Question

Doe and Tac, CPAs, provide tax, audit, and consulting services to clients. For the most recent year, total estimated overhead cost is $998,945. Activity

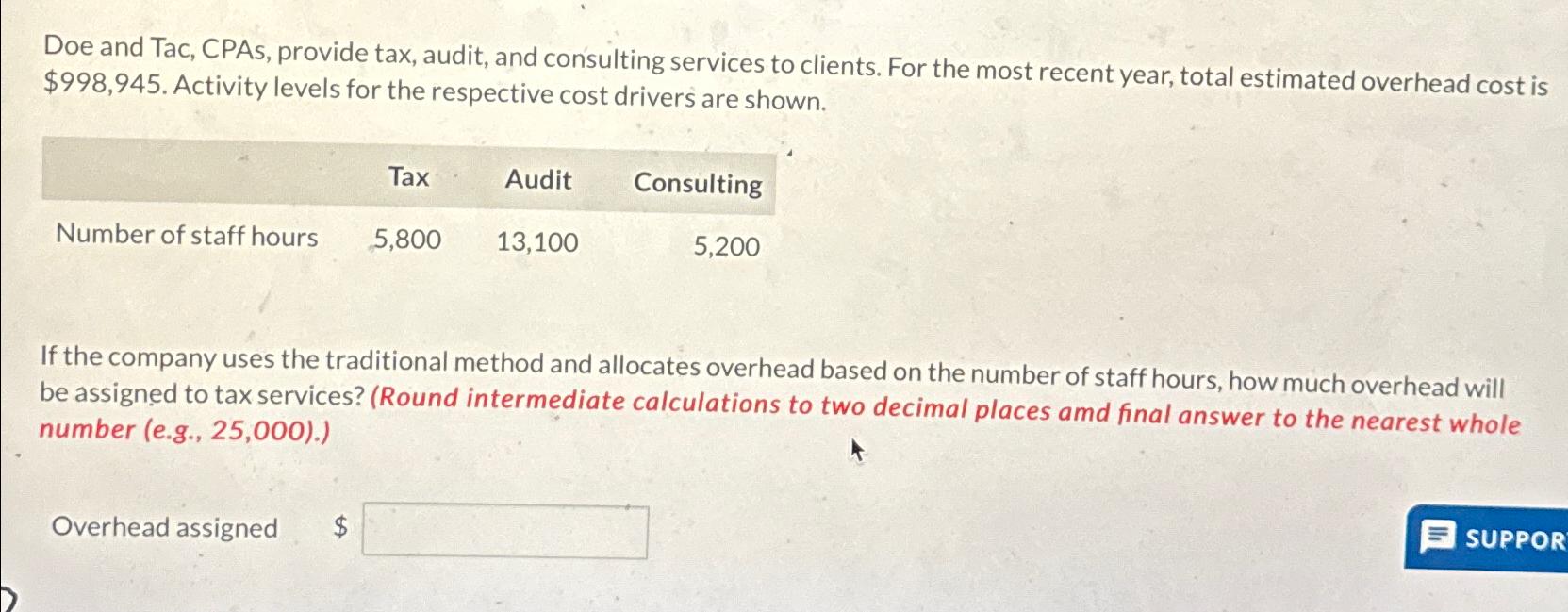

Doe and Tac, CPAs, provide tax, audit, and consulting services to clients. For the most recent year, total estimated overhead cost is $998,945. Activity levels for the respective cost drivers are shown. Tax Audit Consulting Number of staff hours 5,800 13,100 5,200 If the company uses the traditional method and allocates overhead based on the number of staff hours, how much overhead will be assigned to tax services? (Round intermediate calculations to two decimal places amd final answer to the nearest whole number (e.g., 25,000).) Overhead assigned $ SUPPOR

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the overhead rate per staff hour Total overhead cost 99...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting A User Perspective

Authors: Robert E Hoskin, Maureen R Fizzell, Donald C Cherry

6th Canadian Edition

470676604, 978-0470676608

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App