Answered step by step

Verified Expert Solution

Question

1 Approved Answer

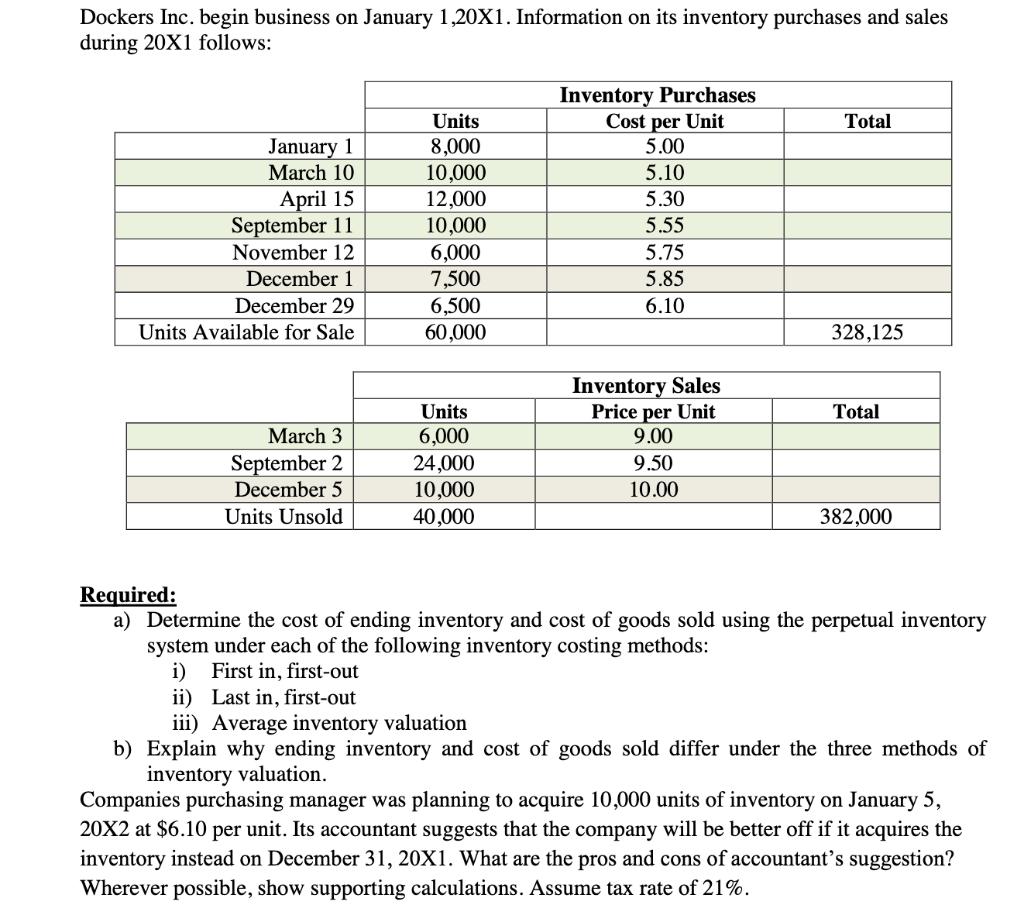

Dockers Inc. begin business on January 1,20X1. Information on its inventory purchases and sales during 20X1 follows: Inventory Purchases Cost per Unit Units Total

Dockers Inc. begin business on January 1,20X1. Information on its inventory purchases and sales during 20X1 follows: Inventory Purchases Cost per Unit Units Total January 1 8,000 5.00 March 10 10,000 5.10 April 15 12,000 5.30 September 11 10,000 5.55 November 12 6,000 5.75 December 1 7,500 5.85 December 29 6,500 6.10 Units Available for Sale 60,000 328,125 Inventory Sales Price per Unit Units Total March 3 6,000 9.00 September 2 24,000 9.50 December 5 10,000 10.00 Units Unsold 40,000 382,000 Required: a) Determine the cost of ending inventory and cost of goods sold using the perpetual inventory system under each of the following inventory costing methods: i) First in, first-out ii) Last in, first-out iii) Average inventory valuation b) Explain why ending inventory and cost of goods sold differ under the three methods of inventory valuation. Companies purchasing manager was planning to acquire 10,000 units of inventory on January 5, 20X2 at $6.10 per unit. Its accountant suggests that the company will be better off if it acquires the inventory instead on December 31, 20X1. What are the pros and cons of accountant's suggestion? Wherever possible, show supporting calculations. Assume tax rate of 21%.

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Since you have written i need only b and the lines below b please I am answering only that part Kindly consider this data for my explanation Answers b The major reason for difference in value of inven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started