Answered step by step

Verified Expert Solution

Question

1 Approved Answer

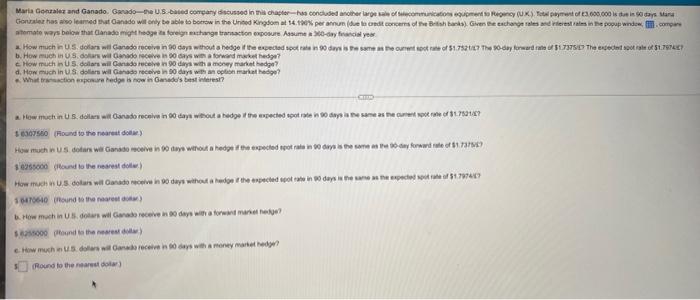

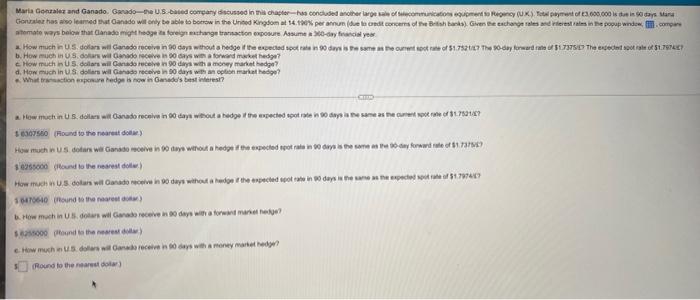

do remaining parts C,D, E Maria Gonzales and Canado Owado - U.S.based company discussed in this chapters concluded a large scale of communicato com o

do remaining parts C,D, E

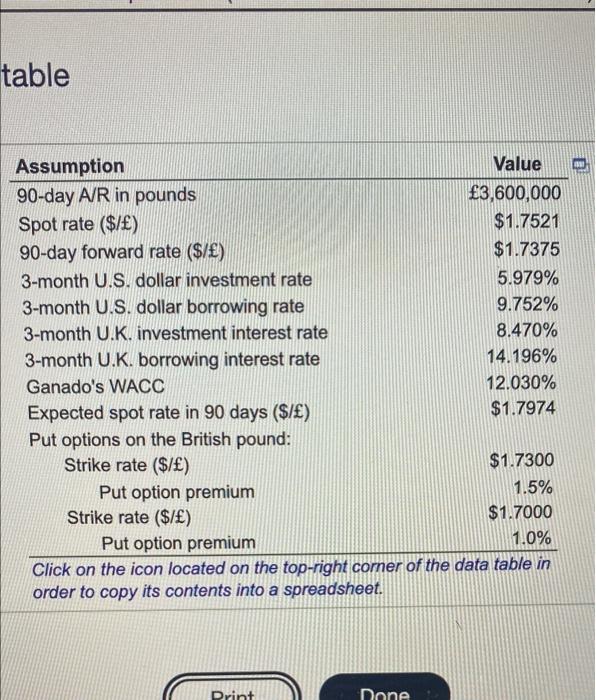

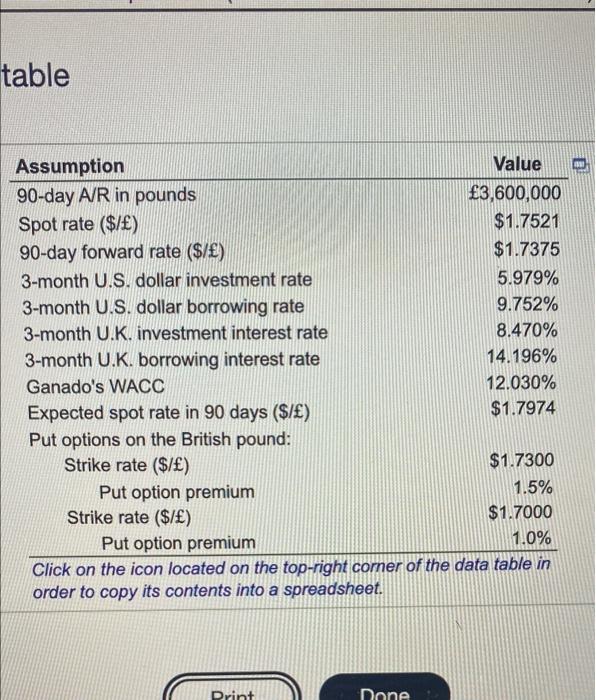

Maria Gonzales and Canado Owado - U.S.based company discussed in this chapters concluded a large scale of communicato com o Rey (UX) Topy 3.000.000 dan in days Mare Gone has learned and will only be able to borrow in the United Kingdom at 14.10% per un due to concerns of the British) Given the dress in the tomate ways below that Canado me a foreign change traction pour une francia y How much in us doara Grado con to do without a hedge the expected to the 90 de les heure tot rate of $1.752127 The Body forward rate 5.775 The eredet 51.797437 b. How much in US dollar wil Grado receive as we toward market redige? How much in US dollars will and receiven 90 days with a money hedge? d. How much in US dollar wil Ganado receiveing days with an option marathon? Whatraction exposar hedon is now in Ganada's best interest? How much in US dollars wie Garado receive in 60 days without a redge the expected spot in dayane as the currento e 3178214? 30307 (Round to the nearest do) How much do wa Ganado receive in today thout hedge expected to run toys forandule of 3095500 round to the nearest do) How mus solus wil Oradece o day without a rendere pected days expecte 1.7 10470640 Round to the rest How much in doswil Garato receive days word? Sound the nearest) How much does wild receive in days with a money marted Round to the nearest) table o Assumption Value 90-day A/R in pounds 3,600,000 Spot rate ($/) $1.7521 90-day forward rate ($/) $1.7375 3-month U.S. dollar investment rate 5.979% 3-month U.S. dollar borrowing rate 9.752% 3-month U.K. investment interest rate 8.470% 3-month U.K. borrowing interest rate 14.196% Ganado's WACC 12.030% Expected spot rate in 90 days ($/) $1.7974 Put options on the British pound: Strike rate ($/) $1.7300 Put option premium 1.5% Strike rate ($/) $1.7000 Put option premium 1.0% Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. Drint None

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started