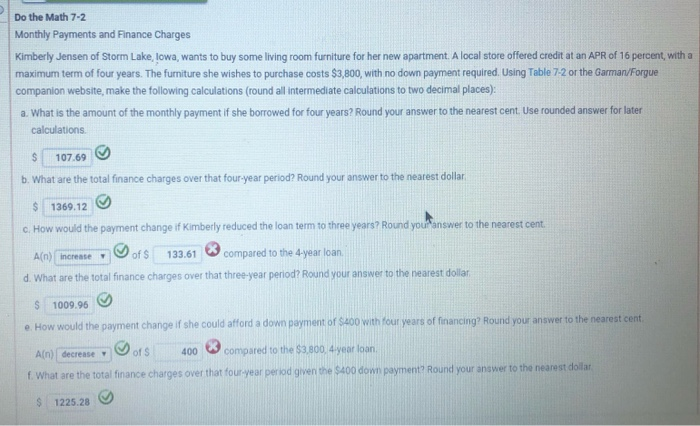

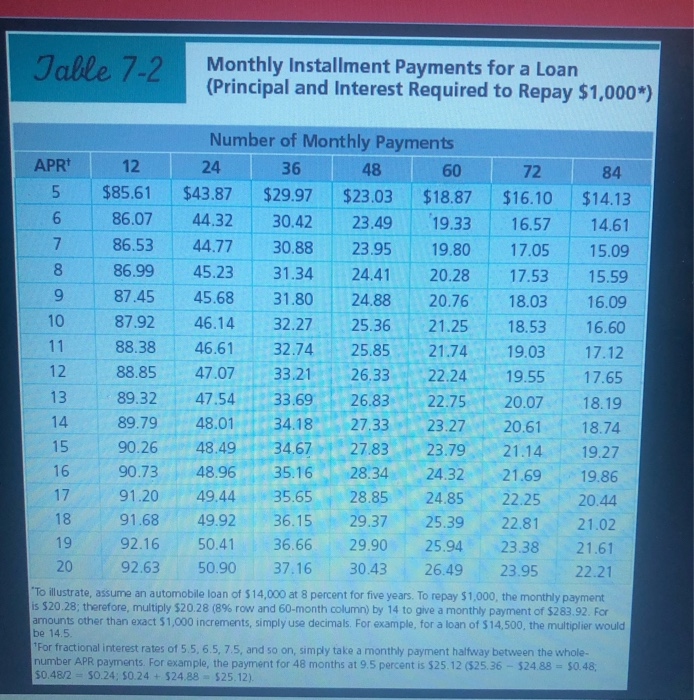

Do the Math 7-2 Monthly Payments and Finance Charges Kimberly Jensen of Storm Lake, Iowa, wants to buy some living room furniture for her new apartment. A local store offered credit a maximum term of four years. The furniture she wishes to purchase costs $3,800, with no down payment required. Using Table 7-2 or the Garman/Forgue companion website, make the following calculations (round all intermediate calculations to two decimal places): a. What is the amount of the monthly payment if she borrowed for four years? Round your answer to the nearest cent. Use rounded answer for later calculations $ 107.69 b. What are the total finance charges over that four-year period? Round your answer to the nearest dollar $ 1369.12 c. How would the payment change if Kimberly reduced the loan term to three years? Round your answer to the nearest cent. A(n) inerente of $ 133.61 compared to the 4-year loan d. What are the total finance charges over that three-year period? Round your answer to the nearest dollar $ 1009.96 e. How would the payment change if she could afford a down payment of $400 with four years of financing Round your answer to the nearest cent A(n) decrease of s 400 compared to the $3,800 4year loan f. What are the total finance charges over that fouryear period given the $400 down payment Round your answer to the nearest dollar $ 1225.28 g Table 7.2 Monthly Installment Payments for a Loan (Principal and Interest Required to Repay $1,000*) 6 009 Number of Monthly Payments APR* 12 24 36 48 60 72 84 5 $85.61 $43.87 $29.97 $23.03 $18.87 $16.10 $14.13 86.07 44.32 30.42 23.49 19.33 16.57 14.61 86.53 44.77 30.88 23.95 19.80 17.05 15.09 86.99 45.23 31.34 24.41 20.28 17.53 15.59 87.45 45.68 31.80 24.88 20.76 18.03 16.09 87.92 46.14 3 2.27 25.36 21.25 18.53 16.60 88.38 46.61 32.74 25.85 21.74 19.03 17.12 88.85 47.07 33.21 26.33 22.24 19.55 17.65 89.32 47.54 3 3.69 26.83 22.75 20.07 18.19 89.79 48.01 34.18 27.33 23.27 20.61 18.74 90.26 48 49 34.67 27.83 23.79 21.14 19.27 90.73 35.16 28.34 24.32 21.69 19.86 91.20 49. 44 35.65 28.85 24.85 22.25 20.44 91.68 49.92 36.15 29.37 25.39 22.81 21.02 19 92.16 50.41 36.66 29.90 25.94 23.38 21.61 92.63 50.90 37.16 30.43 26.49 23.95 22.21 "To illustrate, assume an automobile loan of $14,000 at 8 percent for five years. To repay $1,000, the monthly payment is $20.28; therefore, multiply $20.28 (8% row and 60-month column) by 14 to give a monthly payment of $283.92. For amounts other than exact 51.000 increments, simply use decimals. For example, for a loan of 514,500, the multiplier would be 14.5 For fractional interest rates of 5.5, 6.5, 7.5, and so on, simply take a monthly payment halfway between the whole number APR payments. For example, the payment for 48 months at 9.5 percent is 525.12 (525.36 - 524.88 - 50.48 $0.48/2 - 50.24; 0.24 + $24.88 = 525.12). 17 20