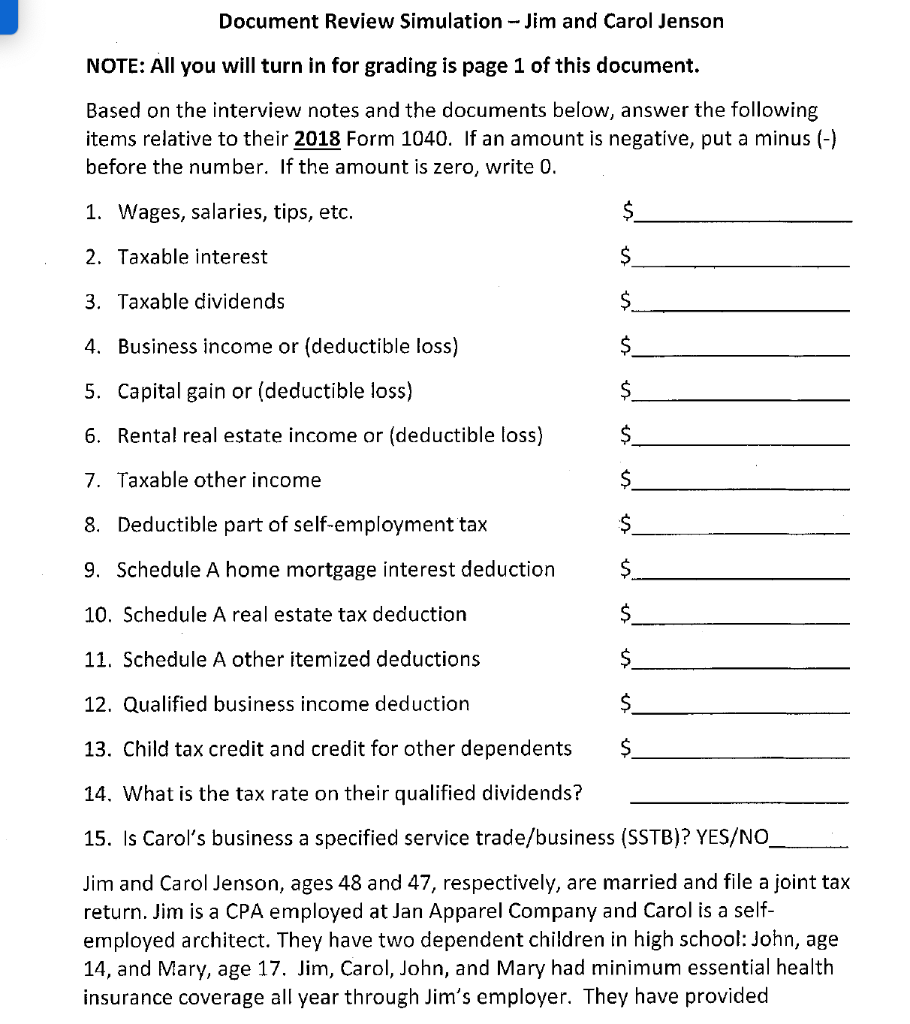

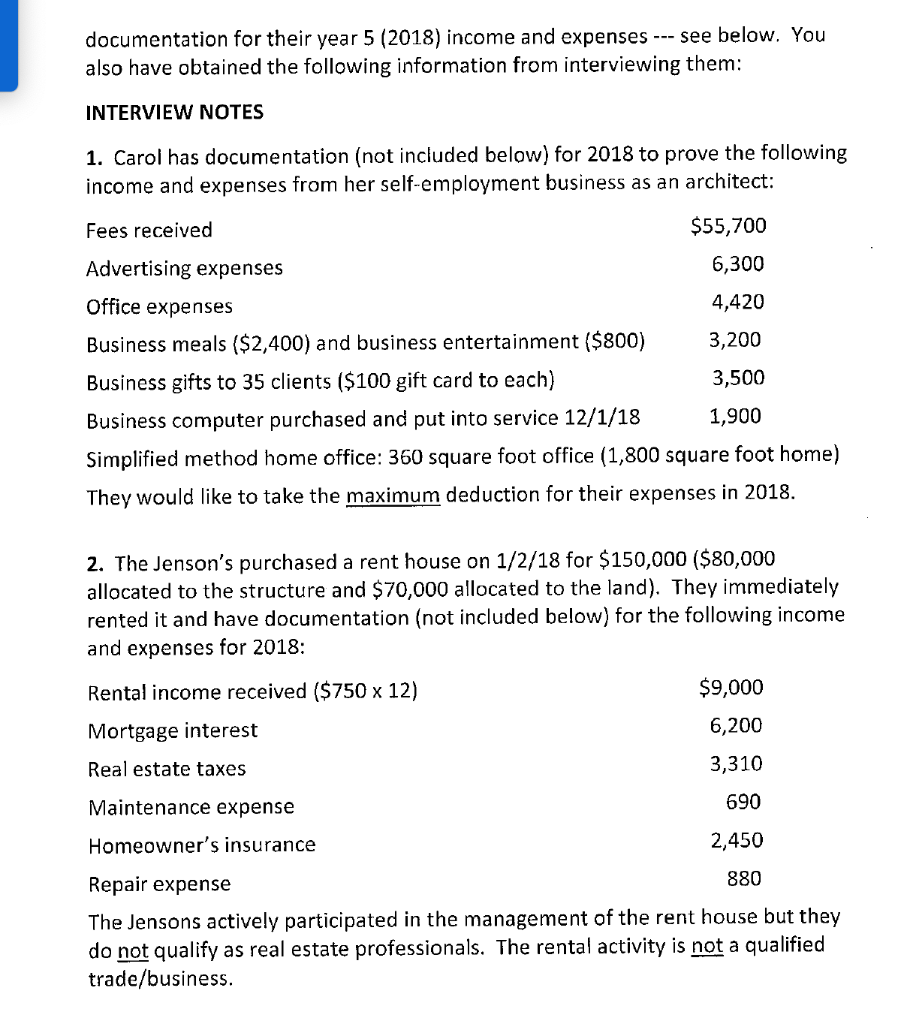

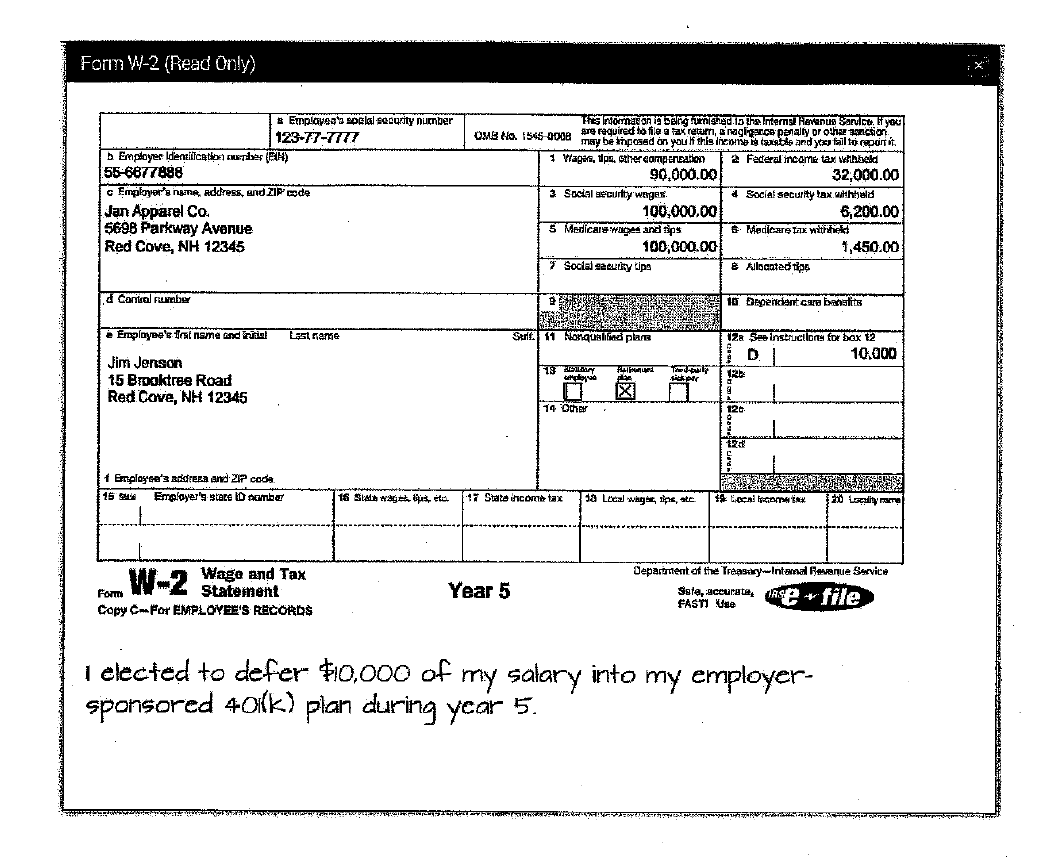

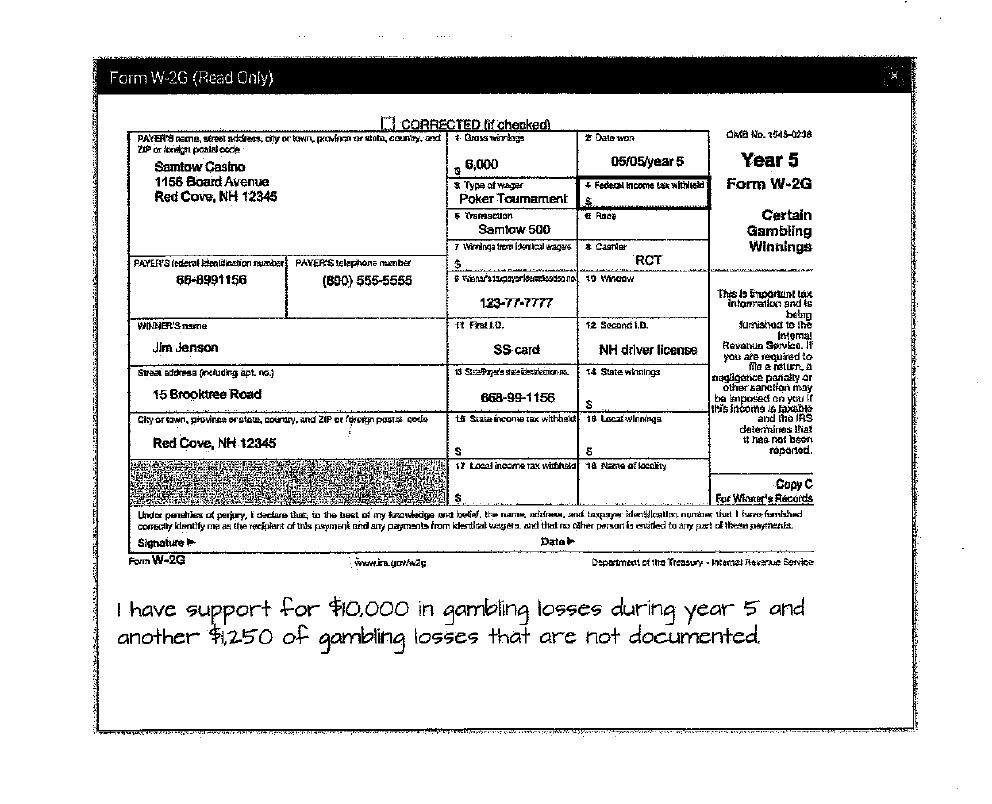

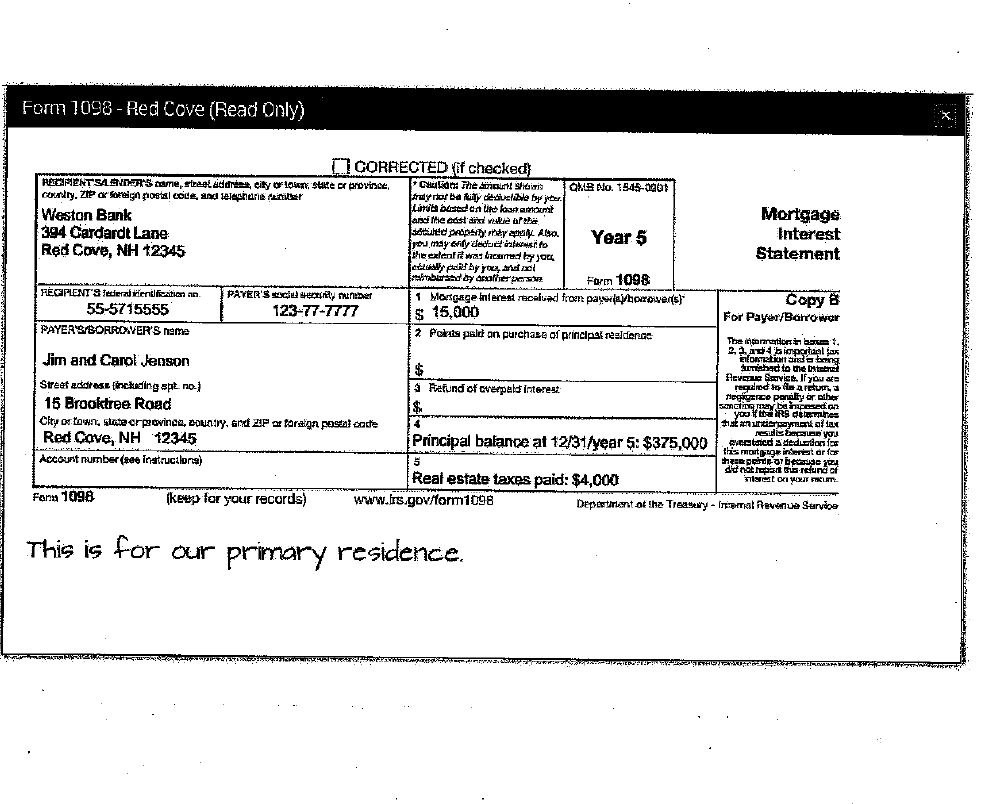

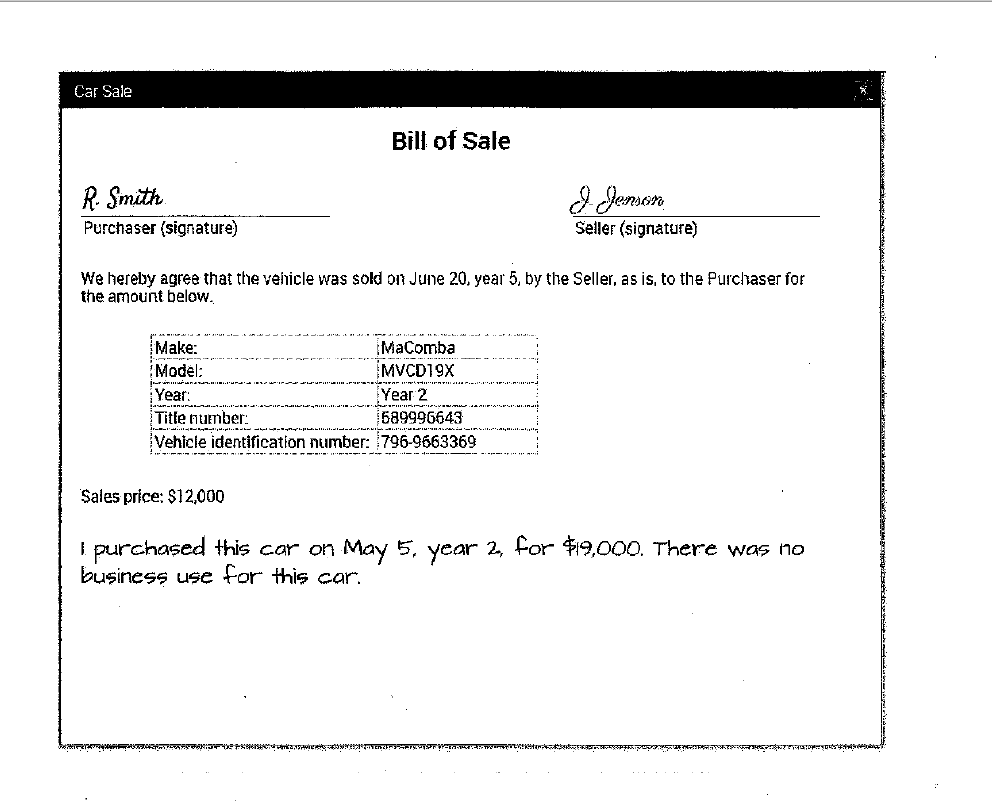

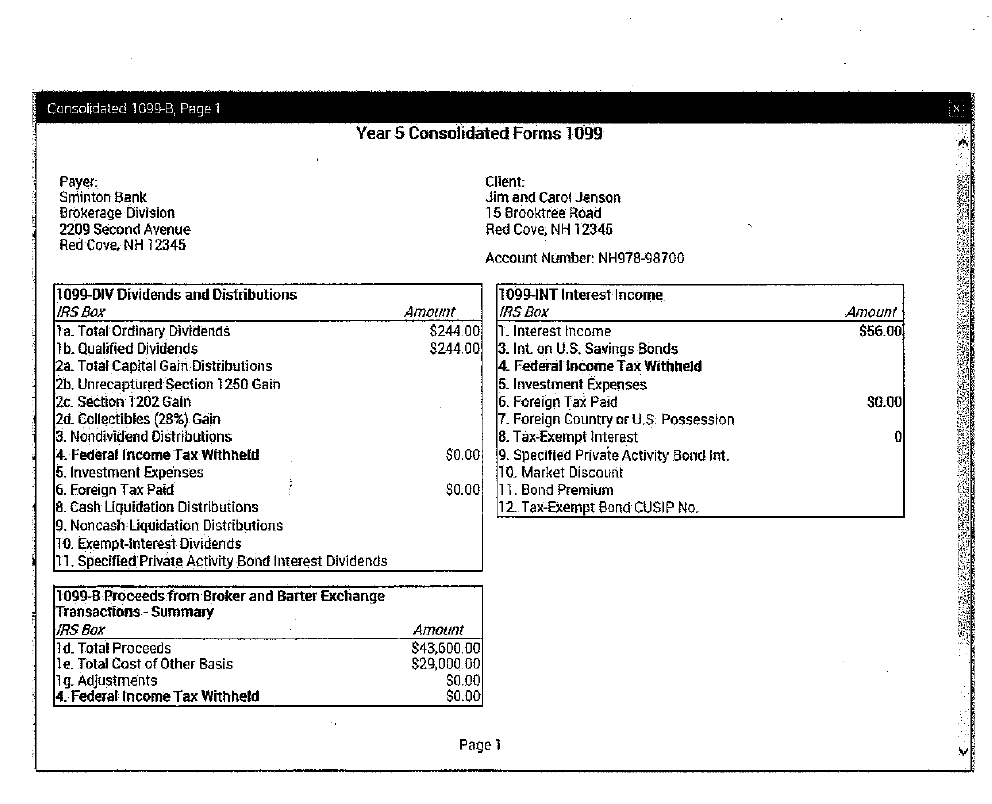

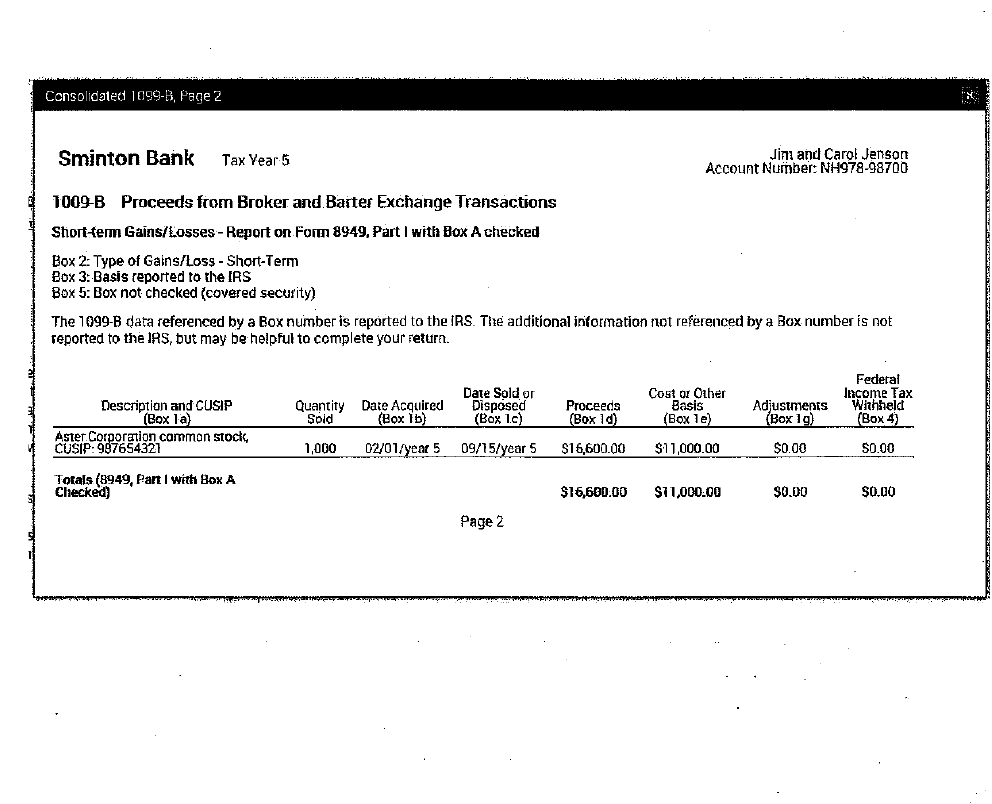

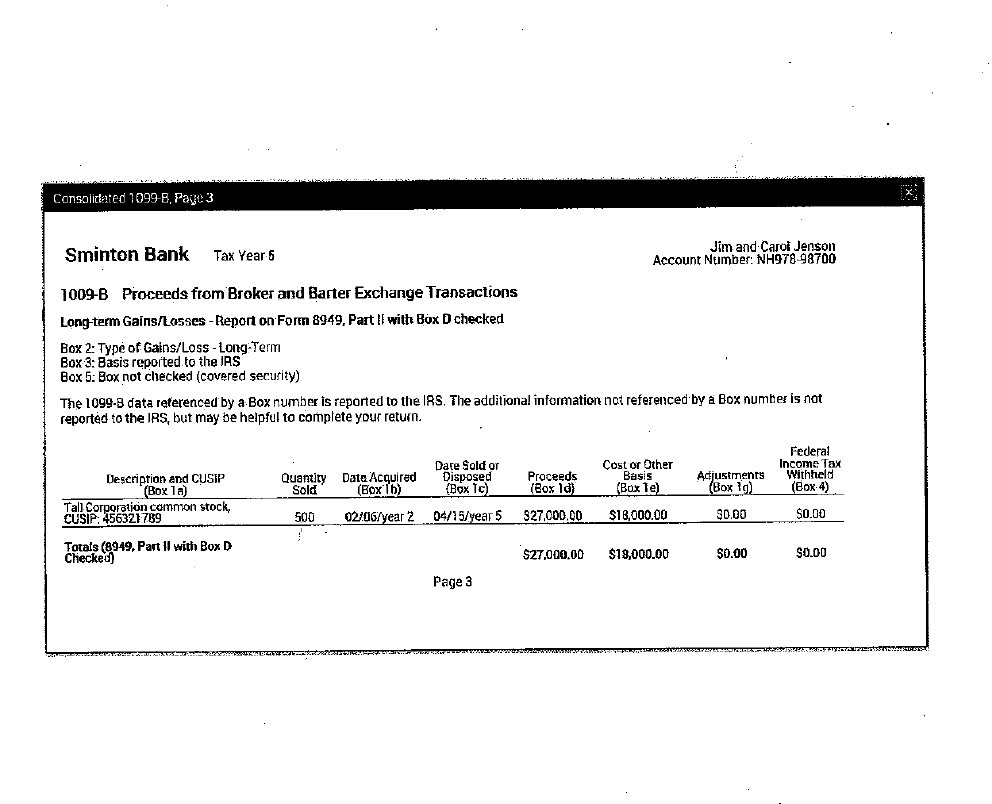

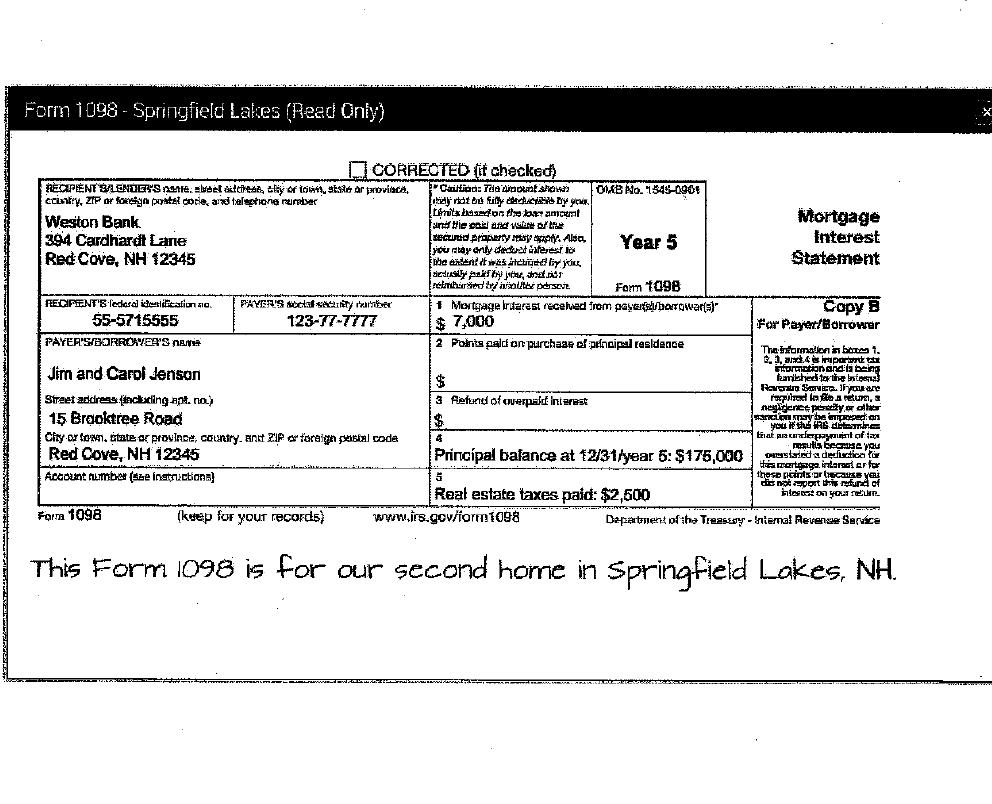

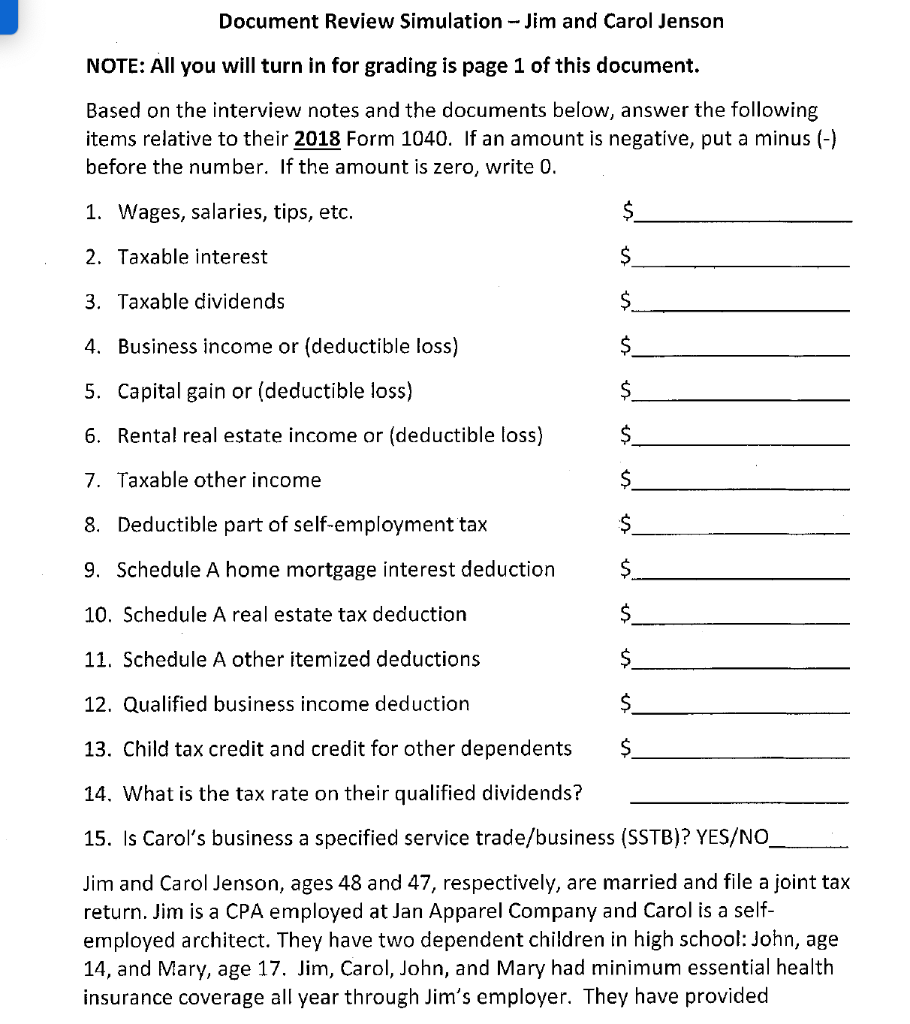

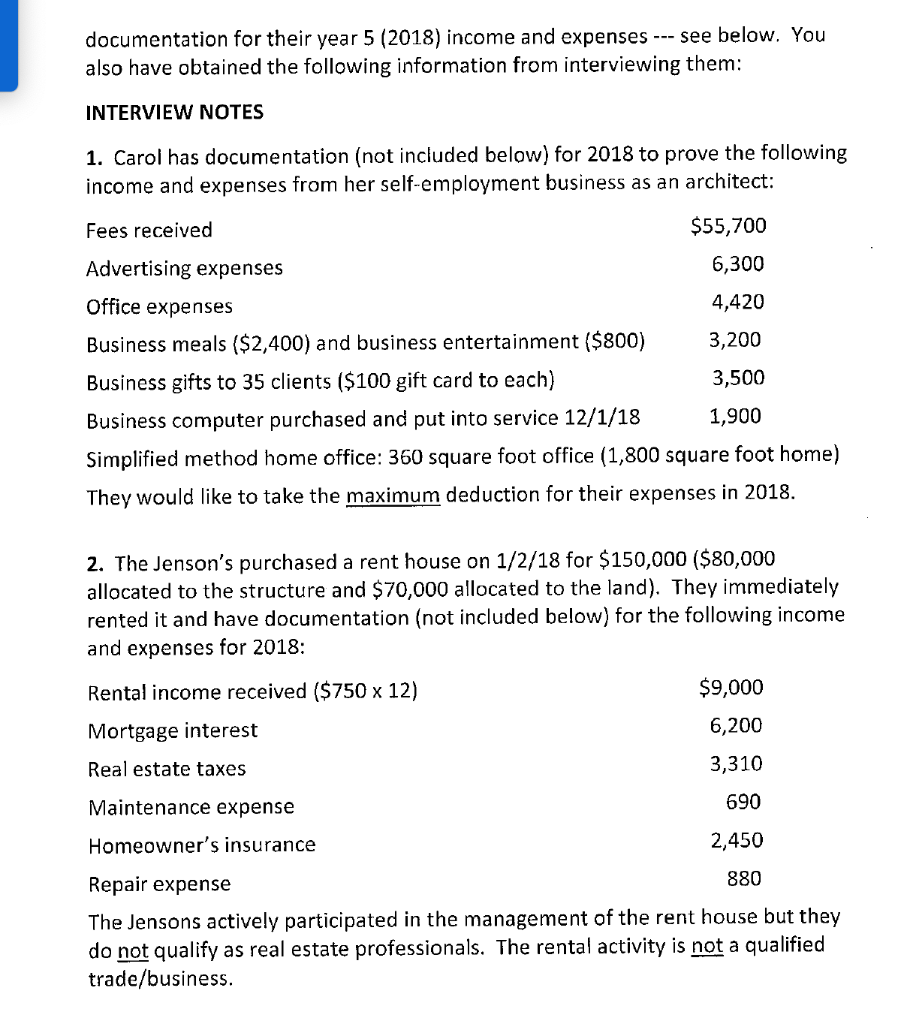

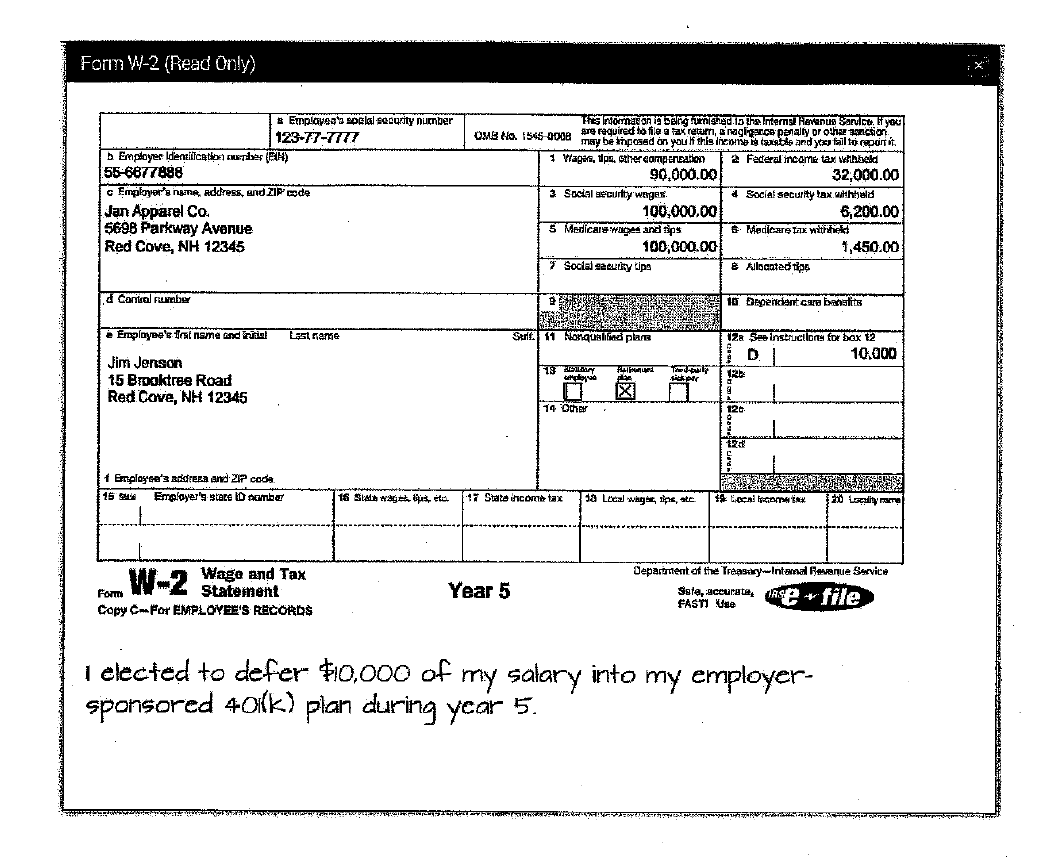

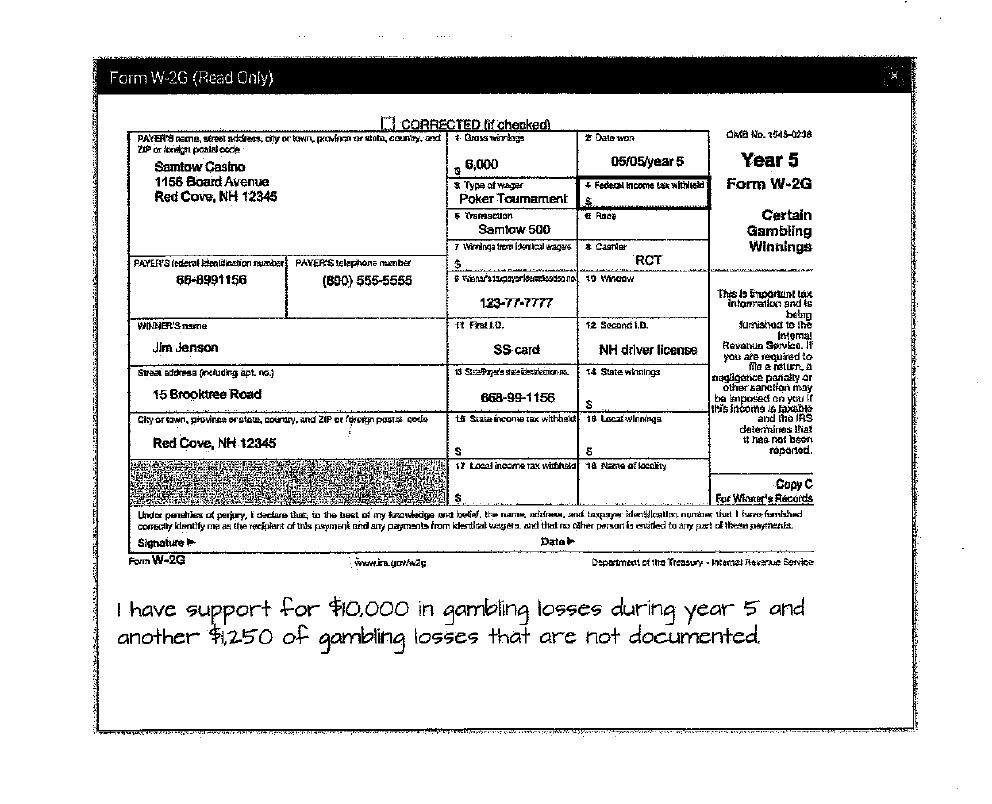

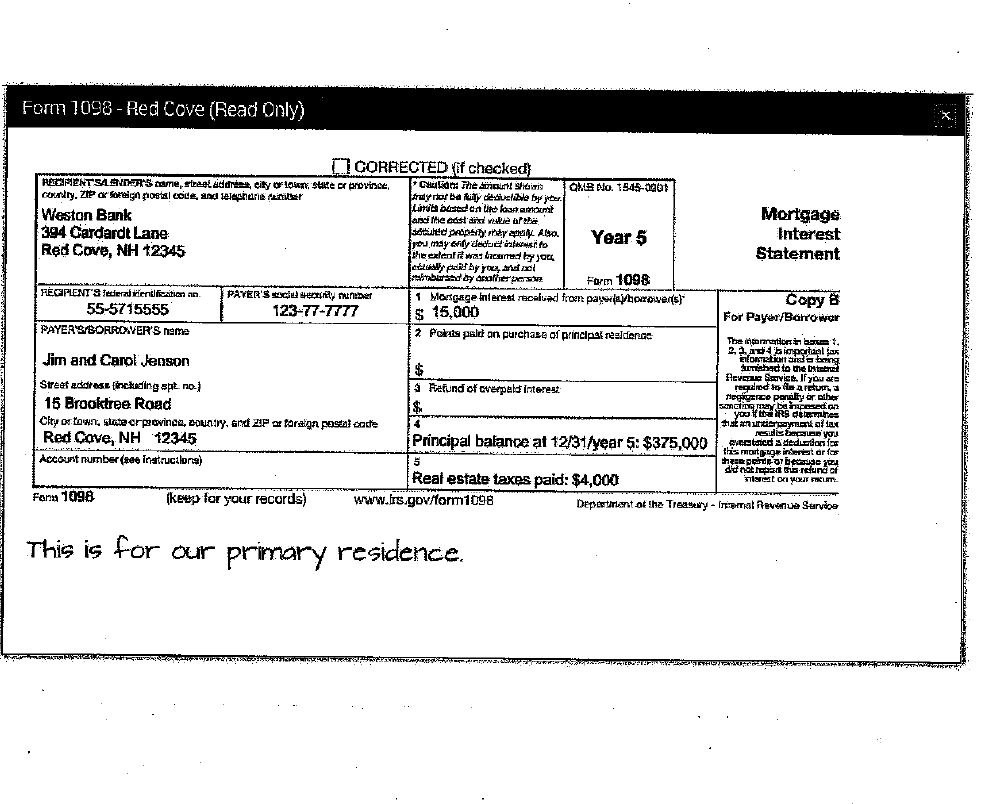

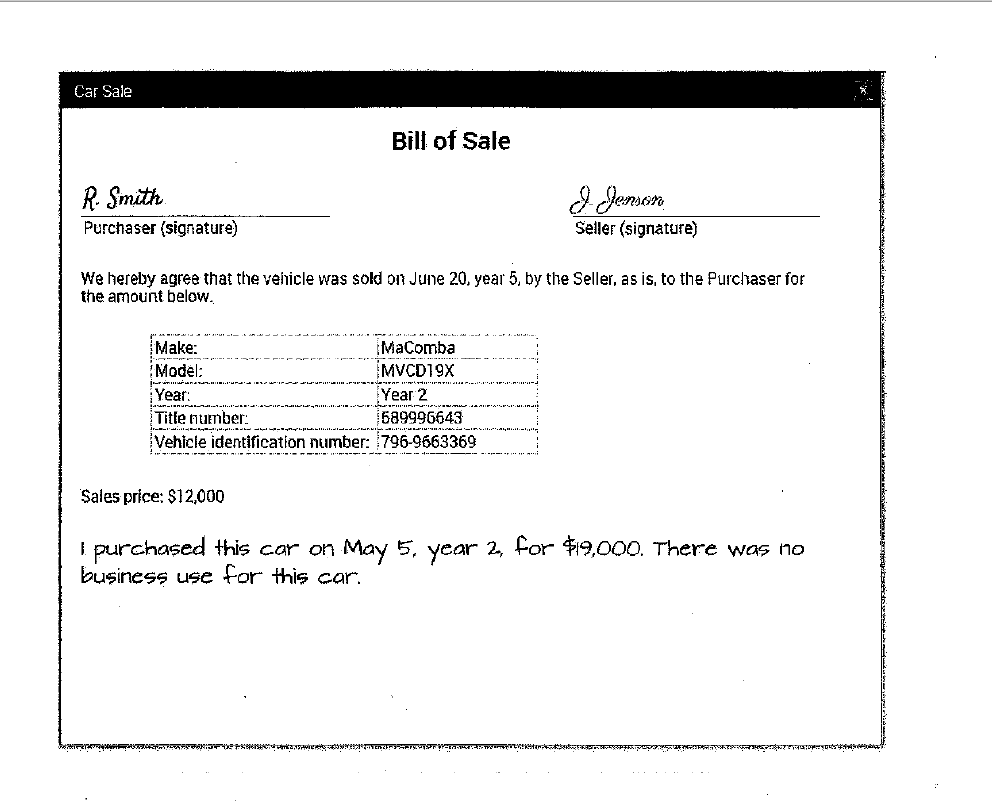

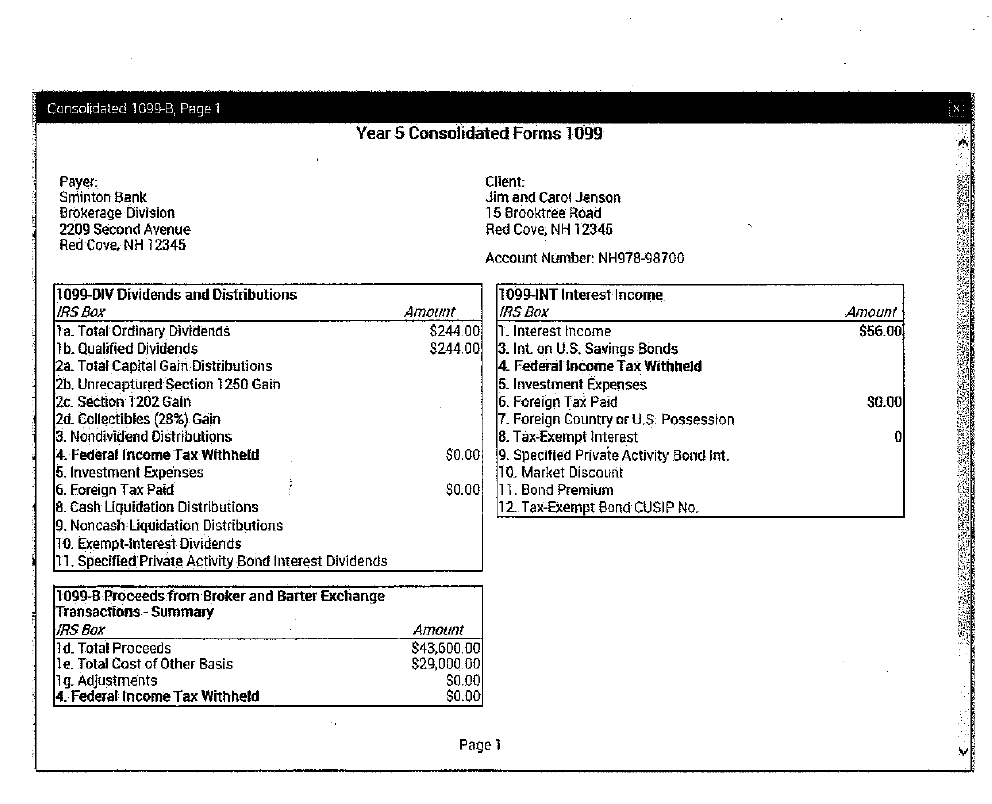

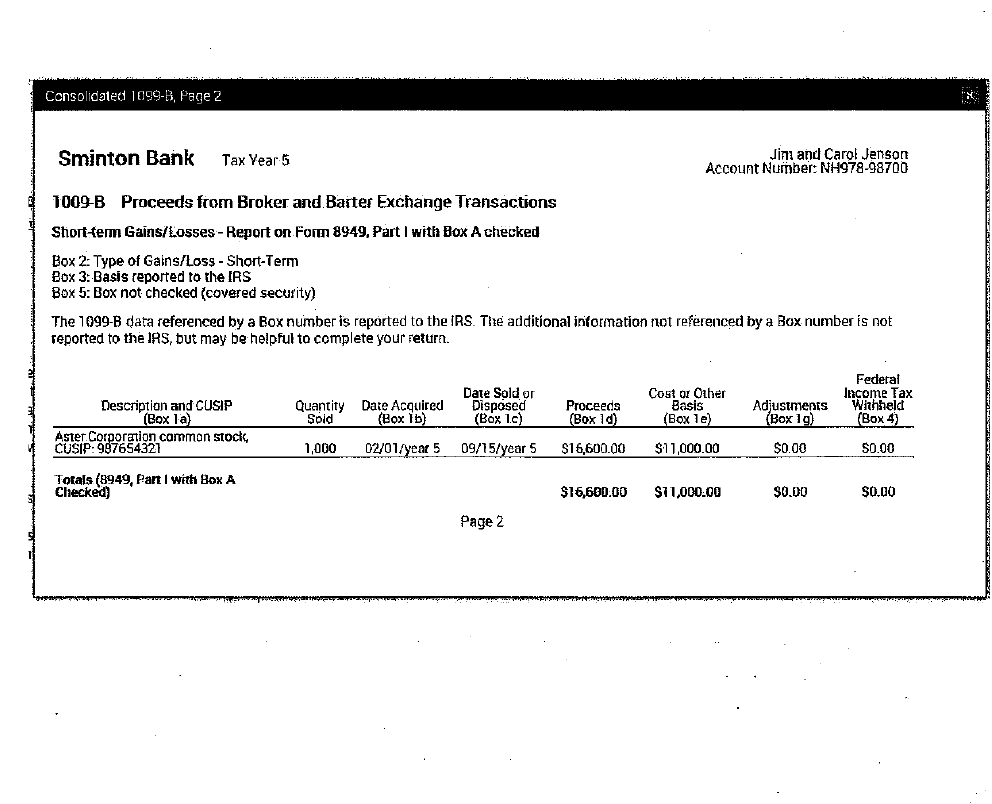

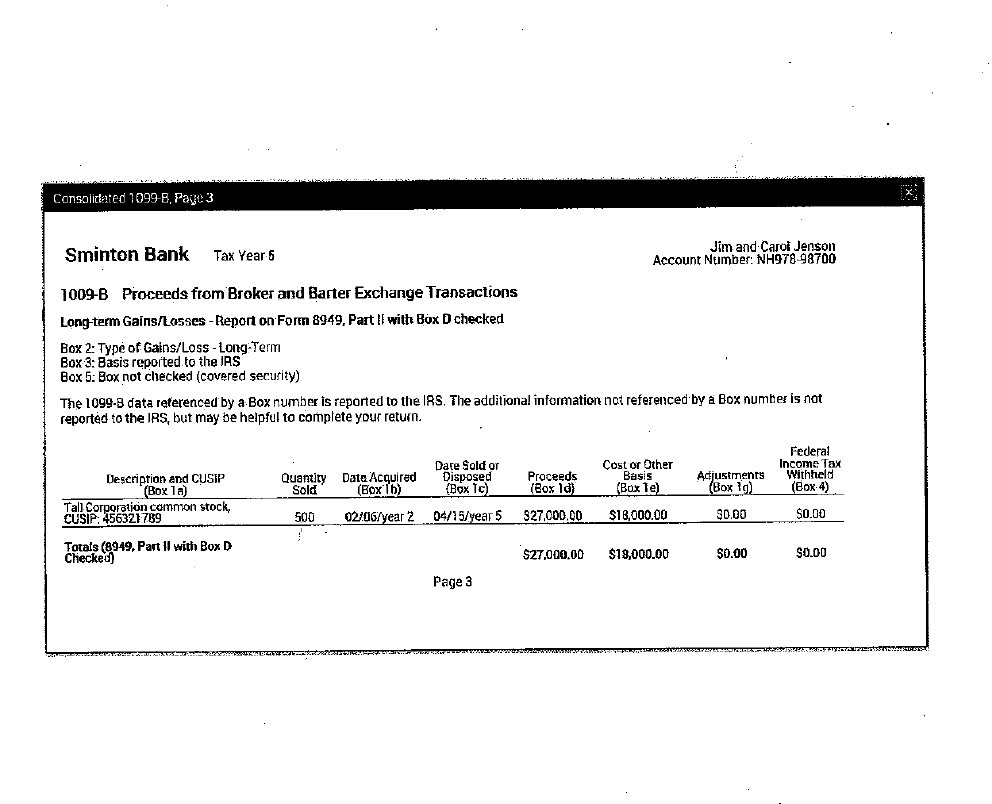

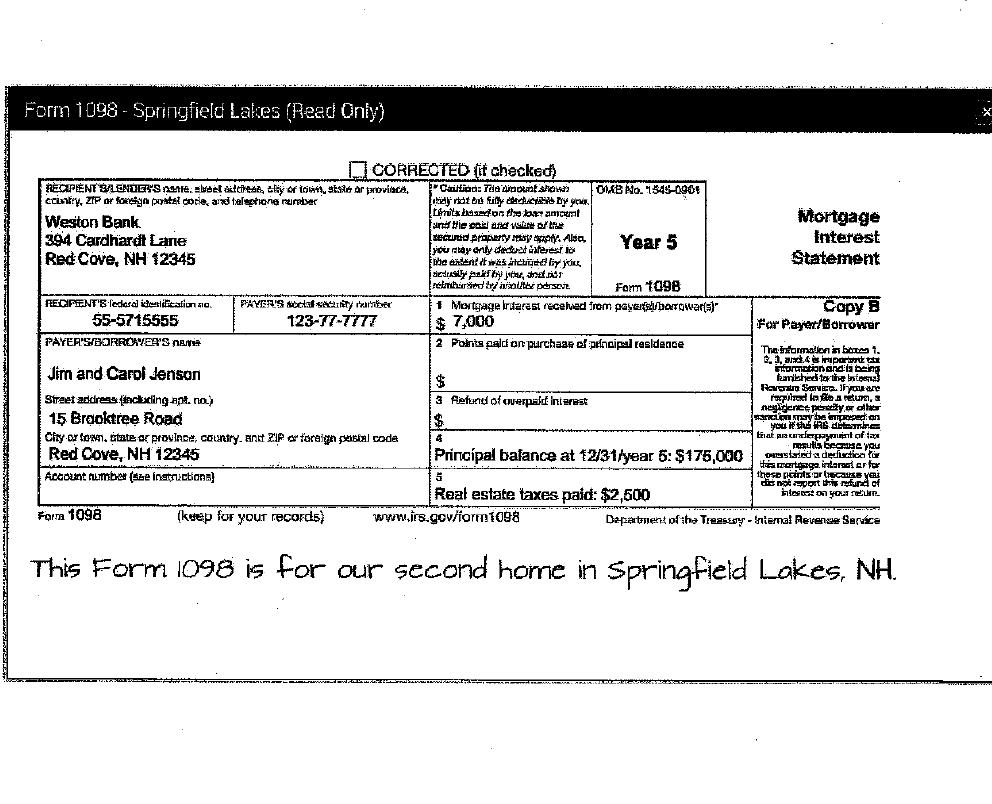

Document Review Simulation - Jim and Carol Jenson NOTE: All you will turn in for grading is page 1 of this document. Based on the interview notes and the documents below, answer the following items relative to their 2018 Form 1040. If an amount is negative, put a minus (-) before the number. If the amount is zero, write 0. 1. Wages, salaries, tips, etc. $ 2. Taxable interest $ 3. Taxable dividends $ 4. Business income or (deductible loss) $ 5. Capital gain or (deductible loss) $ 6. Rental real estate income or (deductible loss) $ 7. Taxable other income $ 8. Deductible part of self-employment tax $ 9. Schedule A home mortgage interest deduction $ 10. Schedule A real estate tax deduction $ 11. Schedule A other itemized deductions $ 12. Qualified business income deduction $ 13. Child tax credit and credit for other dependents un 14. What is the tax rate on their qualified dividends? 15. Is Carol's business a specified service trade/business (SSTB)? YES/NO Jim and Carol Jenson, ages 48 and 47, respectively, are married and file a joint tax return. Jim is a CPA employed at Jan Apparel Company and Carol is a self- employed architect. They have two dependent children in high school: John, age 14, and Mary, age 17. Jim, Carol, John, and Mary had minimum essential health insurance coverage all year through Jim's employer. They have provided documentation for their year 5 (2018) income and expenses --- see below. You also have obtained the following information from interviewing them: INTERVIEW NOTES 1. Carol has documentation (not included below) for 2018 to prove the following income and expenses from her self-employment business as an architect: Fees received $55,700 Advertising expenses 6,300 Office expenses 4,420 Business meals ($2,400) and business entertainment ($800) 3,200 Business gifts to 35 clients ($100 gift card to each) 3,500 Business computer purchased and put into service 12/1/18 1,900 Simplified method home office: 360 square foot office (1,800 square foot home) They would like to take the maximum deduction for their expenses in 2018. 2. The Jenson's purchased a rent house on 1/2/18 for $150,000 ($80,000 allocated to the structure and $70,000 allocated to the land). They immediately rented it and have documentation (not included below) for the following income and expenses for 2018: Rental income received ($750 x 12) $9,000 Mortgage interest 6,200 3,310 Real estate taxes Maintenance expense 690 Homeowner's insurance 2,450 Repair expense 880 The Jensons actively participated in the management of the rent house but they do not qualify as real estate professionals. The rental activity is not a qualified trade/business. Form W-2 (Read Only) Emplavega selal security number 123-77-7777 Employer Identication code 14) 55-6677898 Employer's name, address, and ZIP code Jan Apparel Co. 5698 Parkway Avenue Red Cove, NH 12345 The romaron Clng umighed. 15 F Interns Herenus Sarulot. If you OMB No. 1559001 are required to file a tax return, s'ngligarco penalty or other action may be mposed on you if this is costs and you fail to report. Vlagos, ps. Sther compensation 2 Federal income tax whild 90.000.00 32,000.00 3. Social security wagas & Social security tax withheld 100,000.00 6,200.00 5 Medicare Wipes and tips Medicare Tax with 100,000.00 1,450.00 Social gaurky Lipa & Allocated tips d Control fube SE! 10 Depenchant car batte Employee's tool name and rig La carne Suri 11 Nonqualified plans iza See Instruction for bax 12 D 10.000 Jim Jenson 15 Bipoktree Road Red Cove, NH 12345 3 :III. uwa 22 seper IX 14 Other 126 . 12 t Explore's desa and 217 coda 15 Employer's stoce Doba 16 SM Wat is do 17 Statathcome tax 13 Local whg tips, ste $9 Coen ga HOLT W-2 Wage and Tax Year 5 Form Statement Copy Cm For EMPLOYEE'S RECORDS Department of the Treasury-Intama Bernue Service Sate, accurate file FAST the I elected to defer $10,000 of my salary into my employer- sponsored 40(k) plan during year 5. WART Form W2G (Read Only) I CORRECTED i checked PAYER neme, streets dy orton xo stoty, county, and #Qaysia Dale won Ora No. 14-07-18 Zbornika porin och Samtow Casino 6,000 05/05/year 5 Year 5 1156 Board Avenue Type at Waper + Federal come lak withald Form W-2G Red Cove, NH 12345 Poker Toumaments 5 ramacuan & Anet Certain Samlow 500 Gambling 7 Wiringa tror inte agus # Caenier Wintings PAYERS Inderal Election or PAYERS telephone by $ RCT 68-8991156 (890) 555-5555 agar dan 10 Window this to barulax 123-77-7777 intaramy and ts beby WOMER'S name tt Fra 1.0. 12 Second 1.D. Jumisaa 10 the nema! Jim Jenson SS card NH driver license Revan Sprvkeo.it you are required to Sree addresa including apt. no. ma eigiT, A 13 SET'S TECHN. 14 State winning oggetice panty ar 15 Brooktree Road other sanction may 69-99-1156 S ka plosed on your this income a Cky or town, province or stew, country and ZIP or FORCE Podo Siata inconte Tex with bald 10 Locar winnings and to IAS determines that Red Cove, NH 12345 the not been S 5 roparod. 