does anyone know how to put this information into a form 1040 and schedules 1,2,3?

repostinng the info becasue some one said it was "unclear" this is everything i was given & she said to put this information into a 1040 & schedule 1,2,3.

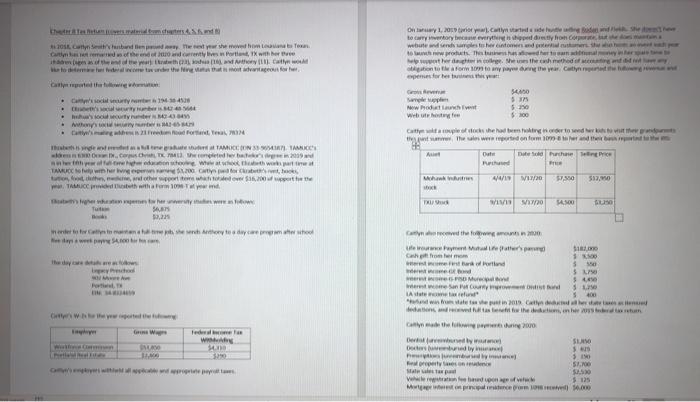

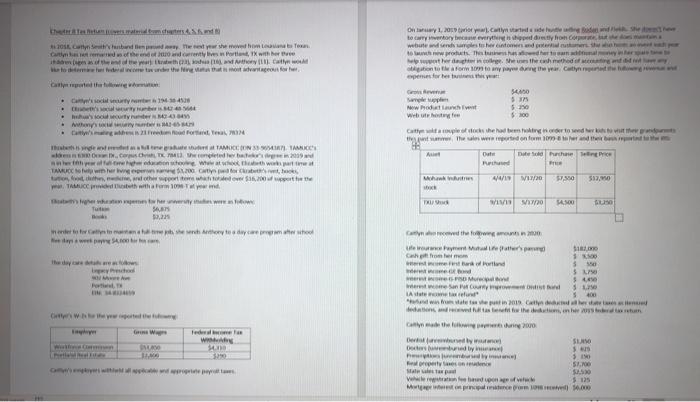

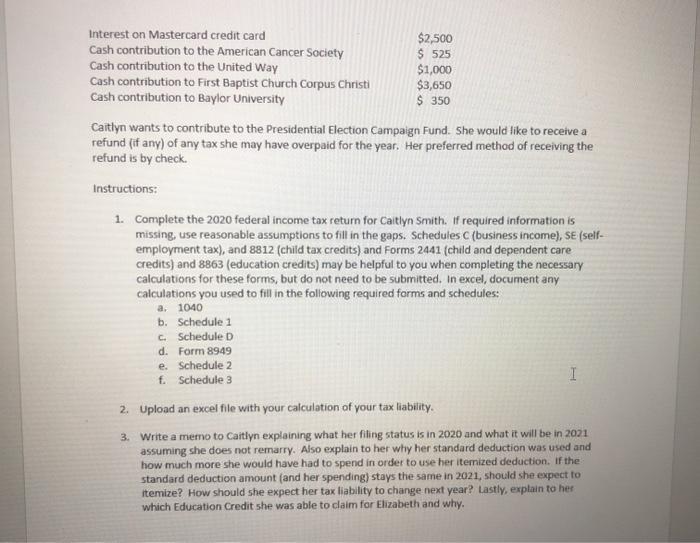

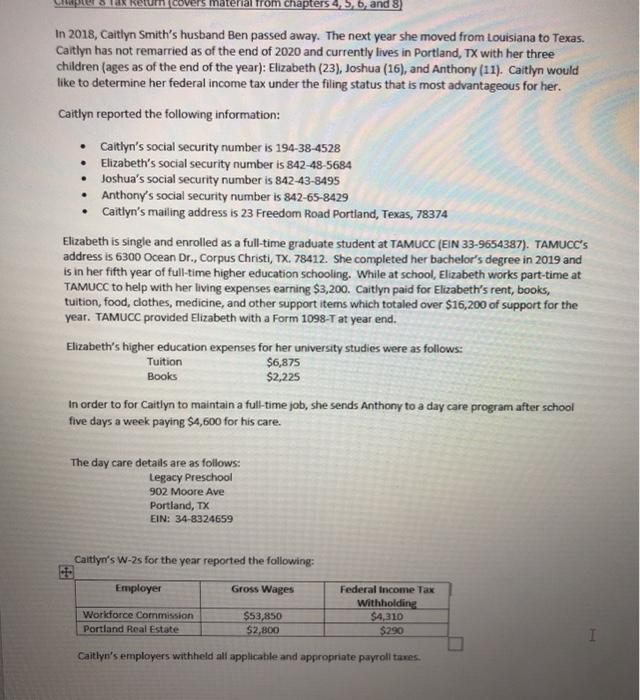

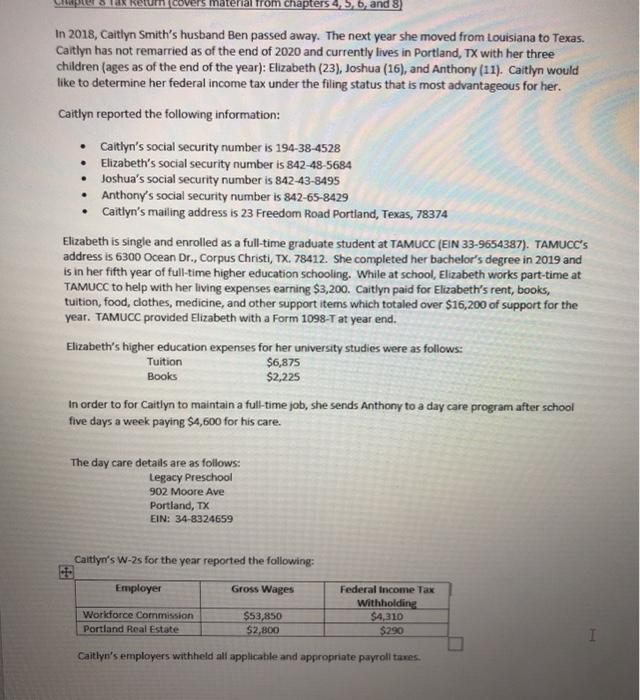

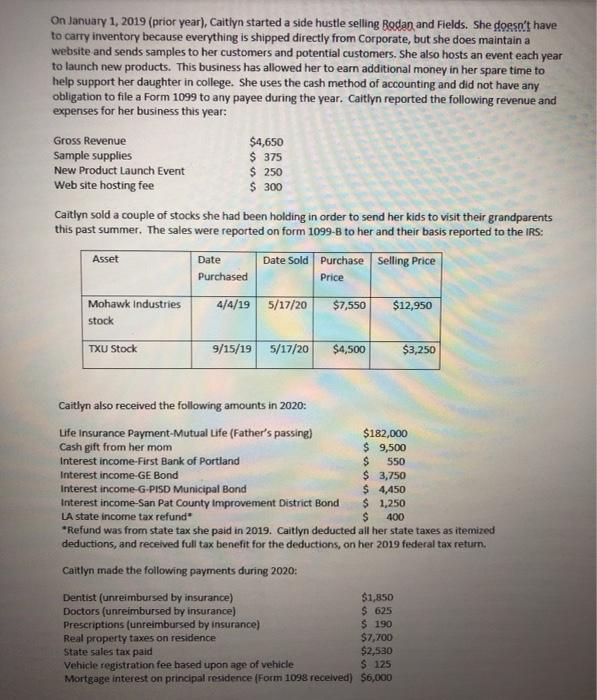

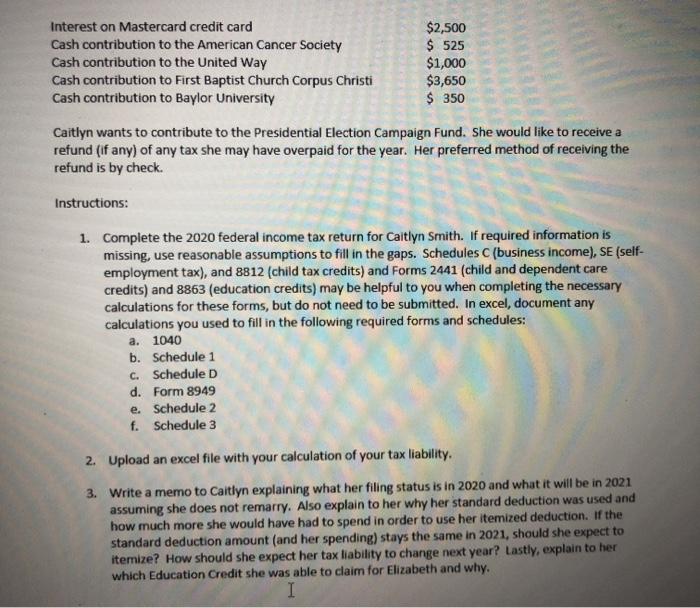

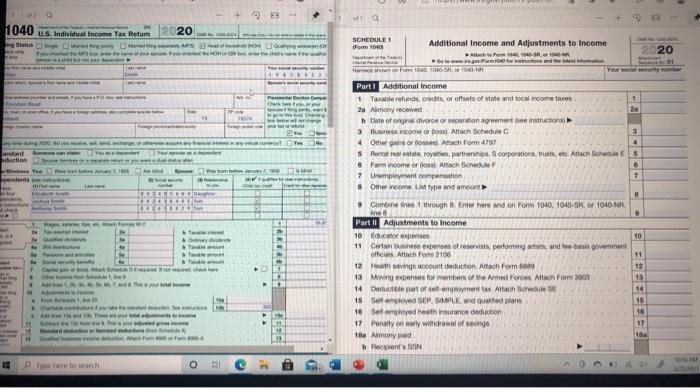

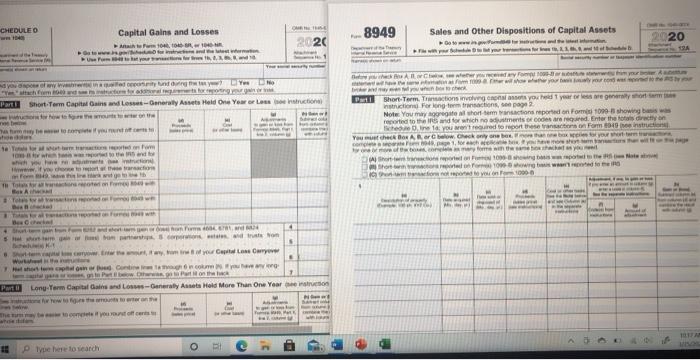

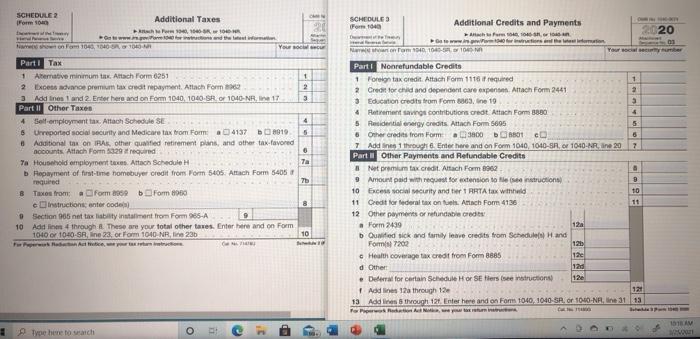

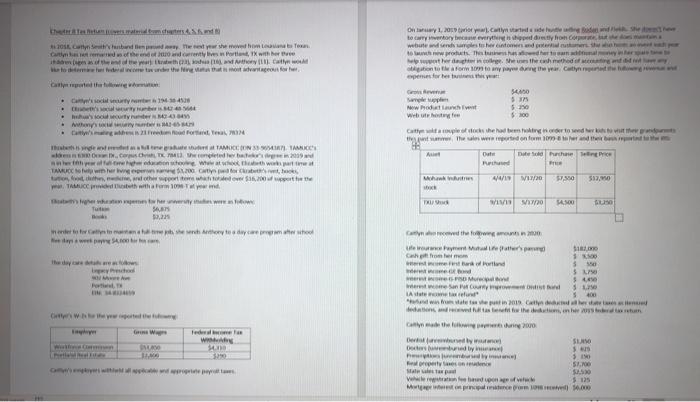

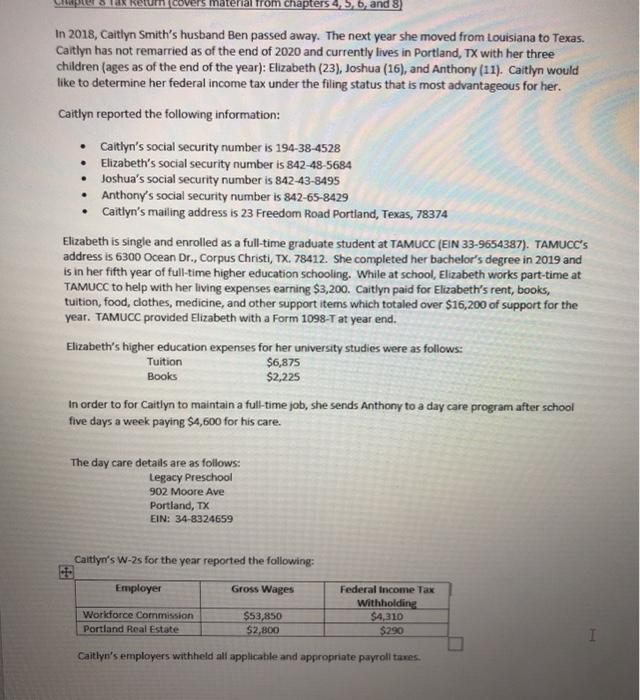

Testerom Cybe they she went home Calendrive Port X with her is watch that Oy 1, 2 in die heme to carry tory becawevery hot honor webu and send to entender owh wrote hedhuron wowother the method of toto wa For some to my pathe year Cathy pl what . 45 .. . ' c SS 53 50 $100 then he was won omo read the Dateso hache Price TAMOCION MITTARICE wo.com web TAMRON for tud, how $3,200 worth the Chwithao100 when they BA 40/18 VIW 7.50 55 w WII Sino SO US to show she thony to daycrew who wp.com Garded them the weaters Si Chrome 1 S 50 5 L SOM $ werwe 3 IA powered 5400 do tale om en Chemie tedations and to the need to the 200 why SUVO Dety . 5 10 con 5. Mateo 5 We done $125 More .000 Federer w 5790 Interest on Mastercard credit card $2,500 Cash contribution to the American Cancer Society $ 525 Cash contribution to the United Way $1,000 Cash contribution to First Baptist Church Corpus Christi $3,650 Cash contribution to Baylor University $ 350 Caitlyn wants to contribute to the Presidential election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check Instructions: 1. Complete the 2020 federal income tax