Question

Do you notice the formula all the way at the top? What is the name and what is the formula I must use to compute

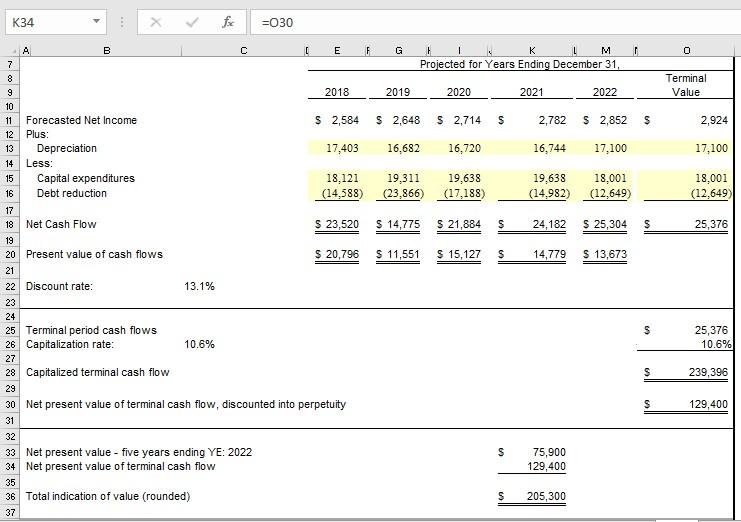

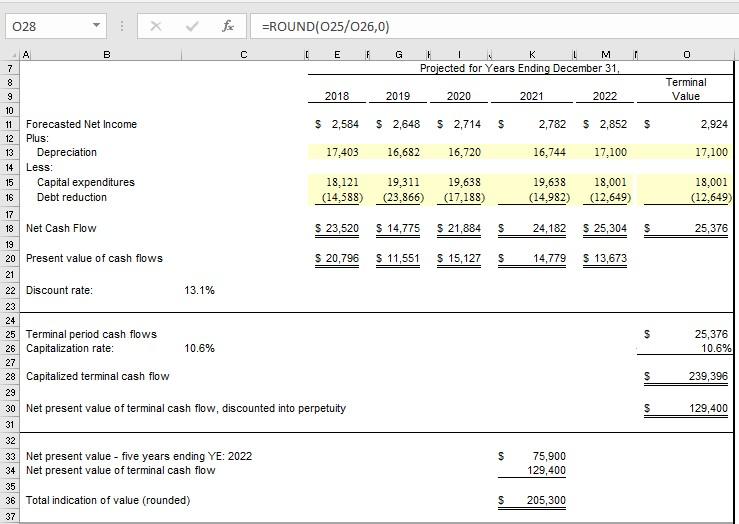

Do you notice the formula all the way at the top? What is the name and what is the formula I must use to compute and find the "Net Present value of terminal cash flow, discounted into perpetuity"? Can you show the step by step work in a very, very detailed manner as what I must to get $129,400, the Net Present Value of terminal cash flow, discounted into perpetuity, please? And can you type an interpretation in the form of one or more sentences to describe all the values as I did with the example at the very, very, very top, please? Thank you very much!

