Question: Do the following problems using Microsoft Excel. Submit your excel workbook (not the printout or pdf) in Moodle. Even though you are not submitting a

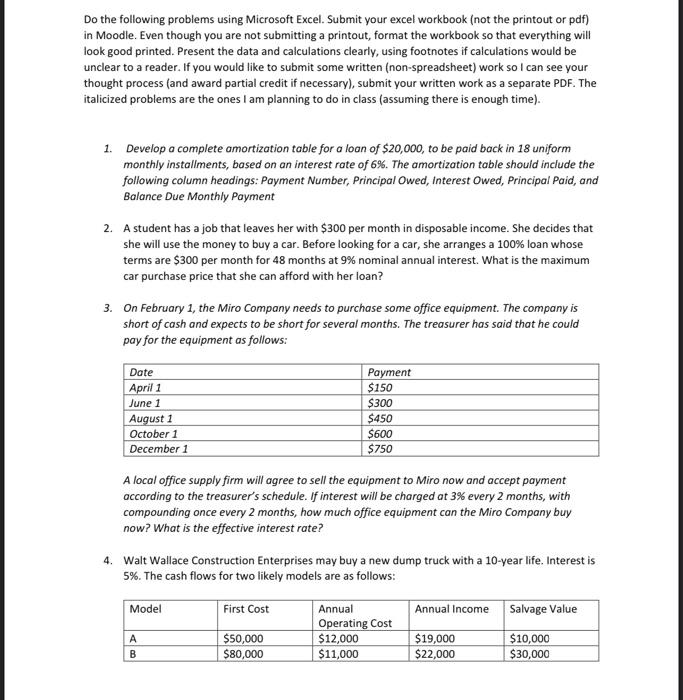

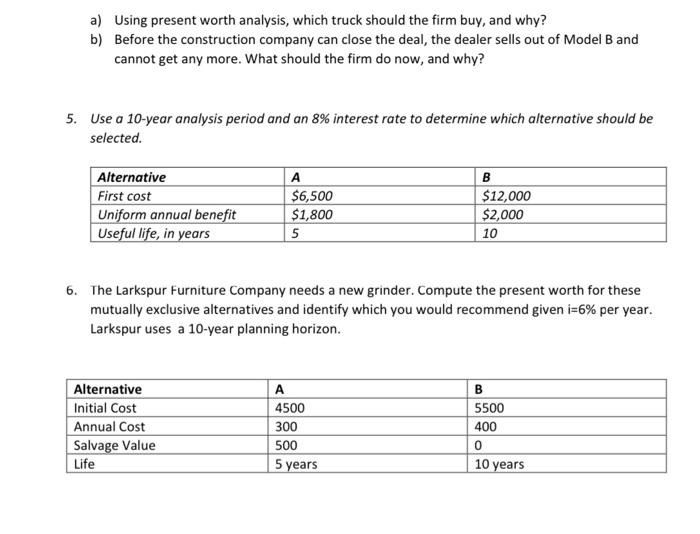

Do the following problems using Microsoft Excel. Submit your excel workbook (not the printout or pdf) in Moodle. Even though you are not submitting a printout, format the workbook so that everything will look good printed. Present the data and calculations clearly, using footnotes if calculations would be unclear to a reader. If you would like to submit some written (non-spreadsheet) work so I can see your thought process (and award partial credit if necessary), submit your written work as a separate PDF. The italicized problems are the ones I am planning to do in class (assuming there is enough time). 1. Develop a complete amortization table for a loan of $20,000, to be paid back in 18 uniform monthly installments, based on an interest rate of 6%. The amortization table should include the following column headings: Payment Number, Principal Owed, Interest Owed, Principal Paid, and Balance Due Monthly Payment 2. A student has a job that leaves her with $300 per month in disposable income. She decides that she will use the money to buy a car. Before looking for a car, she arranges a 100% loan whose terms are $300 per month for 48 months at 9% nominal annual interest. What is the maximum car purchase price that she can afford with her loan? 3. On February 1, the Miro Company needs to purchase some office equipment. The company is short of cash and expects to be short for several months. The treasurer has said that he could pay for the equipment as follows: A local office supply firm will agree to sell the equipment to Miro now and accept payment according to the treasurer's schedule. If interest will be charged at 3% every 2 months, with compounding once every 2 months, how much office equipment can the Miro Company buy now? What is the effective interest rate? 4. Walt Wallace Construction Enterprises may buy a new dump truck with a 10-year life. Interest is 5%. The cash flows for two likely models are as follows: a) Using present worth analysis, which truck should the firm buy, and why? b) Before the construction company can close the deal, the dealer sells out of Model B and cannot get any more. What should the firm do now, and why? Use a 10-year analysis period and an 8% interest rate to determine which alternative should be selected. The Larkspur Furniture Company needs a new grinder. Compute the present worth for these mutually exclusive alternatives and identify which you would recommend given i=6% per year. Larkspur uses a 10-year planning horizon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts