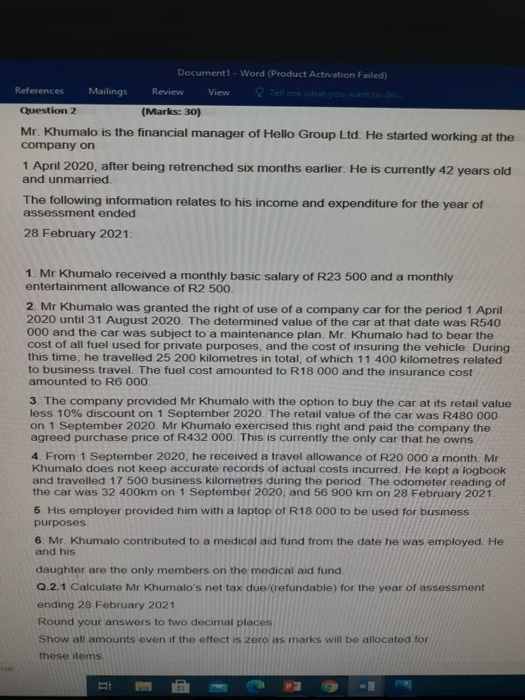

Documenti - Word (Product Activation Failed) References Mailings Review View Question 2 (Marks: 30) Mr. Khumalo is the financial manager of Hello Group Ltd. He started working at the company on 1 April 2020, after being retrenched six months earlier. He is currently 42 years old and unmarried. The following information relates to his income and expenditure for the year of assessment ended 28 February 2021: 1. Mr Khumalo received a monthly basic salary of R23 500 and a monthly entertainment allowance of R2 500 2. Mr Khumalo was granted the right of use of a company car for the period 1 April 2020 until 31 August 2020. The determined value of the car at that date was R540 000 and the car was subject to a maintenance plan. Mr. Khumalo had to bear the cost of all fuel used for private purposes, and the cost of insuring the vehicle. During this time, he travelled 25 200 kilometres in total, of which 11 400 kilometres related to business travel. The fuel cost amounted to R18 000 and the insurance cost amounted to R6 000 3. The company provided Mr Khumalo with the option to buy the car at its retail value less 10% discount on 1 September 2020. The retail value of the car was R480 000 on 1 September 2020. Mr Khumalo exercised this right and paid the company the agreed purchase price of R432 00 his is currently the only car that he owns 4. From 1 September 2020, he received a travel allowance of R20 000 a month. Mr Khumalo does not keep accurate records of actual costs incurred. He kept a logbook and travelled 17 500 business kilometres during the period. The odometer reading of the car was 32 400km on 1 September 2020, and 56 900 km on 28 February 2021 5. His employer provided him with a laptop of R18 000 to be used for business purposes 6. Mr. Khumalo contributed to a medical aid fund from the date he was employed. He and his daughter are the only members on the medical aid fund 0.2.1 Calculate Mr Khumalo's net tax due/trefundable) for the year of assessment ending 28 February 2021 Round your answers to two decimal places Show all amounts even if the effect is zero as marks will be allocated for these items R1