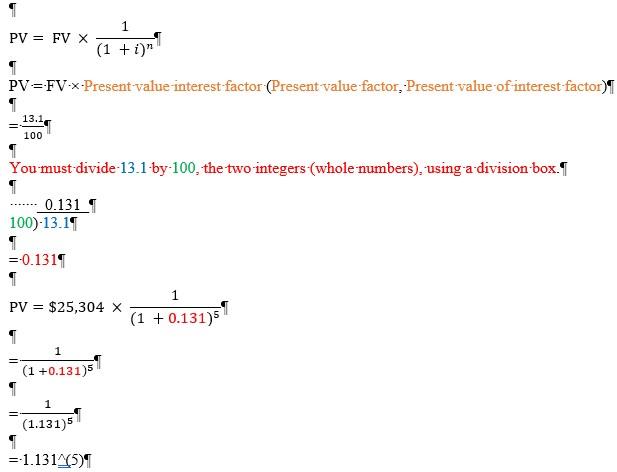

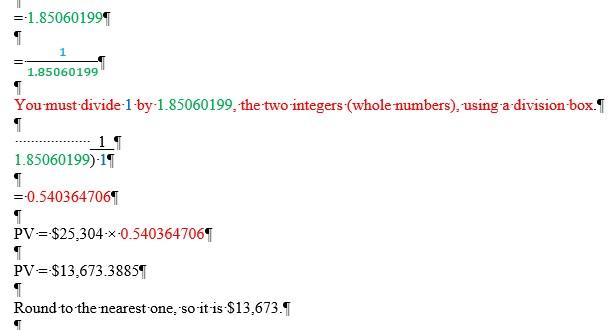

The-Present-Value of A Single Future Amount: (Year 5) The Present Value of A Single Future Amount:Formula 1 PV = FV X (1 + i)" PV=FV-x-Present value interest factor (Present value factor,-Present value of interest factor) 13.1 100 You must divide-13.1 by-100, the two integers (whole numbers), using a division-box. 0.131 100)-13.10 =-0.1319 1 PV = $25,304 X (1 + 0.131)5 1 (1 +0.131) 1 (1.131)51 =-1.131451 =-1.850601991 1.85060199 You must divide-1 by 1.85060199, the two-integers (whole numbers), using a division box. 1 1 1.85060199)-11 1 =-0.5403647061 PV =-$25,304-x-0.540364706 PV=$13,673.38857 Round to the nearest one, so it is $13,673.1 V* We say that-$13,673-is the present value and/or discounted (converted) value of $25,304 to- be received in year 5 at 13.1%, the-discount rate and effective interest rate and market interest rate.* *I must calculate the present value of the projected cash flow-(future cash flow) for and/or at the end of Year 5 by multiplying the cash-inflow of $25,304 by the matching (or corresponding) discount factor of 13.1%.--Afterwards, the present value of the projected cash flow (future cash- flow) is $13,673.*1 *The present (current) value of future cash flows is $13,673-discounted-at-13.1%*1 Present Value is based on time value concept that-current value of money is worth more than-in- the future, so the cash-inflows and-cash-outflows are discounted-at-ongoing-and-effective interest rate (or effective annual-interest rate, market interest rate) to understand whether a project will be acceptable or not. V$13,673-is the Present value of Principal (The Present-Value of A Single Future Amount) at the end of Year 5.1 *$25,304-is the Cash-inflow because it is $25,304, or positive-$25,304. This is because the board of directors of the Verizon received total cash payments that amounted to-$25,304 from issuing shares of stock, borrowed money to pay off their obligations, sold products and services at the end of Year-5.* K34 X for =O30 c G 0 L M Projected for Years Ending December 31, Terminal Value 2019 2020 2021 2022 $ 2,648 $ 2,714 S 2,782 $ 2,852 S 2,924 16,682 16,720 16,744 17,100 17,100 19,311 (23,866) 19,638 (17,188) 19.638 (14.982) 18,001 (12,649) 18,001 (12.649) $ 14,775 $ 21,884 S 24,182 S 25,304 25,376 A B C E F 7 8 9 2018 10 11 Forecasted Net Income $ 2,584 12 Plus: 13 Depreciation 17,403 14 Less: 15 Capital expenditures 18,121 16 Debt reduction (14,588) 17 18 Net Cash Flow $ 23,520 19 20 Present value of cash flows $ 20,796 21 22 Discount rate: 13.1% 23 24 25 Terminal period cash flows 26 Capitalization rate: 10.6% 27 28 Capitalized terminal cash flow 29 30 Net present value of terminal cash flow, discounted into perpetuity 31 $ 11,551 $ 15,127 $ 14,779 $ 13,673 $ 25,376 10.6% $ 239,396 $ 129,400 32 S 33 Net present value - five years ending YE: 2022 34 Net present value of terminal cash flow 75,900 129,400 35 36 Total indication of value (rounded) S 205,300 37 028 X =ROUND(025/026,0) A C G 0 H 1 L M Projected for Years Ending December 31, Terminal Value 2019 2020 2021 2022 $ 2,648 $ 2,714 S 2,782 $ 2,852 S 2,924 16,682 16,720 16,744 17,100 17,100 19,311 (23.866) 19,638 (17,188) 19,638 (14,982) 18,001 (12,649) 18,001 (12,649) $ 14,775 $ 21,884 S 24,182 $ 25,304 S 25,376 $ 11,551 $ 15,127 $ 14,779 $ 13,673 B E F 7 8 9 2018 10 11 Forecasted Net Income $ 2,584 12 Plus: 13 Depreciation 17,403 14 Less: 15 Capital expenditures 18,121 16 Debt reduction (14,588) 17 18 Net Cash Flow $ 23,520 19 20 Present value of cash flows $ 20,796 21 22 Discount rate: 13.1% 23 24 25 Terminal period cash flows 26 Capitalization rate: 10.6% 27 28 Capitalized terminal cash flow 29 30 Net present value of terminal cash flow, discounted into perpetuity 31 32 33 Net present value - five years ending YE: 2022 34 Net present value of terminal cash flow 35 36 Total indication of value (rounded) 37 $ 25,376 10.6% $ 239,396 $ 129,400 S 75,900 129,400 $ 205,300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started