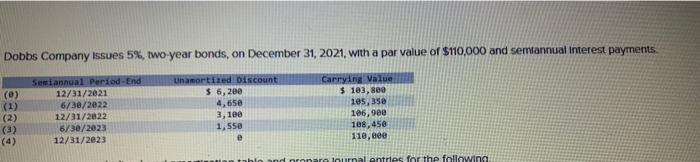

Dobbs Company Issues 5%, two-year bonds, on December 31, 2021, with a par value of $110,000 and semiannual interest payments Semiannual Period-End 12/31/2021 6/30/2022

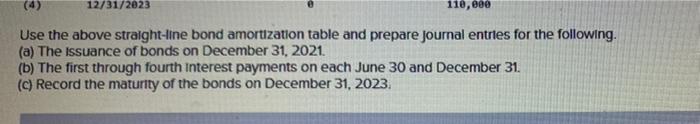

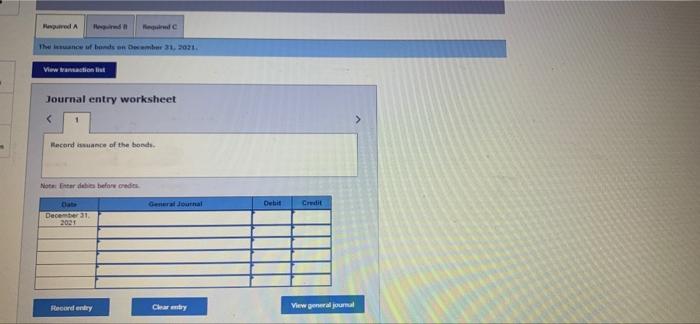

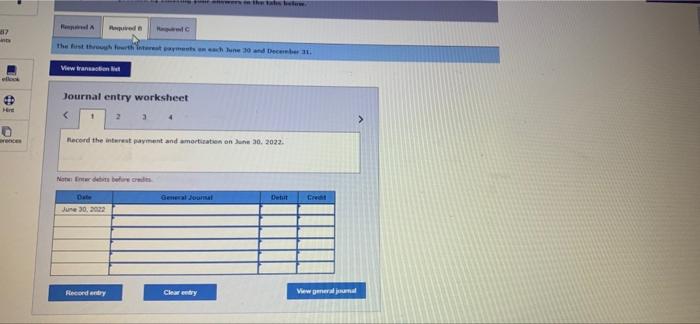

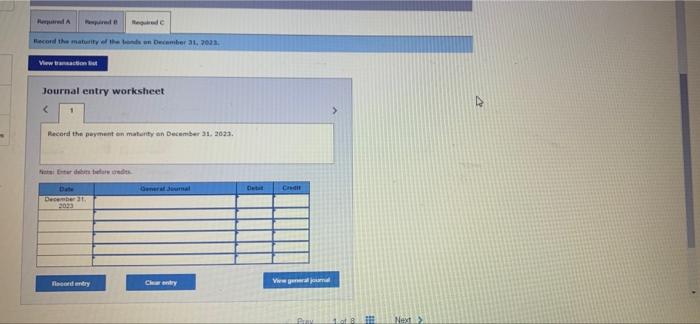

Dobbs Company Issues 5%, two-year bonds, on December 31, 2021, with a par value of $110,000 and semiannual interest payments Semiannual Period-End 12/31/2021 6/30/2022 12/31/2022 6/30/2023 12/31/2023 Unamortized Discount (e) (1) (2) (3) (4) $ 6, 200 4,650 3, 100 1,550 Carrying Value $ 103,800 105, 350 106, 90e 108,450 110, e00 tablo and pronare Journal entries for the following (4) 12/31/2023 110, e Use the above straight-line bond amortization table and prepare journal entries for the following. (a) The Issuance of bonds on December 31, 2021, (b) The first through fourth Interest payments on each June 30 and December 31. (C) Record the maturity of the bonds on December 31, 2023, Rungued A Reud Rered C The lesuance uf bonds on Dember 31, 2021. Viw trannaction list Journal entry worksheet Record issuance of the bonds. Note: Enter dehits before credits Date General Joutnal Debit Credit December 3I. 2021 Record entry Clear my View general joumal 10 the tabs blow ReplA Repuired ints the fst throgh frth interest pyments en each June 30 and December31. Vew transaton t ellok Journal entry worksheet Hre rences Record the interest payment and amortizatien on June 30. 2022. Notw Enter debi betue oed Date General Joual Detut Credt June 30, 2022 Record entry Clear eey View general jmal Rerputred A pired RegudC Record the maturity of the bnds on December 31, 203. View tanaction t Journal entry worksheet Recerd the payment en maturity an December 31. 2023. N Eter debm belre edes Date Deneral Joumal Dett Credit December 31 2023 Cntry Vww gener jumal lecord endry Next >

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Required A Date Dec 31 2021 Cash Required B Date Jun...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started