Answered step by step

Verified Expert Solution

Question

1 Approved Answer

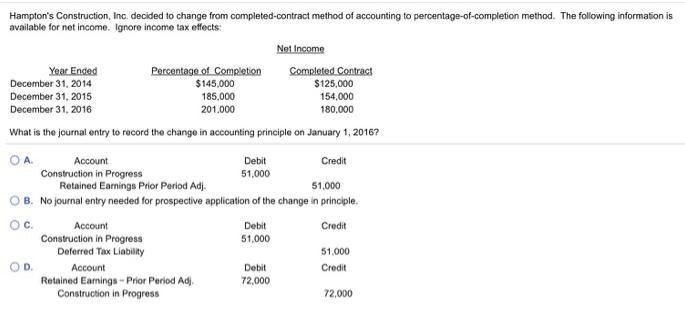

Hampton's Construction, Inc. decided to change from completed-contract method of accounting to percentage-of-completion method. The following information is available for net income. Ignore income

Hampton's Construction, Inc. decided to change from completed-contract method of accounting to percentage-of-completion method. The following information is available for net income. Ignore income tax effects: Net Income Percentage of ComRietion $145,000 185,000 Year Ended December 31, 2014 Completed Contract $125,000 154,000 180,000 December 31, 2015 December 31, 2016 201.000 What is the journal entry to record the change in accounting principle on January 1, 2016? OA. Construction in Progress Retained Earnings Prior Period Adj. O B. No journal entry needed for prospective application of the change in principle. Account Debit Credit 51,000 51.000 Oc. Account Debit Credit Construction in Progress Deferred Tax Liability 51,000 51,000 O D. Retained Eamings - Prior Period Adj. Construction in Progress Account Debit Credit 72,000 72,000

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Hamptons Construction has decided to change its method of accounting from Completed Contract method ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d788758273_175923.pdf

180 KBs PDF File

635d788758273_175923.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started