return for Caitlyn Smith. If required information is missing, use reasonable assumptions to fill in the gaps. Schedules C (business income), SE (self- employment tax), and 8812 (child tax credits) and Forms 2441 (child and dependent care credits) and 8863 (education credits) may be helpful to you when completing the necessary calculations for these forms, but do not need to be submitted. In excel, document any calculations you used to fill in the following required forms and schedules: a. 1040 b. Schedule 1 C. Schedule d. Form 8949 e. Schedule 2 f. Schedule 3 I 2. Upload an excel file with your calculation of your tax liability. 3. Write a memo to Caitlyn explaining what her filing status is in 2020 and what it will be in 2021 assuming she does not remarry. Also explain to her why her standard deduction was used and how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? How should she expect her tax liability to change next year? Lastly, explain to her which Education Credit she was able to claim for Elizabeth and why, 099) Department of the Train Internal Revenue Service E1040 U.S. Individual Income Tax Retum 2020 OMB No. 1545-0074 IRS Use Only Do not worse this Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only one box If you checked the MFS box, enter the name of your spouse. If you checked the HOH or CW box, enter the child's name it the qualitying person is a child but not your dependent Your fustname and middle initial Last name Your social security number Caitlyn Smith 1 9 4 3. B 4 5 28 I joint return, spouse's first name and middle initial Spouse's social security number Last name Home address number and street)If you have a PO box see instructions Apt.no Presidential Election Campaign 23 Freedom Road Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below State ZIP code spouself filing jointly, want $3 Portland