Answered step by step

Verified Expert Solution

Question

1 Approved Answer

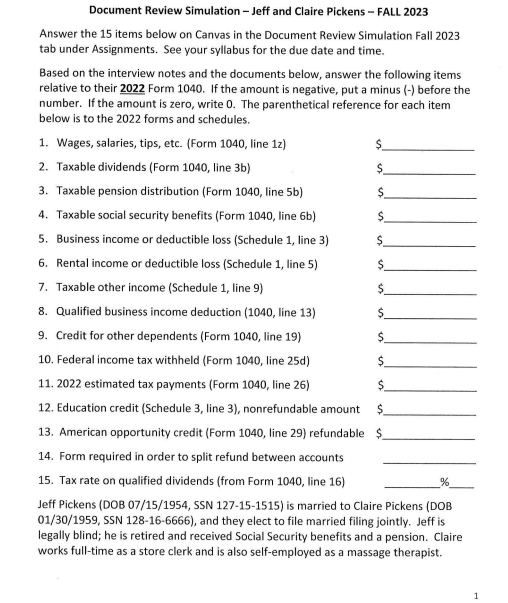

Document Review Simulation - Jeff and Claire Pickens - FALL 2 0 2 3 Answer the 1 5 items below on Canvas in the Document

Document Review Simulation Jeff and Claire Pickens FALL

Answer the items below on Canvas in the Document Review Simulation Fall

tab under Assignments. See your syllabus for the due date and time.

Based on the interview notes and the documents below, answer the following items

relative to their Form If the amount is negative, put a minus before the

number. If the amount is zero, write The parenthetical reference for each item

below is to the forms and schedules.

Wages, salaries, tips, etc. Form line z

Taxable dividends Form line b

Taxable pension distribution Form line b

Taxable social security benefits Form line b

Business income or deductible loss Schedule line

Rental income or deductible loss Schedule line

Taxable other income Schedule line

Qualified business income deduction line

Credit for other dependents Form line

Federal income tax withheld Form line d

estimated tax payments Form line

Education credit Schedule line nonrefundable amount $

American opportunity credit Form line refundable

Form required in order to split refund between accounts

Tax rate on qualified dividends from Form line

Jeff Pickens DOB SSN is married to Claire Pickens DOB

SSN and they elect to file married filing jointly. Jeff is

legally blind; he is retired and received Social Security benefits and a pension. Claire

works fulltime as a store clerk and is also selfemployed as a massage therapist.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started