17 Local income Tax with 18 N21 a locality Copy For Whytes fecards Under parelles perpey, I sadove tue in the best of my troubadigan bolalarne, raf taxpayecal nurdhar set forth COFFE Kontify and the recitalart of this paper and a pajtnants from klestine and that is certificerided to dry peces. Sighatice Data For W-2G www.yowas Department of the Treasury talee Service I have support for $10,000 in gambling losses during year 5 and another $1,250 of gambling losses that are not documented. MITTE Myyery- non Form 1098 - Red Cove (Read Only) O CORRECTED (if checked} REMENTSILEVS teme, street liderim, city loan, Suke or province Chelid: the mounts QXB Do. 1945-0001 conly. ZtPor foreign postal code, and elephanie finder Armyror Bally due tjter. Linha buted on to at Weston Bank Mortgage and the added wilde alta 394 Cardardt Lane stilte ophy A. Year 5 Interest ou may erily deducido Red Cove, NH 12345 Dhe extent it was treated by you Statement ey party, ayanather Form 1098 FECIPIENTS der Wintheation an PAYER'S curry One 1 Mortgage Interest hoolitsed from payworower(s)* Copy 55-5715555 123-77-777 $ 15,000 For Payur/Barrower PAYER'S BORROWER'S name 7 Poku palcan purchase of principalmeeldenge The information that 2. gba important fax Jim and Carol Jenson $ had to me Nevevigt. If you are Street adrese (cing spt no Petund of cuerpals interest required to file a returna Hook.co panely or the 15 Brooktrae Road $ SACC bu haped on : youts alumnes Clty or town, state or povine, Doud, GrX 2Patareign pasta cate Sakaf tax Red Cove, NH 12345 Principal balance at 12/31/year 5: $375,000 watcd dodanie this mortgage insertat or los Account number (see Instructora) 5 these probleugery du na tardund cf Real estate taxes paid: $4,000 net OKI WXJ FILAT: Fanu 1098 keep for your records) www.lrs.gov/farm1098 Deperont of the Treaseny - ITEDTal Revue Service This is for our primary residence. Car Sale Bill of Sale R. Smith Purchaser (signature) I Jenson Seller (signature) We hereby agree that the vehicle was sold on June 20. year 5, by the Seller, as is, to the Purchaser for the amount below. Make: MaComba Model: MVCD19X Year: Year 2 Title number: 689996643 Vehicle identification number: 796-9663369 Sales price: $12,000 I purchased this car on May 5, year 2, for $19,000. There was no business use for this car. PANIJVYPPERWYERSZAFTSTOT 2-42LVIMENT ESPRIT . Consolidated 1999-B, Page 1 X Year 5 Consolidated Forms 1099 Payer: Sminton Bank Brokerage Division 2209 Second Avenue Red Cove, NH 12345 Client: Jim and Caroi Jenson 15 Brooktree Road Red Cove, NH 12345 Account Number: NH978-98700 Amount $56.00 1099-DIV Dividends and Distributions IRS Box ta. Total Ordinary Dividends ib. Qualified Dividends 2a. Total Capital Gain Distibutions 2b. Unrecaptured Section 1250 Gain 2c. Section 1202 Gain 20. Collectibles (28%) Gain 3. Nondividend Distributions 4. Federal Income Tax Withheld 5. Investment Expenses 6. Foreign Tax Paich 8. Cash Liquidation Distributions 9. Noncash Liquidation Distributions 10. Exempt-interest Dividends 17. Specified Private Activity Bond Interest Dividends 1099-INT Interest Income Amount IRS Box $244.00 11. Interest Income $244.00 3. Int on U.S. Savings Bonds 4. Federal income Tax Withheld 5. Investment Expenses 6. Foreign Tax Paid 7. Foreign Country or U.S. Possession 8. Tax-Exempt Interest $0.00 9. Specified Private Activity Bond Int. TO Market Discount $0.00 11. Bond Premium 12. Tax-Exempt Bond CUSIP NO. $0.00 1099-B Proceeds from