TX 78374 to go to this fund. Checking a box below will not change Foreign country name Foreign province/stat/county Foreign postal code your tax or refund. El You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual status alien Age/Blindness You Were born before January 2, 1956 Are blind Spouse: Was bom before January 2, 1956 Is blind Dependents (uee instructions) (2) Social security (9) Relationship V i qualifies for see instruction If more (1) First name Last name number to you Child tax credit Credit for other dependents than four Elizabeth Smith B4E 45.6 8 4 Daughter dependents, se instructions Joshua Smith 84 2484 9 5 Son and check Anthony Smith 84 26 8 4 2 9 Son here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach 21 Tax-exempt interest 20 b Taxable interest 21 Sch. B 3a Qualified dividends 30 required b Ordinary dividends 3b 48 IRA distributions, 4a b Taxable amount 4b 5a Pensions and annuities b Taxable amount 5b Standard Sa Social security benefits b Taxable amount 6b Deduction for 7 Capital gain or (ons). Attach Schedule D if required. If not required, check here 7 Single or Married filing 8 Other income from Schedule 1, line 9 8 separately. 9 $12,400 Add lines 1, 2, 3, 4, 5, 6, 7, and 8. This is your total income 9 Married fing 10 Adjustments to income: jointly or Ouallying From Schedule 1, line 22 TO widower) b Charitable contributions if you take the standard deduction. See Instructions 10b $24,800 Head of C Add lines 10a and 10b. These are your total adjustments to income 100 household $18.650 Subtract line 10c from line 9. This is your adjusted gross income 11 - If you checked 12 Standard deduction or itemized deductions (from Schedule A) any box under 13 Qualified business income deduction. Attach Form 8995 or Form 1995-A 13 Standard Deduction 14 14 Add lines 12 and 13 ed instructions 9:51 PM 3/24/2021 