does a compelling problem exist in the status quo

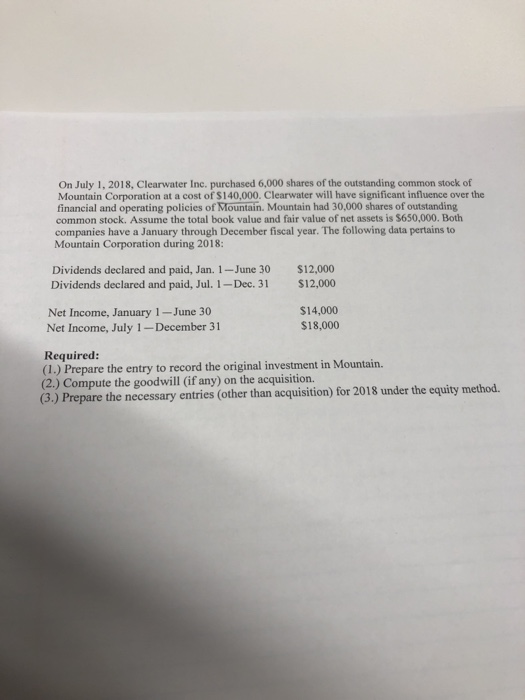

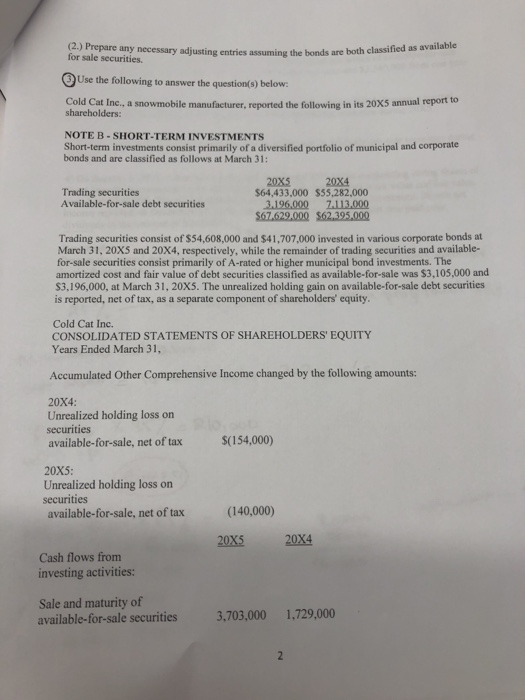

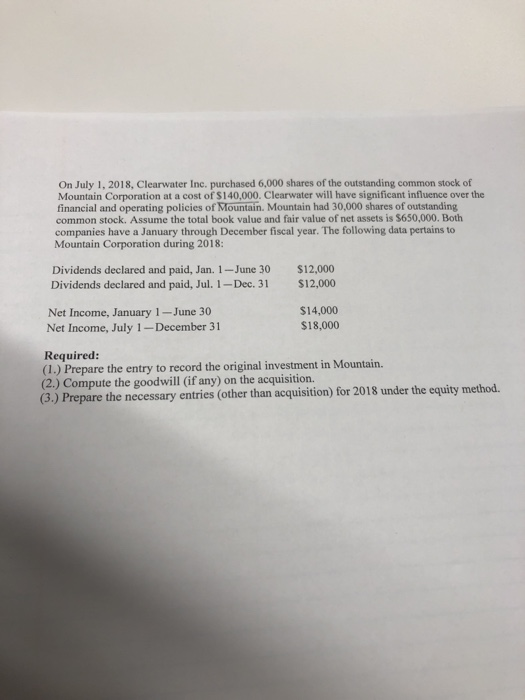

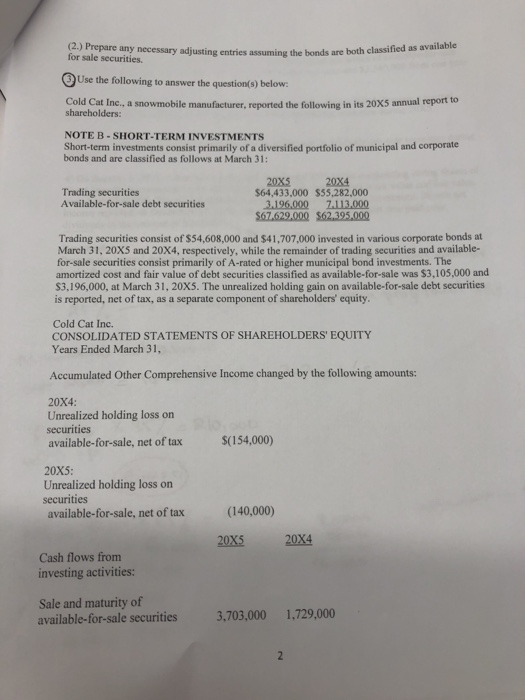

On July 1, 2018, Clearwater Inc. purchased 6,000 shares of the outstanding common stock of Mountain Corporation at a cost of $140,000. Clearwater will have significant influence over the financial and operating policies of Mountain. Mountain had 30,000 shares of outstanding common stock. Assume the total book value and fair value of net assets is $650,000. Both companies have a January through December fiscal year. The following data pertains to Mountain Corporation during 2018: $12,000 $12,000 Dividends declared and paid, Jan. 1-June 30 Dividends declared and paid, Jul. 1-Dec. 31 $14,000 $18,000 Net Income, January 1-June 30 Net Income, July 1-December 31 Required: (1.) Prepare the entry to record the original investment in Mountain. (2.) Compute the goodwill (if any) on the acquisition. (3.) Prepare the necessary entries (other than acquisition) for 2018 under the equity method. (2.) Prepare any necessary adjusting entries assuming the bonds are both classified as available for sale securities. Use the following to answer the question(s) below: Cold Cat Inc., a snowmobile manufacturer, reported the following in its 20X5 annual report to shareholders: NOTE B-SHORT-TERM INVESTMENTS Short-term investments consist primarily of a diversified portfolio of municipal and corporate bonds and are classified as follows at March 31: 20X5 $64,433,000 $55,282,000 3.196.000 $67.629,000 $62,395,000 20X4 Trading securities Available-for-sale debt securities Z113.000 Trading securities consist of $54,608,000 and $41,,707,000 invested in various corporate bonds at March 31, 20X5 and 20X4, respectively, while the remainder of trading securities and available- for-sale securities consist primarily of A-rated or higher municipal bond investments. The amortized cost and fair value of debt securities classified as available-for-sale was $3,105,000 and $3,196,000, at March 31, 20X5. The unrealized holding gain on available-for-sale debt securities is reported, net of tax, as a separate component of shareholders' equity. Cold Cat Inc. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY Years Ended March 31, Accumulated Other Comprehensive Income changed by the folllowing amounts: 20X4: Unrealized holding loss on securities available-for-sale, net of tax $(154,000) 20X5 Unrealized holding loss on securities available-for-sale, net of tax (140,000) 20X5 20X4 Cash flows from investing activities: Sale and maturity of available-for-sale securities 1,729,000 3,703,000 2