Broker and Barter Exchange Transactions-Summary MRS Box 1d. Total Proceeds le. Total Cost of Other Basis 19. Adjustments 4. Federal Income Tax Withheld Amount $43,600.00 $29,000.00 $0.00 $0.00 Page 1 Consolidated 1099-B, Page 2 Sminton Bank Tax Years Jini and Carol Jenson Account Number: NH978-98700 1009B Proceeds from Broker and Barter Exchange Transactions Short-term Gains/Losses - Report on Form 8949, Part I with Box A checked Box 2: Type of Gains/Loss - Short-Term Box 3: Basis reported to the IRS Box 5: Box not checked (covered security) The 1099-B data referenced by a Box number is reported to the IRS. The additional information not referenced by a Box number is not reported to the IRS, but may be helpful to complete your retura. Date Sold or Disposed (Box 1c) Quantity Date Acquired Sold (Box lb) Proceeds (Box 10) Description and CUSIP (Box la Aster Corporation common stock CUSIP: 997654321 Cost or Other Basis (Box le) Adjustments (Box 1g) Federal Income Tax Withheld (Box 4) 1,000 02/01/year 5 09/15/year 5 $16,600.00 $11,000.00 $0.00 $0.00 Totals (8949, Pan I with Box A Checked) $16,600.00 $71,000.00 S0.00 $0.00 Page 2 Consolidated 1099-8. Page 3 Sminton Bank Tax Year 6 Jim and Carol Jenson Account Number: NH978-98700 1009-B Proceeds from Broker and Barter Exchange Transactions Long-term Gains/tosses - Report on Foren 8949, Part II with Box D checked Box 2: Type of Gains/Loss - Long-Term Box 3: Basis reported to the IRS Box 5: Box not checked (covered security) The 1099-8 data referenced by a Box number is reported to the IRS. The additional information not referenced by a Box number is not reported to the IRS, but may be helpful to complete your return. Quantity Sold Dare Sold or Disposed Box 1c) Data Acquired (Box b) Federal Income Tax Withheld (eox4) Cost or Other Basis (Bax te) Proceeds (Box la Adjustments (Box 1g) Description and CUSIP (Box 1a) Tall Corporation common stock, CUSIP: 456321789 500 02/06/year 2 04/15/year 5 $27,000.00 $18,000.00 $0.00 $0.00 Totals (8919, Part 1 with Box D Checked $27,000.00 $19,000.00 $0.00 $0.00 Page 3 FISCALS try Form 1098 - Springfield Lalces (Read Only) CORRECTED it checked) RECUPENT 3/1 ENDER'S nte. Elbettches, hy of star hovica, Capada katanaw OMB No. 1545-0904 country, ZIP of foreign postal code and taltione rureker of rot out fifty Dy your britandose portance Weston Bank Mortgage in Wiene art of 394 Cardhardt Lane Bec Pty tatt Alda Year 5 Interest you clay only duettel Red Cove, NH 12345 the enden esitted by you Statement icdusty punto, cand nutar posee Forn 1098 RECIPENT'Slederal con la FAYER'S Society anter 1 Mertenaga kriterest received from payers borrowarts) Copy B 55-5715555 123-77-7777 For Payer/Borrower PAYERSBORROWEN'S # 2 Points paid or purchaar opincipal residence The hommation in bom 1. 