from chapters 4, 5, 6, and 8) In 2018, Caitlyn Smith's husband Ben passed away. The next year she moved from Louisiana to Texas. Caitlyn has not remarried as of the end of 2020 and currently lives in Portland, TX with her three children (ages as of the end of the year): Elizabeth (23), Joshua (16), and Anthony (11). Caitlyn would like to determine her federal income tax under the filing status that is most advantageous for her. Caitlyn reported the following information: Caitlyn's social security number is 194-38-4528 Elizabeth's social security number is 842-48-5684 Joshua's social security number is 842-43-8495 Anthony's social security number is 842-65-8429 Caitlyn's mailing address is 23 Freedom Road Portland, Texas, 78374 Elizabeth is single and enrolled as a full-time graduate student at TAMUCC (EIN 33-9654387). TAMUCC'S address is 6300 Ocean Dr., Corpus Christi, TX. 78412. She completed her bachelor's degree in 2019 and is in her fifth year of full-time higher education schooling. While at school, Elizabeth works part-time at TAMUCC to help with her living expenses earning $3,200. Caitlyn paid for Elizabeth's rent, books, tuition, food, clothes, medicine, and other support items which totaled over $16,200 of support for the year. TAMUCC provided Elizabeth with a Form 1098-T at year end. Elizabeth's higher education expenses for her university studies were as follows: Tuition $6,875 Books $2,225 In order to for Caitlyn to maintain a full-time job, she sends Anthony to a day care program after school five days a week paying $4,600 for his care. The day care details are as follows: Legacy Preschool 902 Moore Ave Portland, TX EIN: 34-8324659 Caitlyn's W-2s for the year reported the following: Employer Gross Wages Workforce Commission Portland Real Estate Federal income Tax Withholding $4,310 $290 $53,850 $2,800 Caitlyn's