Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do this question according to GAAP canadian standard Callaho Inc. completed the following petty cash transactions during March, 2014. March 1: Drew an $800.00 cheque,

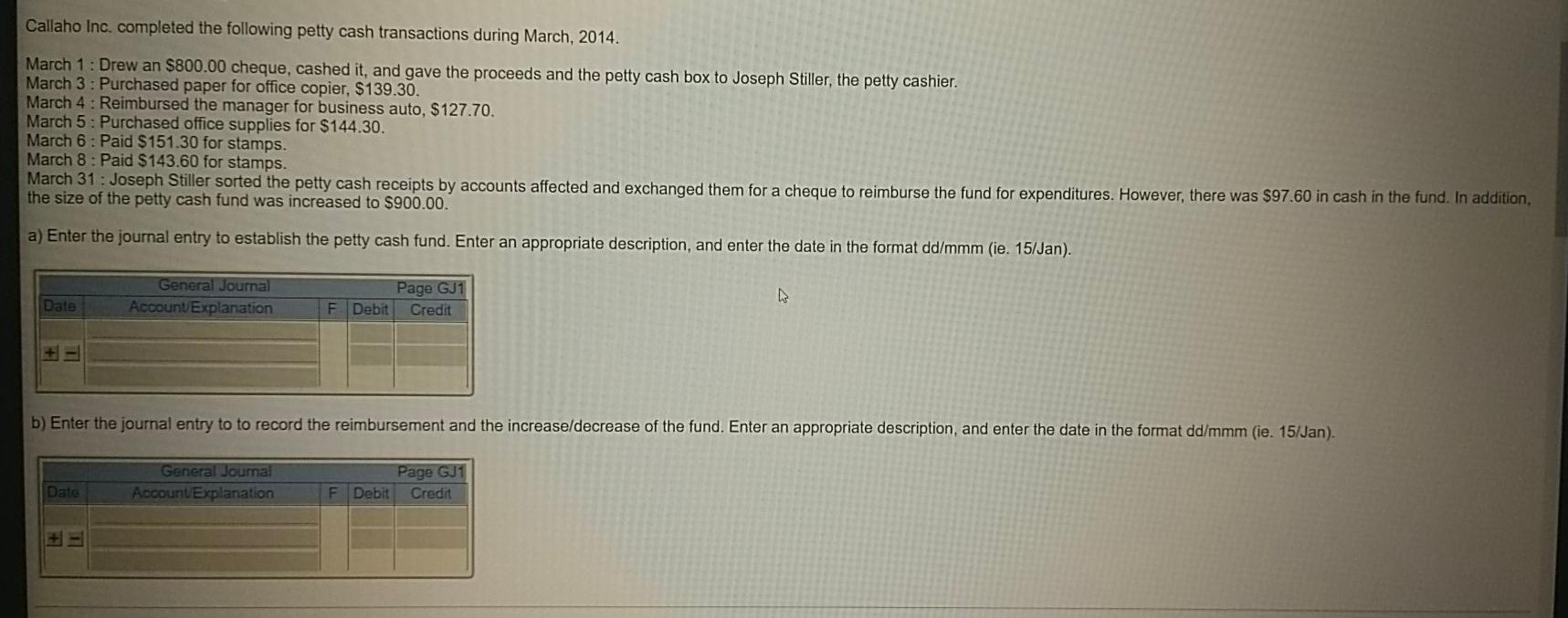

Do this question according to GAAP canadian standard

Callaho Inc. completed the following petty cash transactions during March, 2014. March 1: Drew an $800.00 cheque, cashed it, and gave the proceeds and the petty cash box to Joseph Stiller, the petty cashier. March 3 : Purchased paper for office copier, $139.30. March 4 : Reimbursed the manager for business auto, $127.70. March 5: Purchased office supplies for $144.30. March 6: Paid $ 151.30 for stamps. March 8 : Paid $143.60 for stamps. March 31: Joseph Stiller sorted the petty cash receipts by accounts affected and exchanged them for a cheque to reimburse the fund for expenditures. However, there was $97.60 in cash in the fund. In addition, the size of the petty cash fund was increased to $900.00. a) Enter the journal entry to establish the petty cash fund. Enter an appropriate description, and enter the date in the format dd/mmm (ie. 15/Jan). General Journal Account Explanation Date Page Gj1 Credit F Debit b) Enter the journal entry to to record the reimbursement and the increase/decrease of the fund. Enter an appropriate description, and enter the date in the format dd/mmm (ie. 15/Jan). General Journal Account Explanation Page Gj1 F Debit Credit DateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started