Answered step by step

Verified Expert Solution

Question

1 Approved Answer

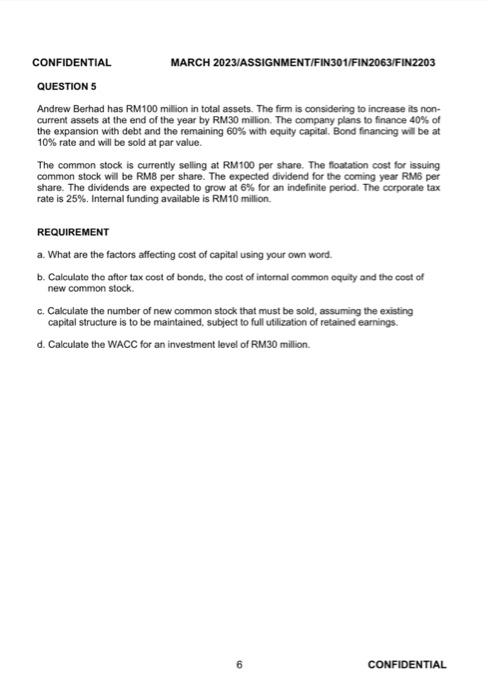

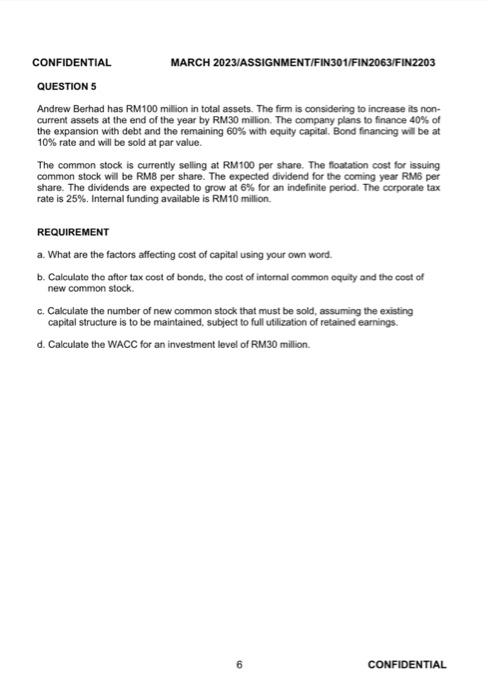

does anyone how to help me with this question CONFIDENTIAL MARCH 2023/ASSIGNMENT/FIN301/FIN2063/FIN2203 QUESTION 5 Andrew Berhad has RM100 milion in total assets. The firm is

does anyone how to help me with this question

CONFIDENTIAL MARCH 2023/ASSIGNMENT/FIN301/FIN2063/FIN2203 QUESTION 5 Andrew Berhad has RM100 milion in total assets. The firm is considering to increase its noncurrent assets at the end of the year by RM30 million. The company plans to finance 40% of the expansion with debt and the remaining 60% with equity capital. Bond financing will be at 10% rate and will be sold at par value. The common stock is currently selling at RM100 per share. The floatation cost for issuing common stock will be RM8 per share. The expected dividend for the coming year RM6 per share. The dividends are expected to grow at 6% for an indefinite period. The corporate tax rate is 25%. Internal funding available is RM10 million. REQUIREMENT a. What are the factors affecting cost of capital using your own word. b. Calculato the aftor tax cott of bonde, the cost of intornal common oquity and the coet of new common stock. c. Calculate the number of new common stock that must be sold, assuming the existing capital structure is to be maintained, subject to full utilization of retained earnings. d. Calculate the WACC for an investment level of RM30 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started