employers withheld all applicable and appropriate payroll taxes. On January 1, 2019 (prior year), Caitlyn started a side hustle selling Rodan and Fields. She dosso't have to carry inventory because everything is shipped directly from Corporate, but she does maintain a website and sends samples to her customers and potential customers. She also hosts an event each year to launch new products. This business has allowed her to earn additional money in her spare time to help support her daughter in college. She uses the cash method of accounting and did not have any obligation to file a Form 1099 to any payee during the year. Caitlyn reported the following revenue and expenses for her business this year: Gross Revenue $4,650 Sample supplies $ 375 New Product Launch Event $ 250 Web site hosting fee $ 300 Caitlyn sold a couple of stocks she had been holding in order to send her kids to visit their grandparents this past summer. The sales were reported on form 1099-B to her and their basis reported to the IRS: Asset Date Date Sold Purchase Selling Price Purchased Price Mohawk Industries stock 4/4/19 5/17/20 $7,550 $12,950 TXU Stock 9/15/19 5/17/20 $4,500 $3,250 Caitlyn also received the following amounts in 2020: Life Insurance Payment-Mutual Life (Father's passing) $182,000 Cash gift from her mom $ 9,500 Interest income-First Bank of Portland $ 550 Interest income-GE Bond $ 3,750 Interest income-G-PISD Municipal Bond $ 4,450 Interest income-San Pat County Improvement District Bond $ 1,250 LA state income tax refund S 400 *Refund was from state tax she paid in 2019. Caitlyn deducted all her state taxes as itemized deductions, and received full tax benefit for the deductions, on her 2019 federal tax return. Caitlyn made the following payments during 2020: Dentist (unreimbursed by insurance) $1,850 Doctors (unreimbursed by insurance) $ 625 