8.1, and import hormation and being Jirn and Carol Jenson tameedstate Rara Sahyou are Street address and wing Apt.no) 3 Alelund of overpal Interest pid lageretur, Peyor of be need on 15 Braoktree Road you #th AG disting | EEat RECIPin a Chyby (on state province, country. And ZIP foreign stal code out Us You Red Cove, NH 12345 Principal balance at $2/31/year 5: $175,000 Sed deflectice for Harrertraga inaral arfer Account number (Sze instruction) these parts or re yet novot the oturd of Real estate taxes paid: $2,500 Steses on your TELUT For 1098 keep for your records) www.iis.gov/form1098 Dapatent of the Treasury - niemal Aevenue Service $ 7,000 This Form 1098 is for our second home in Springfield Lakes, NH. Document Review Simulation - Jim and Carol Jenson NOTE: All you will turn in for grading is page 1 of this document. Based on the interview notes and the documents below, answer the following items relative to their 2018 Form 1040. If an amount is negative, put a minus (-) before the number. If the amount is zero, write 0. 1. Wages, salaries, tips, etc. $ 2. Taxable interest $ 3. Taxable dividends $ 4. Business income or (deductible loss) $ 5. Capital gain or (deductible loss) $ 6. Rental real estate income or (deductible loss) $ 7. Taxable other income $ 8. Deductible part of self-employment tax $ 9. Schedule A home mortgage interest deduction $ 10. Schedule A real estate tax deduction $ 11. Schedule A other itemized deductions $ 12. Qualified business income deduction $ 13. Child tax credit and credit for other dependents un 14. What is the tax rate on their qualified dividends? 15. Is Carol's business a specified service trade/business (SSTB)? YES/NO Jim and Carol Jenson, ages 48 and 47, respectively, are married and file a joint tax return. Jim is a CPA employed at Jan Apparel Company and Carol is a self- employed architect. They have two dependent children in high school: John, age 14, and Mary, age 17. Jim, Carol, John, and Mary had minimum essential health insurance coverage all year through Jim's employer. They have provided documentation for their year 5 (2018) income and expenses --- see below. You also have obtained the following information from interviewing them: INTERVIEW NOTES 1. Carol has documentation (not included below) for 2018 to prove the following income and expenses from her self-employment business as an architect: Fees received $55,700 Advertising expenses 6,300 Office expenses 4,420 Business meals ($2,400) and business entertainment ($800) 3,200 Business gifts to 35 clients ($100 gift card to each) 3,500 Business computer purchased and put into service 12/1/18 1,900 Simplified method home office: 360 square foot office (1,800 square foot home) They would like to take the maximum deduction for their expenses in 2018. 2. The Jenson's purchased a rent house on 1/2/18 for $150,000 ($80,000 allocated to the structure and $70,000 allocated to the land). They immediately rented it and have documentation (not included below) for the following income and expenses for 2018: Rental income received ($750 x 12) $9,000 Mortgage interest 6,200 3,310 Real estate taxes Maintenance expense 690 Homeowner's insurance 2,450 Repair expense 880 The Jensons actively participated in the management of the rent house but they do not qualify as real estate professionals. The rental activity is not a qualified trade/business. Form W-2 (Read Only) Emplavega selal security number 123-77-7777 Employer Identication code 14) 55-6677898 Employer's name, address, and ZIP code Jan Apparel Co. 5698 Parkway Avenue Red Cove, NH 12345 The romaron Clng umighed. 