Three Zero Coupon Bonds (ZCB) are issued on the market. They each have face value of 100 and maturity, respectively, of 1 year, 3

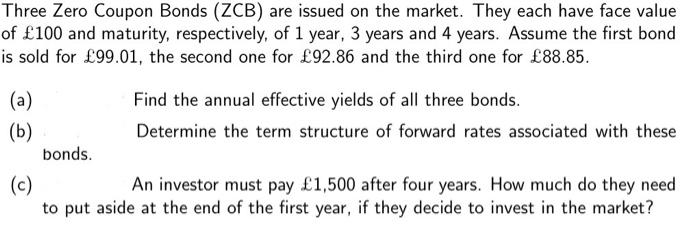

Three Zero Coupon Bonds (ZCB) are issued on the market. They each have face value of 100 and maturity, respectively, of 1 year, 3 years and 4 years. Assume the first bond is sold for 99.01, the second one for 92.86 and the third one for 88.85. (a) (b) bonds. Find the annual effective yields of all three bonds. Determine the term structure of forward rates associated with these (c) An investor must pay 1,500 after four years. How much do they need to put aside at the end of the first year, if they decide to invest in the market?

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The annual effective yields of the three bonds ar...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started