Answered step by step

Verified Expert Solution

Question

1 Approved Answer

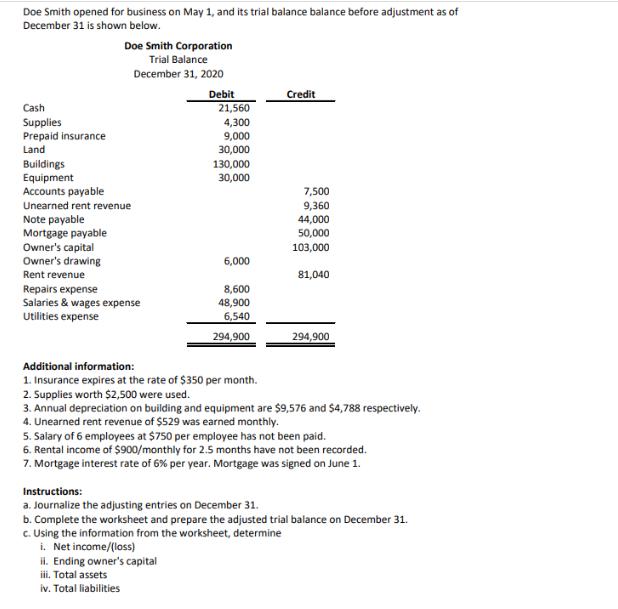

Doe Smith opened for business on May 1, and its trial balance balance before adjustment as of December 31 is shown below. Cash Supplies

Doe Smith opened for business on May 1, and its trial balance balance before adjustment as of December 31 is shown below. Cash Supplies Prepaid insurance Land Buildings Equipment Doe Smith Corporation Trial Balance December 31, 2020 Accounts payable Unearned rent revenue Note payable Mortgage payable Owner's capital Owner's drawing Rent revenue Repairs expense Salaries & wages expense Utilities expense Debit 21,560 4,300 9,000 30,000 130,000 30,000 6,000 8,600 48,900 6,540 294,900 Additional information: 1. Insurance expires at the rate of $350 per month. 2. Supplies worth $2,500 were used. ii. Ending owner's capital iii. Total assets iv. Total liabilities Credit 7,500 9,360 44,000 50,000 103,000 81,040 294,900 3. Annual depreciation on building and equipment are $9,576 and $4,788 respectively. 4. Unearned rent revenue of $529 was earned monthly. 5. Salary of 6 employees at $750 per employee has not been paid. 6. Rental income of $900/monthly for 2.5 months have not been recorded. 7. Mortgage interest rate of 6% per year. Mortgage was signed on June 1. Instructions: a. Journalize the adjusting entries on December 31. b. Complete the worksheet and prepare the adjusted trial balance on December 31. c. Using the information from the worksheet, determine i. Net income/(loss)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we need to perform the following steps a Journalize the adjusting entries on December 31 b Complete the worksheet and prepare the adjusted trial balance on December 31 c Using th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started