Answered step by step

Verified Expert Solution

Question

1 Approved Answer

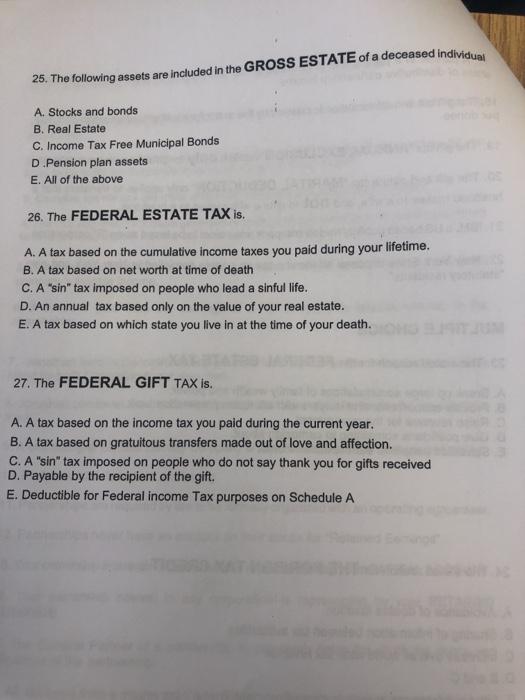

25. The following assets are included in the GROSS ESTATE of a deceased individual A. Stocks and bonds B. Real Estate C. Income Tax

25. The following assets are included in the GROSS ESTATE of a deceased individual A. Stocks and bonds B. Real Estate C. Income Tax Free Municipal Bonds D.Pension plan assets E. All of the above 26. The FEDERAL ESTATE TAX is. A. A tax based on the cumulative income taxes you paid during your lifetime. B. A tax based on net worth at time of death C. A "sin" tax imposed on people who lead a sinful life. D. An annual tax based only on the value of your real estate. E. A tax based on which state you live in at the time of your death. 27. The FEDERAL GIFT TAX is. A. A tax based on the income tax you paid during the current year. B. A tax based on gratuitous transfers made out of love and affection. C. A "sin" tax imposed on people who do not say thank you for gifts received D. Payable by the recipient of the gift. E. Deductible for Federal income Tax purposes on Schedule A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

25 26 property Stocks and bands The To The Answer is F All of the above The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d787b87890_175922.pdf

180 KBs PDF File

635d787b87890_175922.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started