Question

Does a higher p/e ratio tell you that the investing public is optimistic or pessimistic about a company's future growth potential? Why? Use Figure 12.1

- Does a higher p/e ratio tell you that the investing public is optimistic or pessimistic about a company's future growth potential? Why? Use Figure 12.1

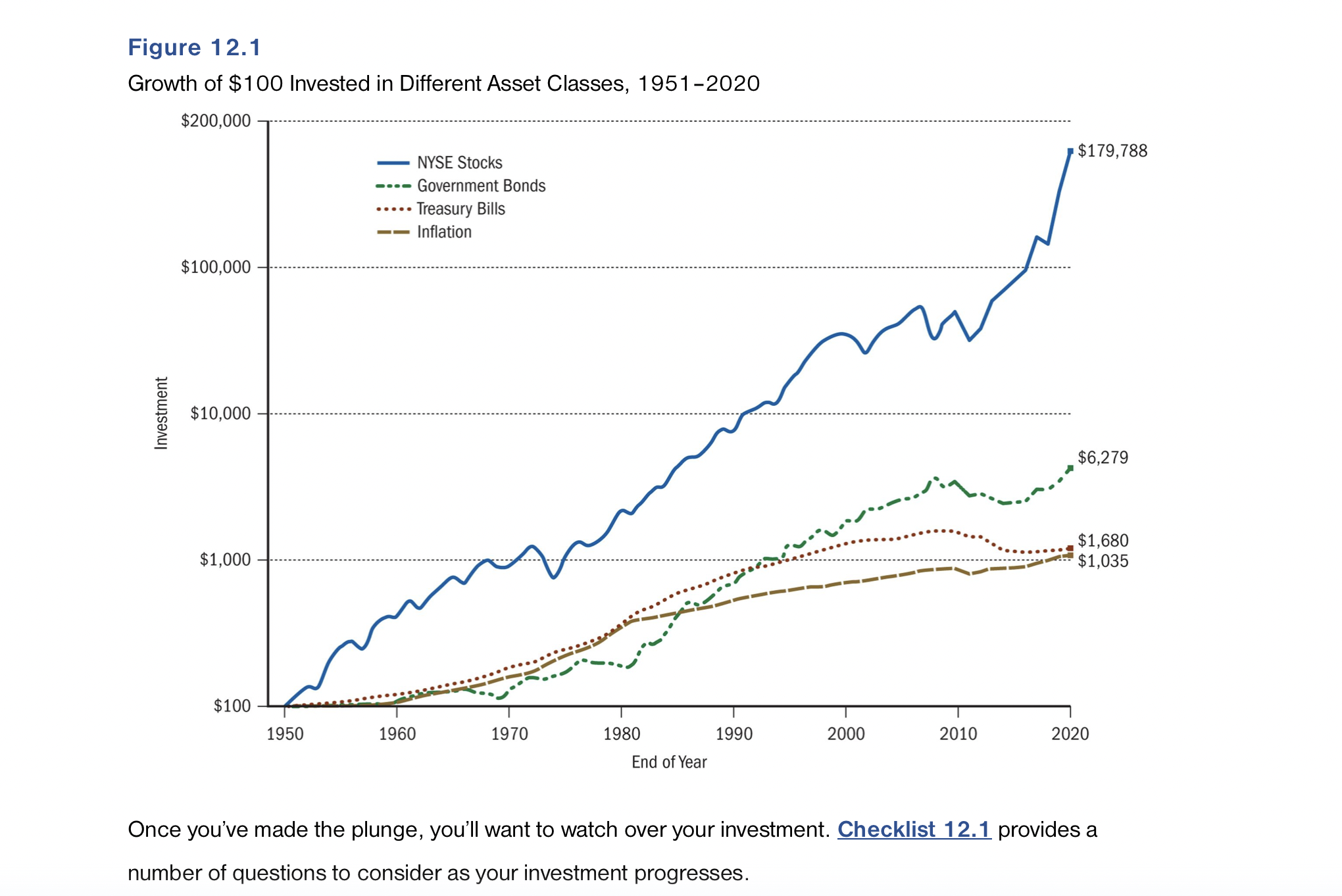

Figure 12.1 Growth of $100 Invested in Different Asset Classes, 1951-2020 $200,000 Investment $100,000 $10,000 $1,000 $100 1950 1960 NYSE Stocks Government Bonds Treasury Bills Inflation 1970 1980 End of Year 1990 2000 2010 $179,788 $6,279 $1,680 $1,035 2020 Once you've made the plunge, you'll want to watch over your investment. Checklist 12.1 provides a number of questions to consider as your investment progresses.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A higher pricetoearnings PE ratio typically suggests that the investing public is optimistic about a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Elementary Statistics

Authors: Neil A. Weiss

8th Edition

321691237, 978-0321691231

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App