Do you think this project should go forward ?

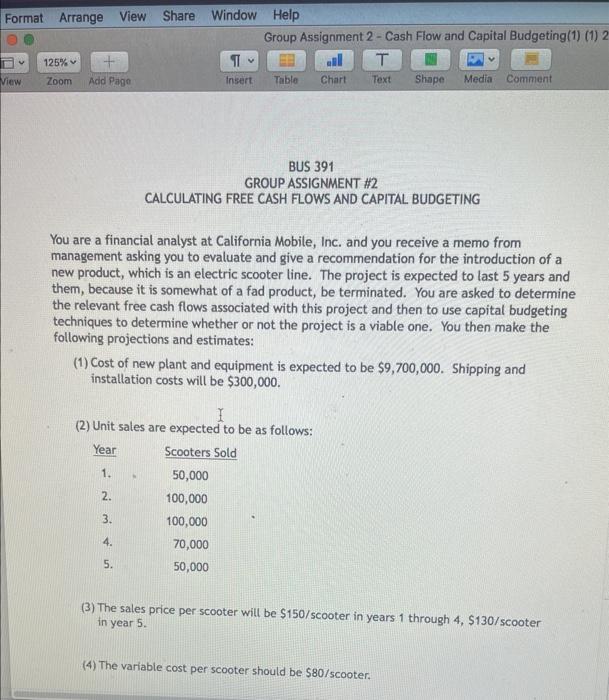

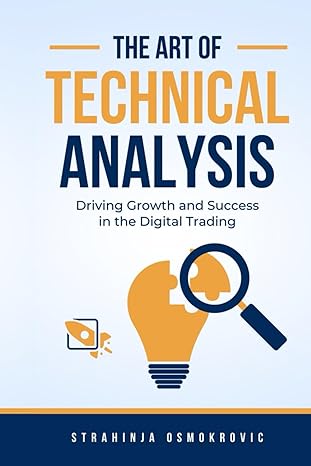

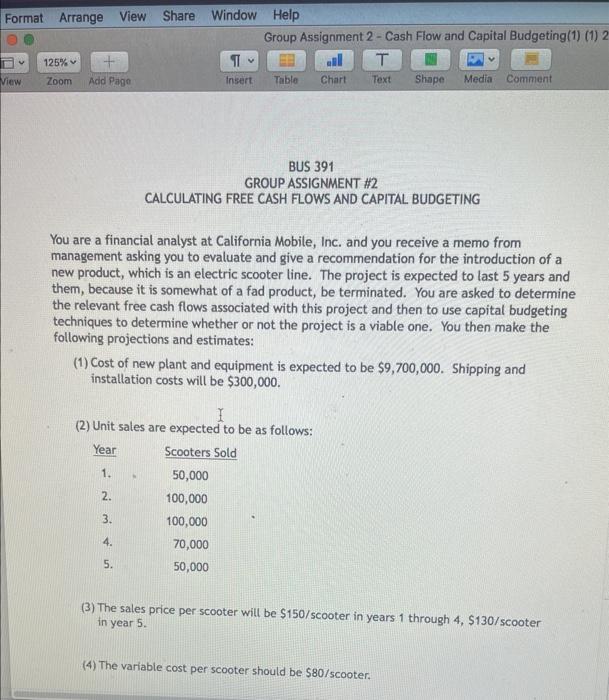

You are a financial analyst at California Mobile, Inc. and you receive a memo from management asking you to evaluate and give a recommendation for the introduction of a new product, which is an electric scooter line. The project is expected to last 5 years and them, because it is somewhat of a fad product, be terminated. You are asked to determine the relevant free cash flows associated with this project and then to use capital budgeting techniques to determine whether or not the project is a viable one. You then make the following projections and estimates: (1) Cost of new plant and equipment is expected to be $9,700,000. Shipping and instatlation costs will be $300,000. (2) Unit sales are expected to be as follows: (3) The sales price per scooter will be $150/ scooter in years 1 through 4,$130/ scooter in year 5. (4) The variable cost per scooter should be $80/ scooter. (4) The variable cost per scooter should be $80/ scooter. (5) Annual fixed costs are expected to be $500,000 each of the 5 years. (6) There will be an initial working capital requirement of $100,000 just to get production started. Then, for each year, the total investment in net working capital will be equal to 10% of the dollar value of sales for that year. Thus, the investment in working capital will increase during years 1 and 2 , then decrease in year 4 . Finally, all working capital will be liquidated at the termination of the project at the end of year 5. (7) The company utilizes straight-line depreciation for determination of net taxable income. The asset is expected to have a salvage value of $2,000,000 at the end of the 5 years. (8) The WACC for California Mobile is 10% and the tax rate is 30%. You are asked to present a short and concise report to management in which you clearly present and explain your findings, as well as recommend whether or not this project should go forward. You are a financial analyst at California Mobile, Inc. and you receive a memo from management asking you to evaluate and give a recommendation for the introduction of a new product, which is an electric scooter line. The project is expected to last 5 years and them, because it is somewhat of a fad product, be terminated. You are asked to determine the relevant free cash flows associated with this project and then to use capital budgeting techniques to determine whether or not the project is a viable one. You then make the following projections and estimates: (1) Cost of new plant and equipment is expected to be $9,700,000. Shipping and instatlation costs will be $300,000. (2) Unit sales are expected to be as follows: (3) The sales price per scooter will be $150/ scooter in years 1 through 4,$130/ scooter in year 5. (4) The variable cost per scooter should be $80/ scooter. (4) The variable cost per scooter should be $80/ scooter. (5) Annual fixed costs are expected to be $500,000 each of the 5 years. (6) There will be an initial working capital requirement of $100,000 just to get production started. Then, for each year, the total investment in net working capital will be equal to 10% of the dollar value of sales for that year. Thus, the investment in working capital will increase during years 1 and 2 , then decrease in year 4 . Finally, all working capital will be liquidated at the termination of the project at the end of year 5. (7) The company utilizes straight-line depreciation for determination of net taxable income. The asset is expected to have a salvage value of $2,000,000 at the end of the 5 years. (8) The WACC for California Mobile is 10% and the tax rate is 30%. You are asked to present a short and concise report to management in which you clearly present and explain your findings, as well as recommend whether or not this project should go forward