15 F Interns Herenus Sarulot. If you OMB No. 1559001 are required to file a tax return, s'ngligarco penalty or other action may be mposed on you if this is costs and you fail to report. Vlagos, ps. Sther compensation 2 Federal income tax whild 90.000.00 32,000.00 3. Social security wagas & Social security tax withheld 100,000.00 6,200.00 5 Medicare Wipes and tips Medicare Tax with 100,000.00 1,450.00 Social gaurky Lipa & Allocated tips d Control fube SE! 10 Depenchant car batte Employee's tool name and rig La carne Suri 11 Nonqualified plans iza See Instruction for bax 12 D 10.000 Jim Jenson 15 Bipoktree Road Red Cove, NH 12345 3 :III. uwa 22 seper IX 14 Other 126 . 12 t Explore's desa and 217 coda 15 Employer's stoce Doba 16 SM Wat is do 17 Statathcome tax 13 Local whg tips, ste $9 Coen ga HOLT W-2 Wage and Tax Year 5 Form Statement Copy Cm For EMPLOYEE'S RECORDS Department of the Treasury-Intama Bernue Service Sate, accurate file FAST the I elected to defer $10,000 of my salary into my employer- sponsored 40(k) plan during year 5. WART Form W2G (Read Only) I CORRECTED i checked PAYER neme, streets dy orton xo stoty, county, and #Qaysia Dale won Ora No. 14-07-18 Zbornika porin och Samtow Casino 6,000 05/05/year 5 Year 5 1156 Board Avenue Type at Waper + Federal come lak withald Form W-2G Red Cove, NH 12345 Poker Toumaments 5 ramacuan & Anet Certain Samlow 500 Gambling 7 Wiringa tror inte agus # Caenier Wintings PAYERS Inderal Election or PAYERS telephone by $ RCT 68-8991156 (890) 555-5555 agar dan 10 Window this to barulax 123-77-7777 intaramy and ts beby WOMER'S name tt Fra 1.0. 12 Second 1.D. Jumisaa 10 the nema! Jim Jenson SS card NH driver license Revan Sprvkeo.it you are required to Sree addresa including apt. no. ma eigiT, A 13 SET'S TECHN. 14 State winning oggetice panty ar 15 Brooktree Road other sanction may 69-99-1156 S ka plosed on your this income a Cky or town, province or stew, country and ZIP or FORCE Podo Siata inconte Tex with bald 10 Locar winnings and to IAS determines that Red Cove, NH 12345 the not been S 5 roparod. 17 Local income Tax with 18 N21 a locality Copy For Whytes fecards Under parelles perpey, I sadove tue in the best of my troubadigan bolalarne, raf taxpayecal nurdhar set forth COFFE Kontify and the recitalart of this paper and a pajtnants from klestine and that is certificerided to dry peces. Sighatice Data For W-2G www.yowas Department of the Treasury talee Service I have support for $10,000 in gambling losses during year 5 and another $1,250 of gambling losses that are not documented. MITTE Myyery- non Form 1098 - Red Cove (Read Only) O CORRECTED (if checked} REMENTSILEVS teme, street liderim, city loan, Suke or province Chelid: the mounts QXB Do. 1945-0001 conly. ZtPor foreign postal code, and elephanie finder Armyror Bally due tjter. Linha buted on to at Weston Bank Mortgage and