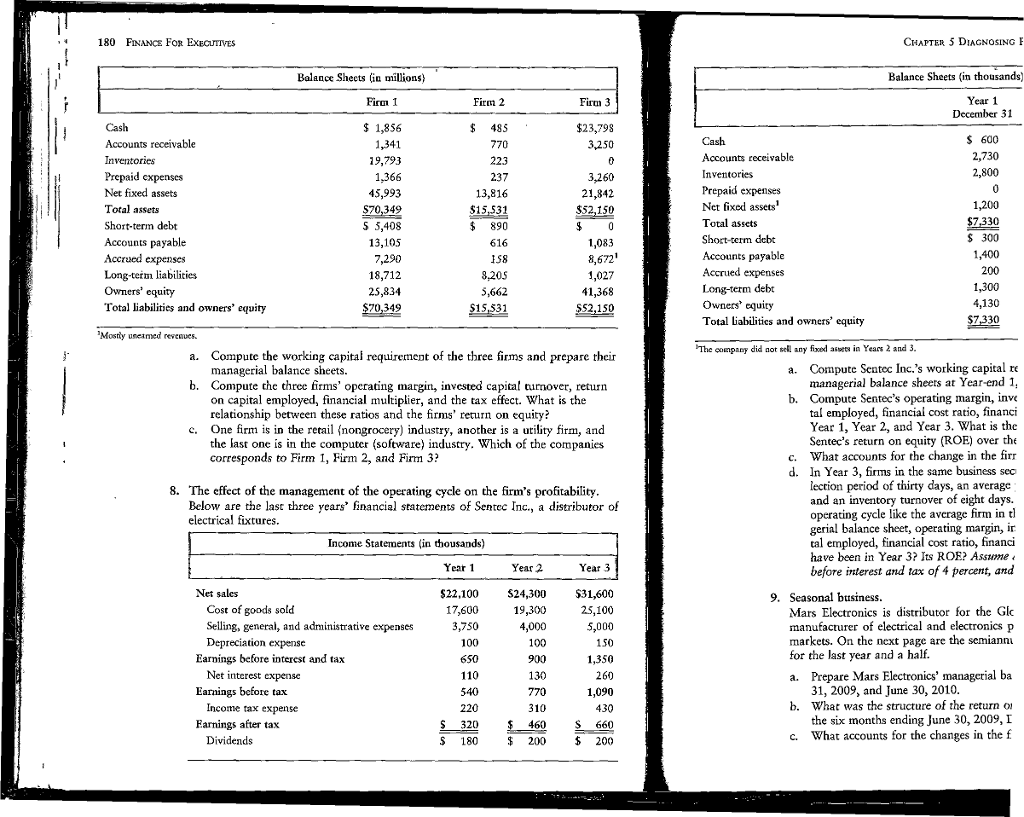

ChaPter 5 DiaGNosING PrOFTABILrTY, Risk, anD Growrh 179 3. Book versus market return on equity. Return on equity (ROE) can be estimated using financial statements (book value)I or financial market data (market value). The book value of ROE over an account ing period is earnings after tax divided by owncrs' equity. The market value of ROE is the return that an investor would have experienced during the same period It is the difference in share price plus dividend paid during the period divided by the share price at the beginning of the period. Why are the two ratios different? If the market ROE is more relevant to any investor, what is the use of the book ROE? 4. The structure of a firm's profitability a. If a firm has a return on equity (ROE) of 15 percent, a financial multiplier of 2, and does not pay any tax, what is its return on invested capital before tax? If a firm has an ROE of 15 percent, a financial cost effect of 0.9, and an pre-tax ROIC of 10 percent, what is its debt-to-equity ratio (total debt divided by owners' equity)? Assume that the firm does not pay any tax. Under what condition(s) can a firm have, at the same time, a negative pre-tax ROIC and a positive ROE? b. c. 5. Misuse of the structure of return on equity Cite two cases in which a bad decision (i.e., a decision that negatively affects the market value of a firm) would increase its return on equity 6. Financial leverage. Under what intuitive condition will increasc in debt (either short term or long term) relative to equity always increase a firm's return on equity? Can the structure of return on equity (ROE) relationship be used to determine a firm's optimal debt-to- equity ratio? 7. Industry effect on the structure of the return on equity. Below are summarized balance sheets and income statements of three U.S companics: Income Statements (in millions) Firm 1 $166,809 Firm 3 Revenues Earnings before interest and ta:x Earnings before tax Earnings after tax $7,132 1,419 1,114 $714 $22,956 10,937 14,275 $ 9,421 10,105 9,083 S 5,745 ChaPter 5 DiaGNosING PrOFTABILrTY, Risk, anD Growrh 179 3. Book versus market return on equity. Return on equity (ROE) can be estimated using financial statements (book value)I or financial market data (market value). The book value of ROE over an account ing period is earnings after tax divided by owncrs' equity. The market value of ROE is the return that an investor would have experienced during the same period It is the difference in share price plus dividend paid during the period divided by the share price at the beginning of the period. Why are the two ratios different? If the market ROE is more relevant to any investor, what is the use of the book ROE? 4. The structure of a firm's profitability a. If a firm has a return on equity (ROE) of 15 percent, a financial multiplier of 2, and does not pay any tax, what is its return on invested capital before tax? If a firm has an ROE of 15 percent, a financial cost effect of 0.9, and an pre-tax ROIC of 10 percent, what is its debt-to-equity ratio (total debt divided by owners' equity)? Assume that the firm does not pay any tax. Under what condition(s) can a firm have, at the same time, a negative pre-tax ROIC and a positive ROE? b. c. 5. Misuse of the structure of return on equity Cite two cases in which a bad decision (i.e., a decision that negatively affects the market value of a firm) would increase its return on equity 6. Financial leverage. Under what intuitive condition will increasc in debt (either short term or long term) relative to equity always increase a firm's return on equity? Can the structure of return on equity (ROE) relationship be used to determine a firm's optimal debt-to- equity ratio? 7. Industry effect on the structure of the return on equity. Below are summarized balance sheets and income statements of three U.S companics: Income Statements (in millions) Firm 1 $166,809 Firm 3 Revenues Earnings before interest and ta:x Earnings before tax Earnings after tax $7,132 1,419 1,114 $714 $22,956 10,937 14,275 $ 9,421 10,105 9,083 S 5,745Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started