Do you just add their incomes together or do you have to do their deductions? I included both tax tables.

undefined

undefined

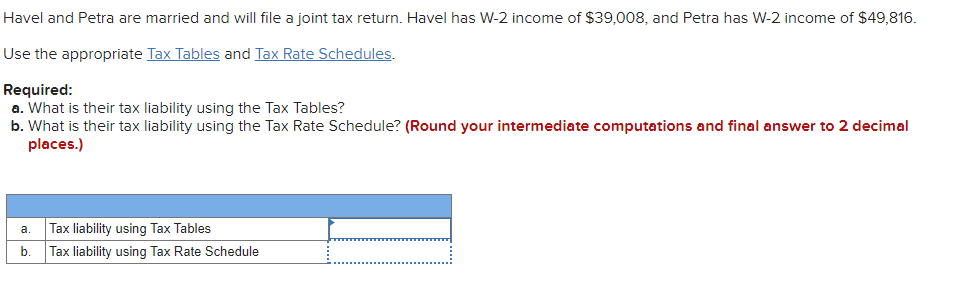

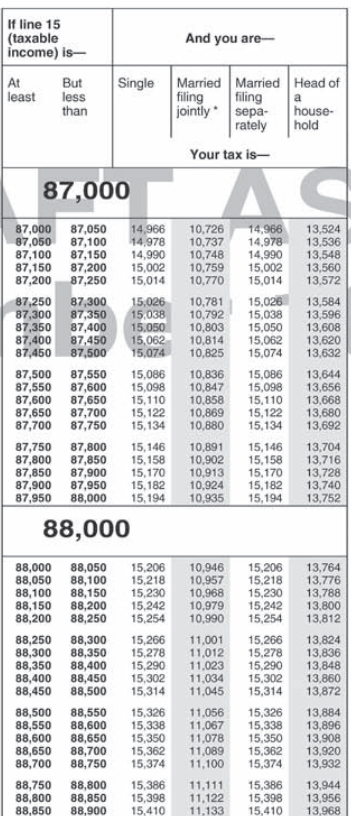

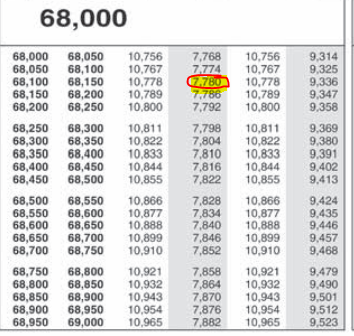

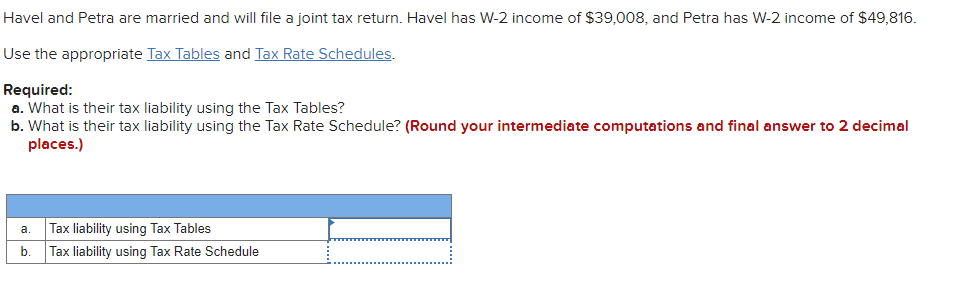

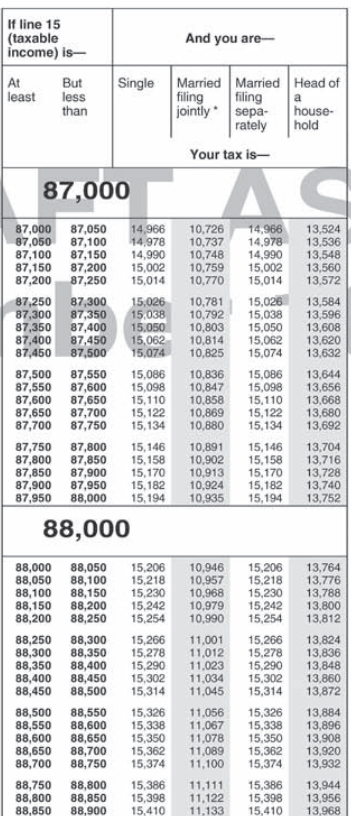

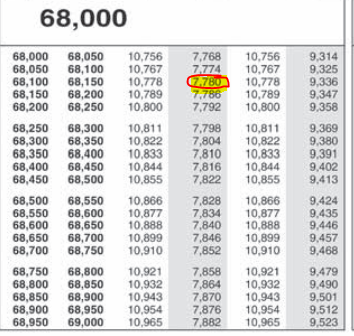

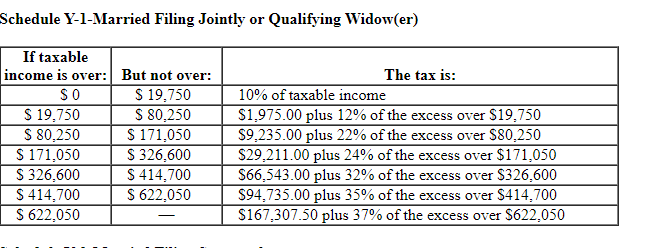

Havel and Petra are married and will file a joint tax return. Havel has W-2 income of $39,008, and Petra has W-2 income of $49,816. Use the appropriate Tax Tables and Tax Rate Schedules. Required: a. What is their tax liability using the Tax Tables? b. What is their tax liability using the Tax Rate Schedule? (Round your intermediate computations and final answer to 2 decimal places.) a. Tax liability using Tax Tables Tax liability using Tax Rate Schedule b And you are- If line 15 (taxable income) is- | At But least less than Single filing Married Married Head of filing a jointly sepa- house- rately hold Your tax is- 87,000 AC 87,000 87,050 87,100 87,150 87,200 14,966 14.978 14,990 15,002 15,014 13,524 13,536 13,548 13,560 13.572 87,250 87,300 87,350 87,400 87,450 87,500 87,550 87,600 87,650 87,700 87,050 87,100 87,150 87,200 87,250 87,300 87,350 87,400 87,450 87,500 87,550 87,600 87,650 87,700 87,750 87,800 87,850 87,900 87,950 88,000 15,026 15.038 15.050 15,062 15,074 15,086 15,098 15,110 15,122 15,134 10,726 10.737 10,748 10.759 10.770 10.781 10,792 10.803 10,814 10,825 10,836 10.847 10.858 10,869 10,880 10,891 10.902 10.913 10,924 10,935 14,966 14,978 14,990 15,002 15,014 15,026 15,038 15,050 15,062 15,074 15,086 15,098 15,110 15,122 15,134 13,584 13,596 13,608 13,620 13.632 13,644 13,656 13,668 13,680 13,692 87,750 87,800 87,850 87,900 87,950 15,146 15,158 15,170 15,182 15,194 15,146 15,158 15,170 15,182 15,194 13,704 13,716 13,728 13,740 13,752 88,000 15,206 15,218 15,230 15,242 15,254 15,206 15,218 15,230 15,242 15,254 