the added wilde alta 394 Cardardt Lane stilte ophy A. Year 5 Interest ou may erily deducido Red Cove, NH 12345 Dhe extent it was treated by you Statement ey party, ayanather Form 1098 FECIPIENTS der Wintheation an PAYER'S curry One 1 Mortgage Interest hoolitsed from payworower(s)* Copy 55-5715555 123-77-777 $ 15,000 For Payur/Barrower PAYER'S BORROWER'S name 7 Poku palcan purchase of principalmeeldenge The information that 2. gba important fax Jim and Carol Jenson $ had to me Nevevigt. If you are Street adrese (cing spt no Petund of cuerpals interest required to file a returna Hook.co panely or the 15 Brooktrae Road $ SACC bu haped on : youts alumnes Clty or town, state or povine, Doud, GrX 2Patareign pasta cate Sakaf tax Red Cove, NH 12345 Principal balance at 12/31/year 5: $375,000 watcd dodanie this mortgage insertat or los Account number (see Instructora) 5 these probleugery du na tardund cf Real estate taxes paid: $4,000 net OKI WXJ FILAT: Fanu 1098 keep for your records) www.lrs.gov/farm1098 Deperont of the Treaseny - ITEDTal Revue Service This is for our primary residence. Car Sale Bill of Sale R. Smith Purchaser (signature) I Jenson Seller (signature) We hereby agree that the vehicle was sold on June 20. year 5, by the Seller, as is, to the Purchaser for the amount below. Make: MaComba Model: MVCD19X Year: Year 2 Title number: 689996643 Vehicle identification number: 796-9663369 Sales price: $12,000 I purchased this car on May 5, year 2, for $19,000. There was no business use for this car. PANIJVYPPERWYERSZAFTSTOT 2-42LVIMENT ESPRIT . Consolidated 1999-B, Page 1 X Year 5 Consolidated Forms 1099 Payer: Sminton Bank Brokerage Division 2209 Second Avenue Red Cove, NH 12345 Client: Jim and Caroi Jenson 15 Brooktree Road Red Cove, NH 12345 Account Number: NH978-98700 Amount $56.00 1099-DIV Dividends and Distributions IRS Box ta. Total Ordinary Dividends ib. Qualified Dividends 2a. Total Capital Gain Distibutions 2b. Unrecaptured Section 1250 Gain 2c. Section 1202 Gain 20. Collectibles (28%) Gain 3. Nondividend Distributions 4. Federal Income Tax Withheld 5. Investment Expenses 6. Foreign Tax Paich 8. Cash Liquidation Distributions 9. Noncash Liquidation Distributions 10. Exempt-interest Dividends 17. Specified Private Activity Bond Interest Dividends 1099-INT Interest Income Amount IRS Box $244.00 11. Interest Income $244.00 3. Int on U.S. Savings Bonds 4. Federal income Tax Withheld 5. Investment Expenses 6. Foreign Tax Paid 7. Foreign Country or U.S. Possession 8. Tax-Exempt Interest $0.00 9. Specified Private Activity Bond Int. TO Market Discount $0.00 11. Bond Premium 12. Tax-Exempt Bond CUSIP NO. $0.00 1099-B Proceeds from Broker and Barter Exchange Transactions-Summary MRS Box 1d. Total Proceeds le. Total Cost of Other Basis 19. Adjustments 4. Federal Income Tax Withheld Amount $43,600.00 $29,000.00 $0.00 $0.00 Page 1 Consolidated 1099-B, Page 2 Sminton Bank Tax Years Jini and Carol Jenson Account Number: NH978-98700 1009B Proceeds from Broker and Barter Exchange Transactions Short-term Gains/Losses - Report on Form 8949, Part I