Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do you agree with Joanna Cohens assumptions for calculating the individual components; why and why not? Which method would you choose for Nike and why?

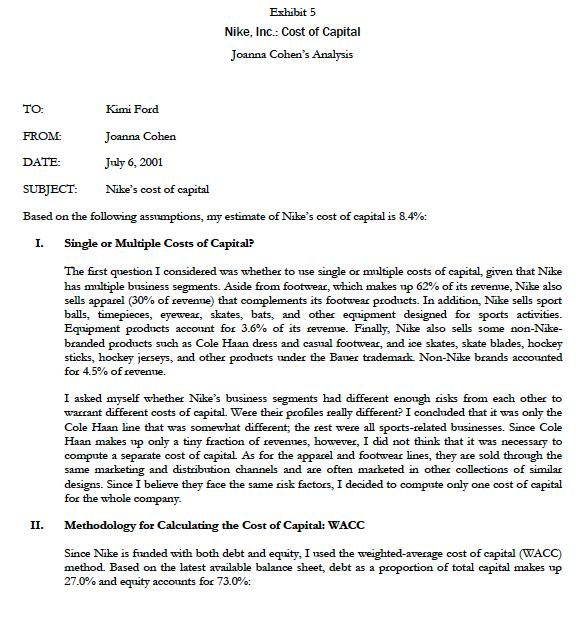

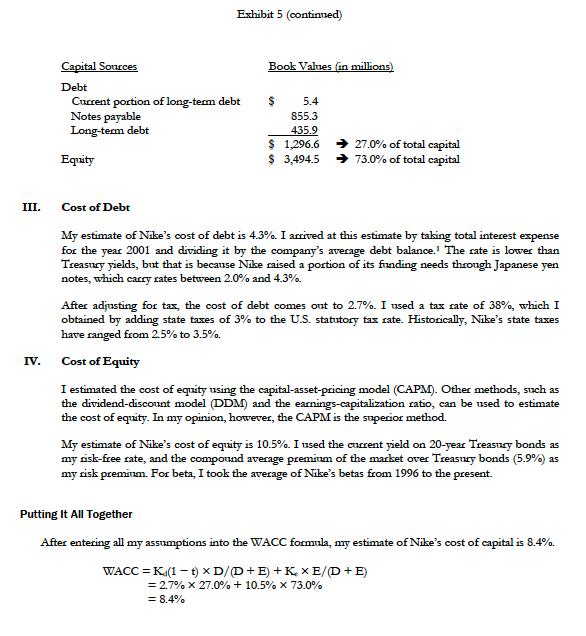

Do you agree with Joanna Cohen’s assumptions for calculating the individual components; why and why not?

Which method would you choose for Nike and why? You will need information from Exhibit 4 here. (Cost of Equity Analysis)

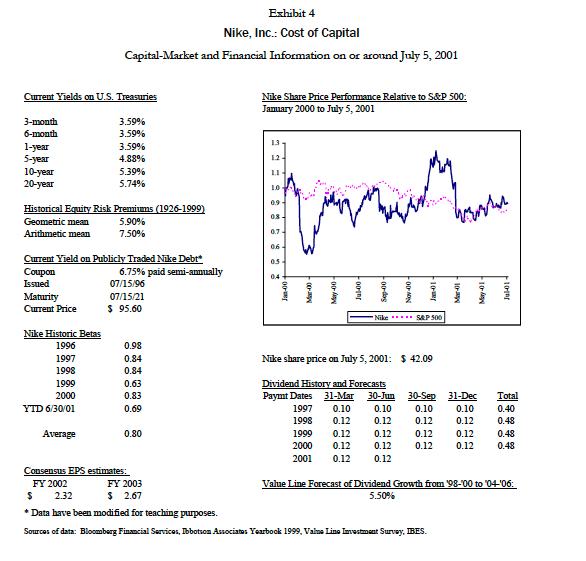

Current Yields on U.S. Treasuries 3-month 6-month 1-year 5-year 10-year 20-year Exhibit 4 Nike, Inc.: Cost of Capital Capital-Market and Financial Information on or around July 5, 2001 Historical Equity Risk Premiums (1926-1999) Geometric mean 5.90% Arithmetic mean 7.50% Maturity Current Price Current Yield on Publicly Traded Nike Debt* Coupon Issued Nike Historic Betas 1996 1997 1998 1999 2000 YTD 6/30/01 3.59% 3.59% 3.59% 4.88% 5.39% 5.74% Average 6.75% paid semi-annually 07/15/96 07/15/21 $ 95.60 0.98 0.84 0.84 0.63 0.83 0.69 0.80 Consensus EPS estimates: FY 2002 Nike Share Price Performance Relative to S&P 500: January 2000 to July 5, 2001 1.3 1.2 www 1.0 0.9 0.8 0.7- 0.6 0.5 0.4 00-0 -00- 00- Jul-00- -oo-dae 1999 0.12 2000 0.12 2001 0.12 ODON Jan-01- Nike S&P 500 Nike share price on July 5, 2001: $42.09 Dividend History and Forecasts Paymt Dates 31-Mar 30-Jun 30-Sep 1997 0.10 0.10 0.10 1998 0.12 0.12 0.12 0.12 0.12 0.12 0.12 0.12 FY 2003 $ 2.32 $ 2.67 * Data have been modified for teaching purposes. Sources of data: Bloomberg Financial Services, Ibbotson Associates Yearbook 1999, Valme Line Investment Survey, IBES. brows 10-a 31-Dec 0.10 0.12 0.12 0.12 May-01- Jul-01- Total 0.40 0.48 0.48 0.48 Value Line Forecast of Dividend Growth from '98-'00 to '04-'06: 5.50%

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

It is to be considered that there are three basic concepts It is not a cost as such It is merely a hurdle rate It is the minimum rate of return It con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started