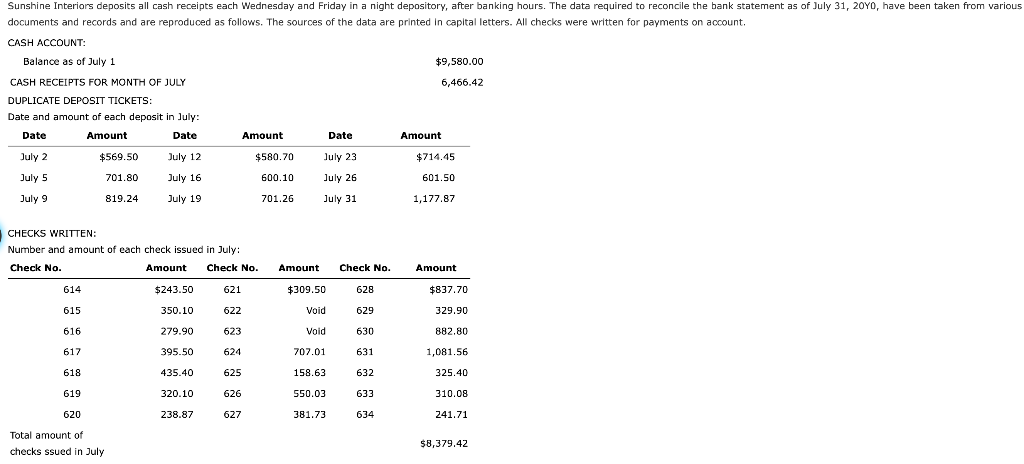

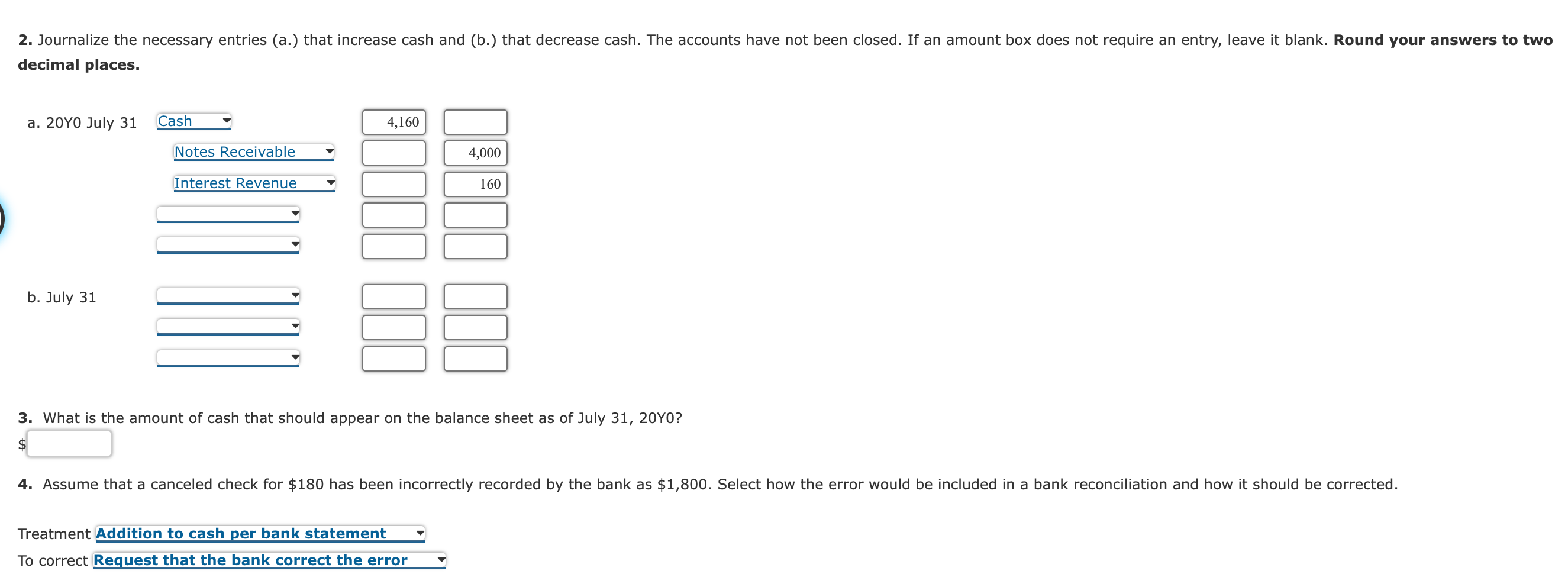

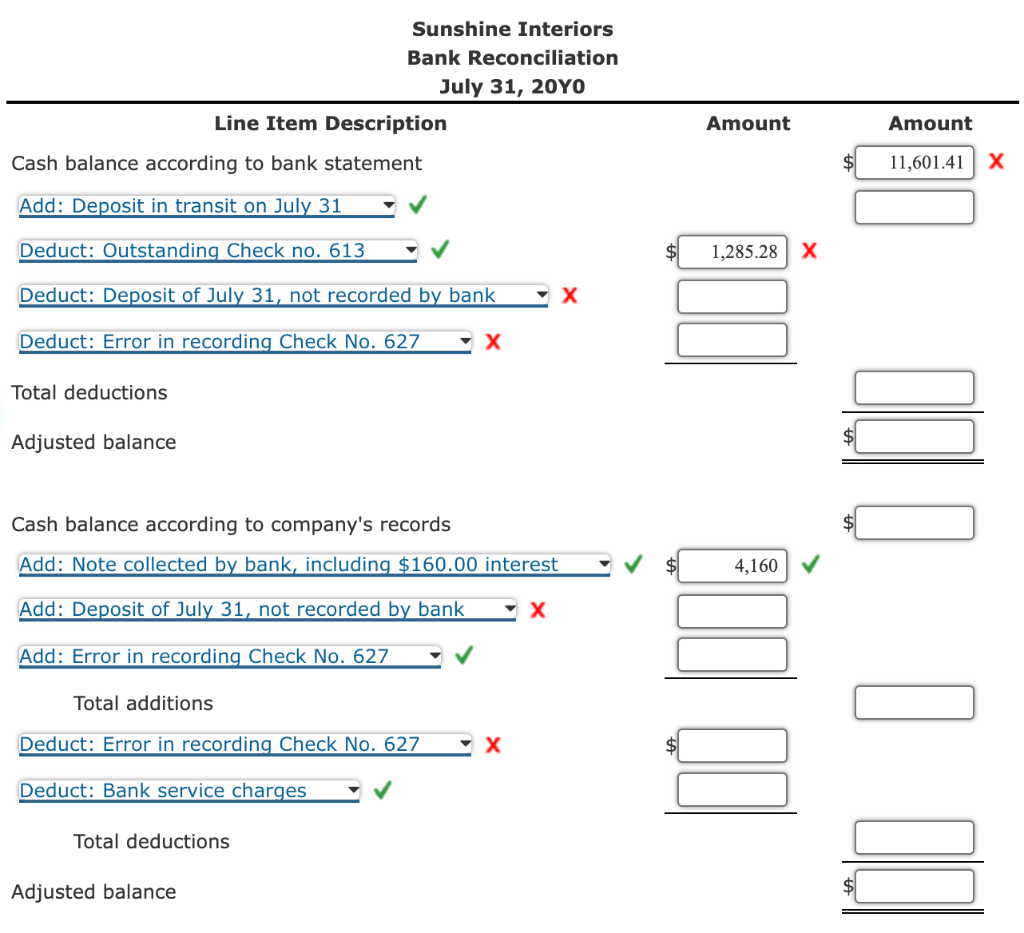

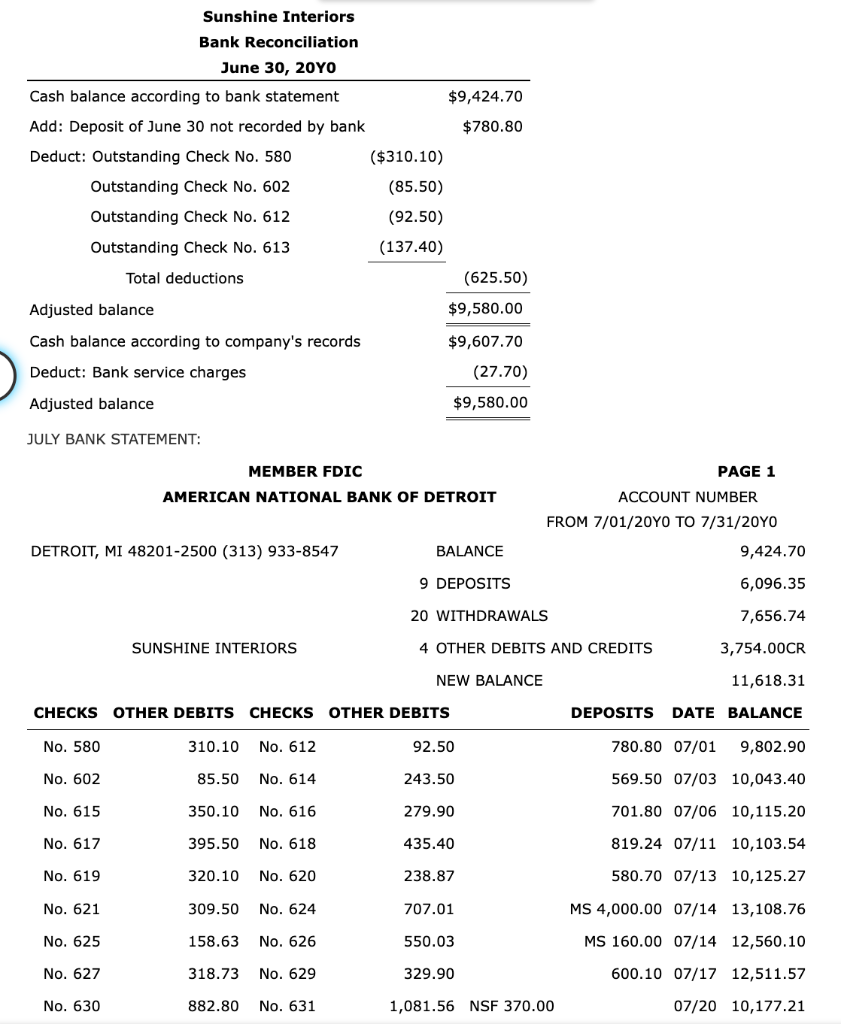

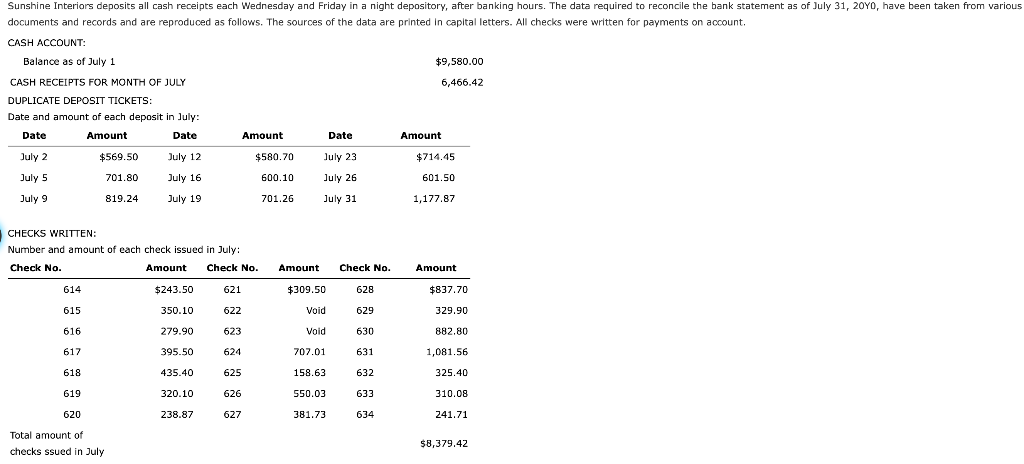

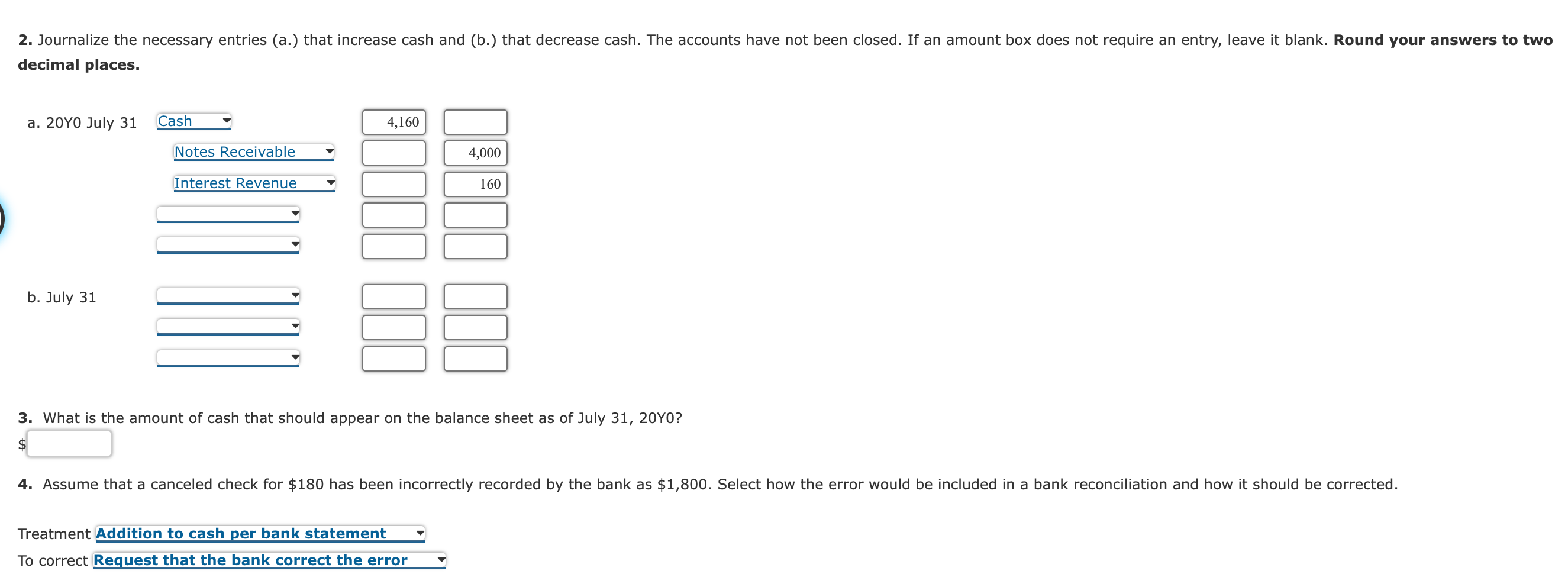

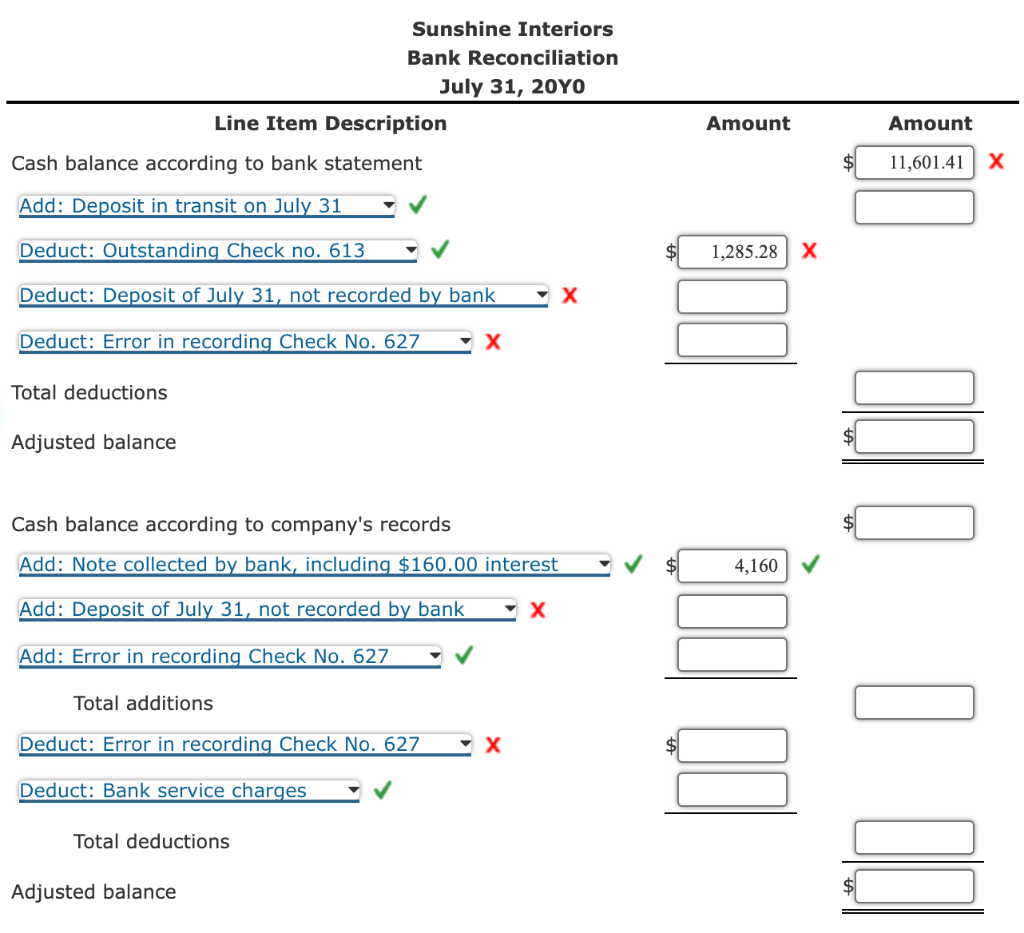

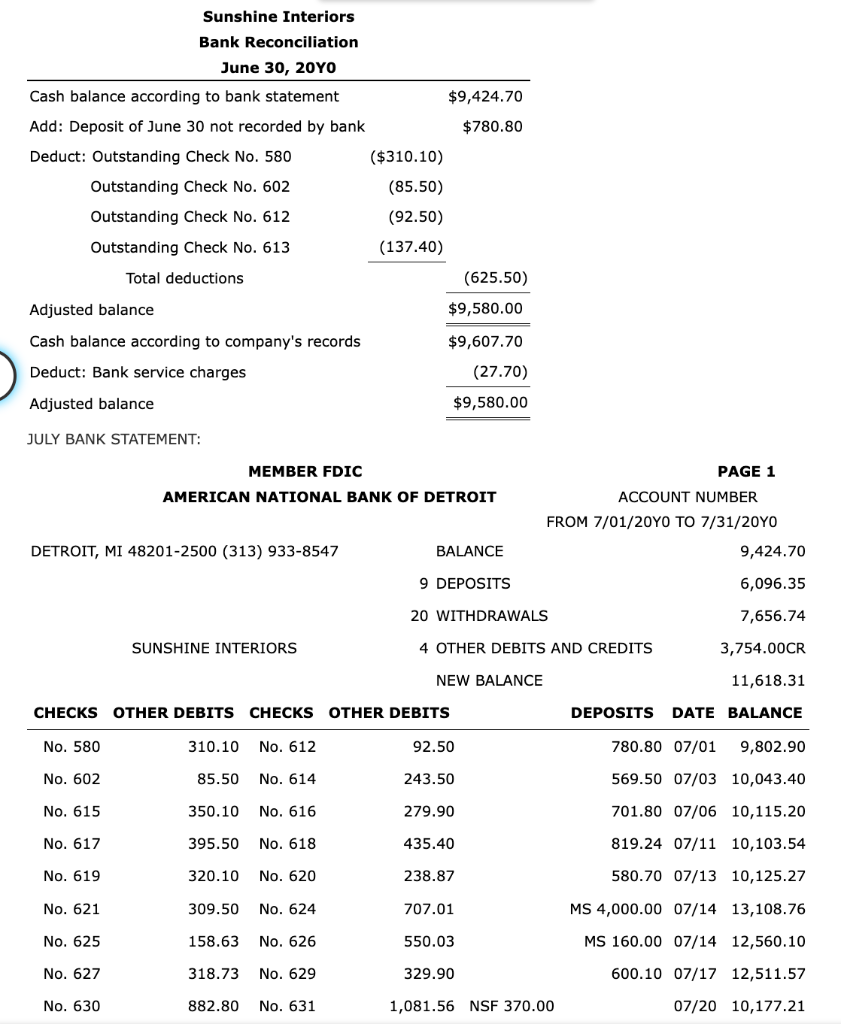

documents and records and are reproduced as follows. The sources of the data are printed in capital letters. All checks were written for payments on acoount. CASH ACCOUNT: Balance as of July 