13,764 13.776 13.788 13.800 13,812 88,000 88,050 88,100 88,150 88,200 88,250 88,300 88,350 88,400 88,450 88,500 88,550 88,600 88,650 88,700 88,750 88,800 88,850 88,050 88,100 88,150 88,200 88,250 88,300 88,350 88,400 88,450 88,500 88,550 88,600 88,650 88,700 88,750 88,800 88,850 88,900 15,266 15,278 15,290 15,302 15,314 10,946 10,957 10,968 10.979 10,990 11,001 11.012 11,023 11.034 11.045 11,056 11,067 11,078 11,089 11.100 15.266 15,278 15,290 15,302 15,314 15,326 15,338 15,350 15,362 15,374 13,824 13,836 13,848 13,860 13,872 13,884 13,896 13,908 13.920 13,932 15,326 15,338 15,350 15,362 15,374 15,386 15,398 15,410 11.111 11.122 11.133 15,386 15,398 15,410 13,944 13,956 13,968 68,000 10.756 10.767 10.778 10789 10.00 68,000 ,050 68.100 68.150 60 200 68,250 68.300 66,350 6,400 60.450 68,050 6.100 68.150 68,200 66.250 66,300 68,350 68.400 66,460 68,500 10,756 10.767 10.778 10.789 10,800 10.81] 10.822 10.833 10.844 10.855 10.611 10.822 10.833 10.844 10.855 7768 774 BUT 7766 7792 7798 7,804 7.810 7.816 7.822 7.626 7.31 7.840 7.846 7.852 7.858 7.864 7.870 7876 7.62 9314 9.325 9.336 9.347 9.35B 9.369 9.380 9391 3.402 9.413 9.424 9.435 9.446 9.457 9.46 66,500 8.550 68.600 60.650 68,700 66.750 68.00 68,650 6.900 ,50 66.550 66.500 68.650 66.700 68.750 68,800 58.950 66,900 68,950 9,000 10.866 10.677 10.888 10.99 10.910 10.92] 10.32 10.943 10.95 10.965 10.666 10.877 10.888 10.899 | 10.910 10.921 10.932 10.93 10.954 10.965 9.479 9.490 9.501 9512 9523 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: SO $ 19.750 S 19.750 S 80,250 S 80,250 $ 171,050 S 171,050 S 326,600 S 326,600 $ 414.700 $ 414.700 S 622,050 S 622.050 The tax is: 10% of taxable income $1,975.00 plus 12% of the excess over $19,750 $9.235.00 plus 22% of the excess over $80,250 $29,211.00 plus 24% of the excess over $171,050 $66,543.00 plus 32% of the excess over $326.600 $94.735.00 plus 35% of the excess over $414,700 $167,307.50 plus 37% of the excess over $622,050

undefined

undefined