Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Document3 References Mailings Review View A A AaBbCcDdEe AaBbCcDdEe AaBbCcD AaBl 2 Normal No Spacing Heading 1 He This Setup pertains to the next four

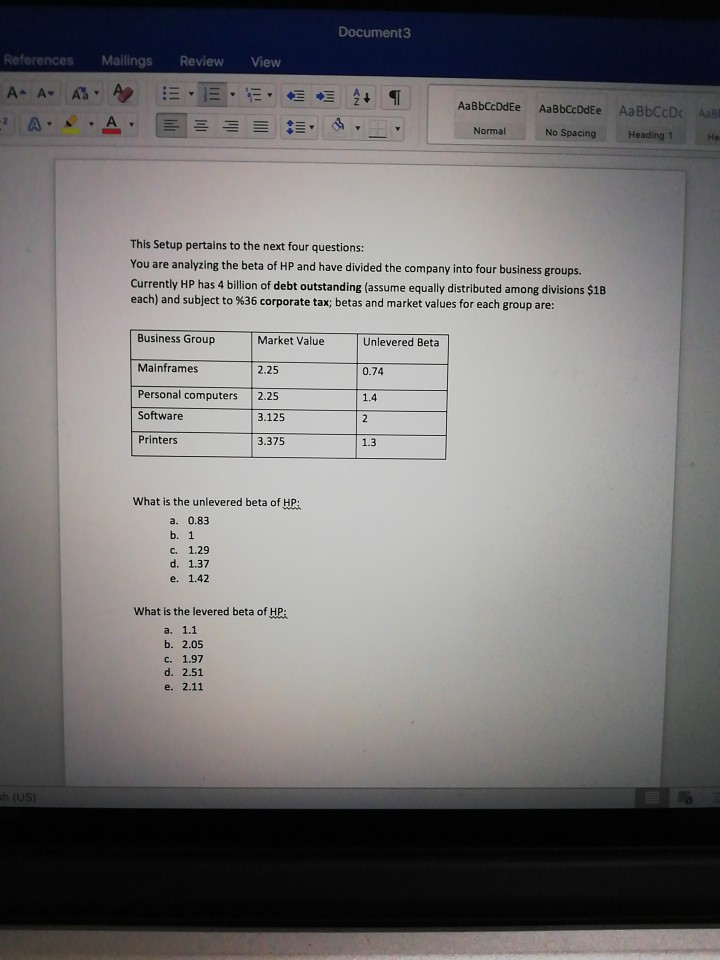

Document3 References Mailings Review View A A AaBbCcDdEe AaBbCcDdEe AaBbCcD AaBl 2 Normal No Spacing Heading 1 He This Setup pertains to the next four questions: You are analyzing the beta of HP and have divided the company into four business groups. Currently HP has 4 billion of debt outstanding (assume equally distributed among divisions $1B each) and subject to % 36 corporate tax; betas and market values for each group are: Business Group Market Value Unlevered Beta Mainframes 2.25 0.74 Personal computers 2.25 1.4 Software 3.125 2 Printers 3.375 1.3 What is the unlevered beta of HP: a. 0.83 b. 1 C. 1.29 d. 1.37 e. 1.42 What is the levered beta of HP: a. 1.1 b. 2.05 c. 1.97 d. 2.51 e. 2.11 h (US) AN 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started