Question

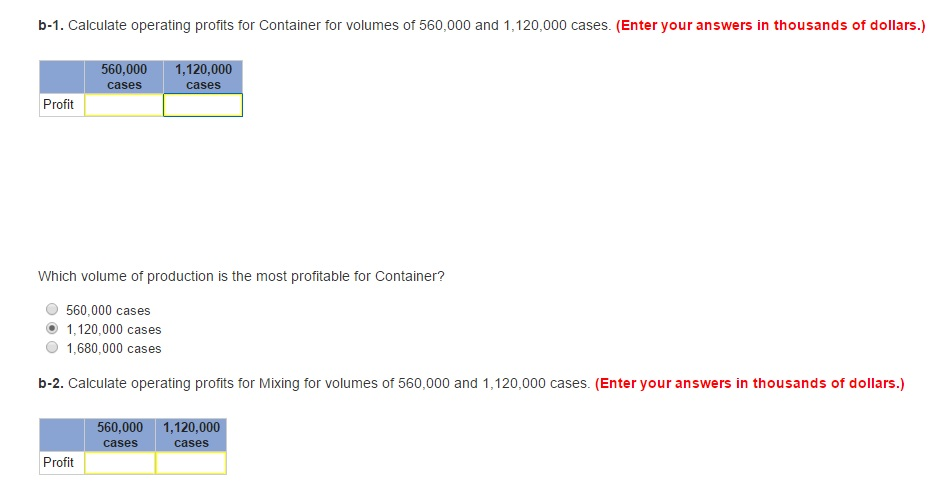

Do what is left please (b1, b2 & b3) Amazon Beverages produces and bottles a line of soft drinks using exotic fruits from Latin America

Do what is left please (b1, b2 & b3)

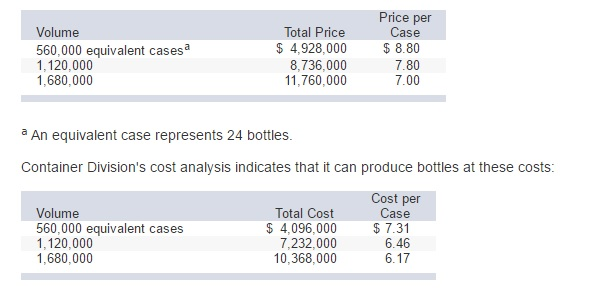

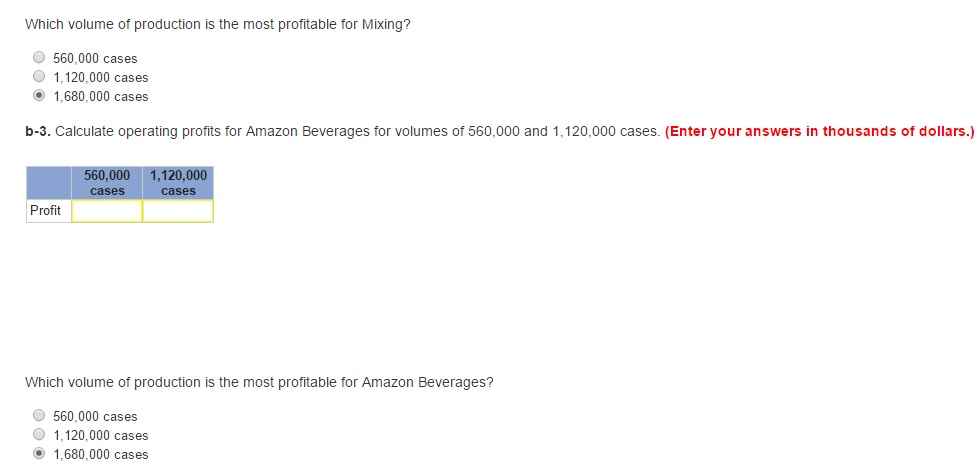

Amazon Beverages produces and bottles a line of soft drinks using exotic fruits from Latin America and Asia. The manufacturing process entails mixing and adding juices and coloring ingredients at the bottling plant, which is a part of Mixing Division. The finished product is packaged in a company-produced glass bottle and packed in cases of 24 bottles each. Because the appearance of the bottle heavily influences sales volume, Amazon developed a unique bottle production process at the companys container plant, which is a part of Container Division. Mixing Division uses all of the container plants production. Each division (Mixing and Container) is considered a separate profit center and evaluated as such. As the new corporate controller, you are responsible for determining the proper transfer price to use for the bottles produced for Mixing Division. At your request, Container Divisions general manager asked other bottle manufacturers to quote a price for the number and sizes demanded by Mixing Division. These competitive prices follow:

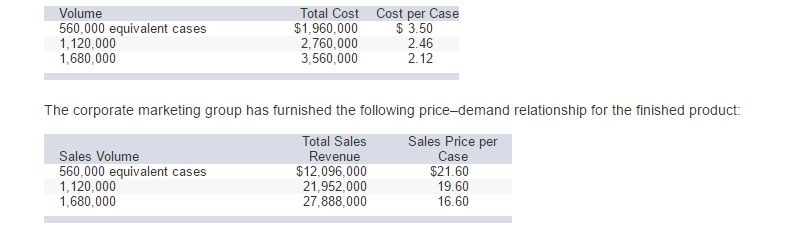

These costs include fixed costs of $960,000 and variable costs of $5.60 per equivalent case. These data have caused considerable corporate discussion as to the proper price to use in the transfer of bottles from Container Division to Mixing Division. This interest is heightened because a significant portion of a division managers income is an incentive bonus based on profit center results.

Mixing Division has the following costs in addition to the bottle costs:

Required:

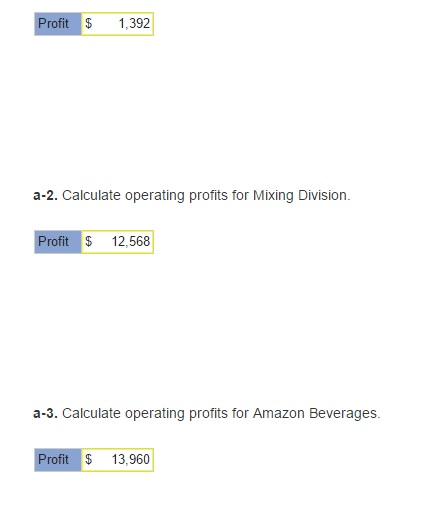

a. Amazon Beverages has used market pricebased transfer prices in the past. Using the current market prices and costs and assuming a volume of 1.68 million cases (Enter your answers in thousands of dollars.)

a-1. Calculate operating profits for Container Division.

Price per Volume Total Price Case 4,928,000 8.80 560,000 equivalent casesa 8,736,000 1,120,000 7.80 1,680,000 11,760,000 7.00 a An equivalent case represents 24 bottles. Container Division's cost analysis indicates that it can produce bottles at these costs: Cost per Total Cost Volume Case 560,000 equivalent cases 4,096,000 7.31 1,120,000 6.46 7,232,000 1,680,000 6.17 10.368.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started