Question

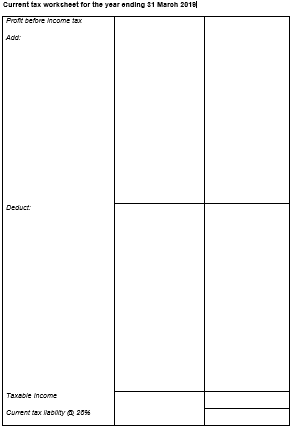

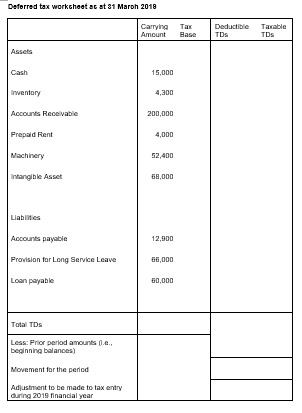

Doc McStuffins, CEO of McStuffinsville Hospital has asked you for help with her deferred tax. For the year ending 31 March 2019, McStuffinsville Hospital made

Doc McStuffins, CEO of McStuffinsville Hospital has asked you for help with her deferred tax. For the year ending 31 March 2019, McStuffinsville Hospital made an accounting profit that is 929,434. The tax rate is 28%. The following information was also provided to you:

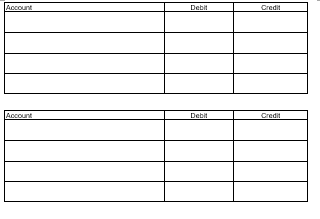

As at the end of the 2019 financial year McStuffinsville Hospital has a 4 year-old portable x-ray machine. The machine cost $62,000 and is depreciated over a total useful life of 25 years with an expected residual or salvage value of $2,000. For tax purposes the machinery is fully depreciated using a 5% depreciation rate. At the start of the 2016 financial year $119,000 of R&D expenditure was capitalized and turned into an intangible asset to be amortized over seven years. For tax purposes such expenditure is deductible in the year incurred (note there was no R&D tax credit in 2016-2019). McStuffinsville Hospital rents iPads and iPhones for staff. At 31 March 2019, $4,000 was paid in advance for the next year . Tax deductions for this item are available for amounts paid. At the start of the year there was a provision for annual long service leave of $56,000. $8,000 long service leave was taken during the year and the long service leave expense for the year was $18,000. Tax deductions for this item are available for amounts paid. There were entertainment expenses incurred and paid of $11,000. For tax purposes only 50% of the amount paid for entertainment expenses are tax deductible. The allowance for doubtful debts at the start of the year was $27,000, and at the end of the year it was $26,000. $5,000 of bad debts were written off during the year. Tax deductions for this item are available when debts are written off. The opening balances as at 1 April 2018 for Deductible Temporary Differences and Taxable Temporary Differences were 77,800 and 81,900, respectively. The tax rate is 28%. Fill in the current tax worksheet and deferred tax worksheet below. Record any journal entries relating to tax for the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started