Answered step by step

Verified Expert Solution

Question

1 Approved Answer

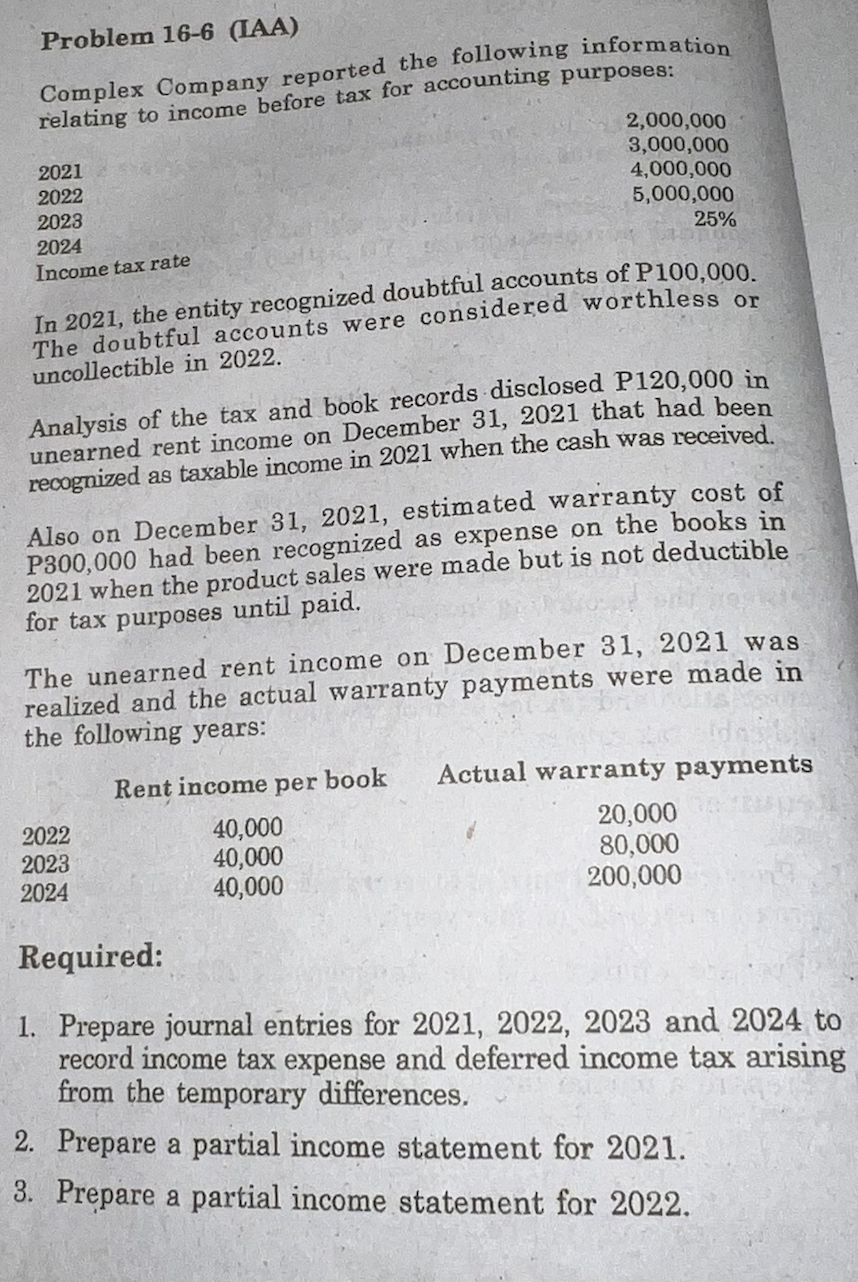

do required part. numbers 1 to 3 Problem 16-6 (LAA) Comnlex Company reported the following information tow for accounting purposes: In 2021, the entity recognized

do required part. numbers 1 to 3

Problem 16-6 (LAA) Comnlex Company reported the following information tow for accounting purposes: In 2021, the entity recognized doubtful accounls un I Lvu,uv. The doubtful accounts were considered worthless or uncollectible in 2022. Analysis of the tax and book records disclosed P120,000 in unearned rent income on December 31,2021 that had been recognized as taxable income in 2021 when the cash was received. Also on December 31,2021 , estimated warranty cost of P300,000 had been recognized as expense on the books in 2021 when the product sales were made but is not deductible for tax purposes until paid. The unearned rent income on December 31,2021 was realized and the actual warranty payments were made in the following years: ts Required: 1. Prepare journal entries for 2021, 2022, 2023 and 2024 to record income tax expense and deferred income tax arising from the temporary differences. 2. Prepare a partial income statement for 2021. 3. Prepare a partial income statement for 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started