Question

Do the Following Questions: a) What is the maximum federal cost recovery deduction Riverside Corporation may take in 2021 assuming the company elects 179 expense

Do the Following Questions:

a) What is the maximum federal cost recovery deduction Riverside Corporation may take in 2021 assuming the company elects §179 expense and elects out of bonus depreciation? Please show your work and explain your calculations.

b) What is the federal cost recovery deduction Riverside Corporation may take in 2022 on the office furniture asset? (NOTE: You do not need to calculate the federal cost recovery deduction on the other assets placed in 2022, just the office furniture). Please show your work and explain your calculations.

c) What is Riverside Corporation's adjusted basis in the office furniture at the end of 2022? (NOTE: You do not need to calculate adjusted basis on the other assets as of the end of 2022, just the office furniture). Please show your work and explain your calculations.

d) How would your answer to question 2(a) above change if Riverside Corporation does NOT elect out of bonus depreciation in 2021? That is, what is the maximum federal cost recovery deduction Riverside Corporation may take in 2021 assuming that Riverside Corporation takes bonus depreciation on any qualifying assets? Please show your work and explain your calculations.

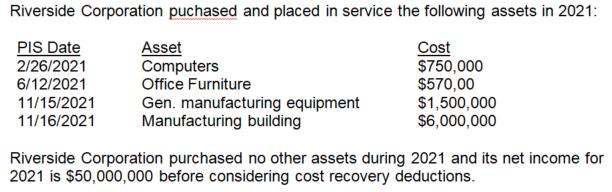

Riverside Corporation puchased and placed in service the following assets in 2021: PIS Date Asset Computers Office Furniture Cost 2/26/2021 6/12/2021 $750,000 $570,00 $1,500,000 $6,000,000 Gen. manufacturing equipment Manufacturing building 11/15/2021 11/16/2021 Riverside Corporation purchased no other assets during 2021 and its net income for 2021 is $50,000,000 before considering cost recovery deductions.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer a iSection 179 of the US inner sales code is an instantaneous rate deduction that commercial enterprise proprietors can take for purchases of depreciable commercial enterprise gadget in prefere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started