with Box A checked Box 2: Type of Gains/Loss - Short-Term Box 3: Basis reported to the IRS Box 5: Box not checked (covered security) The 1099-B data referenced by a Box number is reported to the IRS. The additional information not referenced by a Box number is not reported to the IRS, but may be helpful to complete your retura. Date Sold or Disposed (Box 1c) Quantity Date Acquired Sold (Box lb) Proceeds (Box 10) Description and CUSIP (Box la Aster Corporation common stock CUSIP: 997654321 Cost or Other Basis (Box le) Adjustments (Box 1g) Federal Income Tax Withheld (Box 4) 1,000 02/01/year 5 09/15/year 5 $16,600.00 $11,000.00 $0.00 $0.00 Totals (8949, Pan I with Box A Checked) $16,600.00 $71,000.00 S0.00 $0.00 Page 2 Consolidated 1099-8. Page 3 Sminton Bank Tax Year 6 Jim and Carol Jenson Account Number: NH978-98700 1009-B Proceeds from Broker and Barter Exchange Transactions Long-term Gains/tosses - Report on Foren 8949, Part II with Box D checked Box 2: Type of Gains/Loss - Long-Term Box 3: Basis reported to the IRS Box 5: Box not checked (covered security) The 1099-8 data referenced by a Box number is reported to the IRS. The additional information not referenced by a Box number is not reported to the IRS, but may be helpful to complete your return. Quantity Sold Dare Sold or Disposed Box 1c) Data Acquired (Box b) Federal Income Tax Withheld (eox4) Cost or Other Basis (Bax te) Proceeds (Box la Adjustments (Box 1g) Description and CUSIP (Box 1a) Tall Corporation common stock, CUSIP: 456321789 500 02/06/year 2 04/15/year 5 $27,000.00 $18,000.00 $0.00 $0.00 Totals (8919, Part 1 with Box D Checked $27,000.00 $19,000.00 $0.00 $0.00 Page 3 FISCALS try Form 1098 - Springfield Lalces (Read Only) CORRECTED it checked) RECUPENT 3/1 ENDER'S nte. Elbettches, hy of star hovica, Capada katanaw OMB No. 1545-0904 country, ZIP of foreign postal code and taltione rureker of rot out fifty Dy your britandose portance Weston Bank Mortgage in Wiene art of 394 Cardhardt Lane Bec Pty tatt Alda Year 5 Interest you clay only duettel Red Cove, NH 12345 the enden esitted by you Statement icdusty punto, cand nutar posee Forn 1098 RECIPENT'Slederal con la FAYER'S Society anter 1 Mertenaga kriterest received from payers borrowarts) Copy B 55-5715555 123-77-7777 For Payer/Borrower PAYERSBORROWEN'S # 2 Points paid or purchaar opincipal residence The hommation in bom 1. 8.1, and import hormation and being Jirn and Carol Jenson tameedstate Rara Sahyou are Street address and wing Apt.no) 3 Alelund of overpal Interest pid lageretur, Peyor of be need on 15 Braoktree Road you #th AG disting | EEat RECIPin a Chyby (on state province, country. And ZIP foreign stal code out Us You Red Cove, NH 12345 Principal balance at $2/31/year 5: $175,000 Sed deflectice for Harrertraga inaral arfer Account number (Sze instruction) these parts or re yet novot the oturd of Real estate taxes paid: $2,500 Steses on your TELUT For 1098 keep for your records) www.iis.gov/form1098 Dapatent of the Treasury - niemal Aevenue Service $ 7,000 This Form 1098 is for our second home in Springfield Lakes, NH