1 $9,580.00 CASH RECEIPTS FOR MONTH OF JULY 6,466.42 DUPLICATE DEPOSIT TICKETS: Date and amount of each deposit in July: CHECKS WRITTEN: Number and amount of each check issued in July: 3. What is the amount of cash that should appear on the balance sheet as of July 31,20Y0 ? Treatmen' To correct Sunshine Interiors Bank Reconciliation July 31, 20Yo \begin{tabular}{lrr} \hline Line Item Description & Amount & Amount \\ \hline Cash balance according to bank statement & $11,601.41 \\ \hline \end{tabular} Add: Deposit in transit on July 31 Deduct: Outstanding Check no. 613 $1,285.28X Deduct: Deposit of July 31 , not recorded by bank Deduct: Error in recording Check No. 627 X Total deductions Adjusted balance Cash balance according to company's records Add: Note collected by bank, including $160.00 interest Add: Deposit of July 31 , not recorded by bank X Add: Error in recording Check No. 627 Total additions Deduct: Error in recording Check No. 627X Deduct: Bank service charges Total deductions Adjusted balance Sunshine Interiors Bank Reconciliation June 30, 20Yo Cash balance according to bank statement $9,424.70 Add: Deposit of June 30 not recorded by bank $780.80 Deduct: Outstanding Check No. 580 ($310.10) Outstanding Check No. 602 (85.50) Outstanding Check No. 612 (92.50) Outstanding Check No. 613 (137.40) \begin{tabular}{lr} \multicolumn{1}{c}{ Total deductions } & (625.50) \\ Adjusted balance & $9,580.00 \\ \hline \hline Cash balance according to company's records & $9,607.70 \\ Deduct: Bank service charges & (27.70) \\ Adjusted balance & $9,580.00 \\ \hline \end{tabular} JULY BANK STATEMENT: MEMBER FDIC PAGE 1 AMERICAN NATIONAL BANK OF DETROIT ACCOUNT NUMBER FROM 7/01/20YO TO 7/31/20YO DETROIT, MI 48201-2500 (313) 933-8547 BALANCE 9,424.70 9 DEPOSITS 6,096.35 20 WITHDRAWALS 7,656.74 SUNSHINE INTERIORS 4 OTHER DEBITS AND CREDITS 3,754.00CR NEW BALANCE 11,618.31 \begin{tabular}{rrrrrrr} CHECKS & OTHER DEBITS & CHECKS & OTHER DEBITS & DEPOSITS & DATE & BALANCE \\ \hline No. 580 & 310.10 & No. 612 & 92.50 & 780.80 & 07/01 & 9,802.90 \\ No. 602 & 85.50 & No. 614 & 243.50 & 569.50 & 07/03 & 10,043.40 \\ No. 615 & 350.10 & No. 616 & 279.90 & 701.80 & 07/06 & 10,115.20 \\ No. 617 & 395.50 & No. 618 & 435.40 & 819.24 & 07/11 & 10,103.54 \\ No. 619 & 320.10 & No. 620 & 238.87 & 580.70 & 07/13 & 10,125.27 \\ No. 621 & 309.50 & No. 624 & 707.01 & MS 4,000.00 & 07/14 & 13,108.76 \\ No. 625 & 158.63 & No. 626 & 550.03 & MS 160.00 & 07/14 & 12,560.10 \\ No. 627 & 318.73 & No. 629 & 329.90 & 600.10 & 07/17 & 12,511.57 \\ No. 630 & 882.80 & No. 631 & 1,081.56 & NSF 370.00 & 07/20 & 10,177.21 \end{tabular}