Prescriptions (unreimbursed by insurance) $ 190 Real property taxes on residence $7,700 State sales tax paid $2,530 Vehicle registration fee based upon age of vehicle S 125 Mortgage interest on principal residence (Form 1098 received) $6,000 Interest on Mastercard credit card Cash contribution to the American Cancer Society Cash contribution to the United Way Cash contribution to First Baptist Church Corpus Christi Cash contribution to Baylor University $2,500 $ 525 $1,000 $3,650 $ 350 Caitlyn wants to contribute to the Presidential Election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check. Instructions: 1. Complete the 2020 federal income tax return for Caitlyn Smith. If required information is missing, use reasonable assumptions to fill in the gaps. Schedules C (business income), SE (self- employment tax), and 8812 (child tax credits) and Forms 2441 (child and dependent care credits) and 8863 (education credits) may be helpful to you when completing the necessary calculations for these forms, but do not need to be submitted. In excel, document any calculations you used to fill in the following required forms and schedules: a. 1040 b. Schedule 1 C. Schedule D d. Form 8949 e. Schedule 2 f. Schedule 3 2. Upload an excel file with your calculation of your tax liability, 3. Write a memo to Caitlyn explaining what her filing status is in 2020 and what it will be in 2021 assuming she does not remarry. Also explain to her why her standard deduction was used and how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? How should she expect her tax liability to change next year? Lastly, explain to her which Education Credit she was able to claim for Elizabeth and why. I + 1040 us. Individual Income Tax Retum 2020 why show 20 www Yo 4 andard duction we rendente SCHEDULE: Form 1040 Additional Income and Adjustments to Income 14,45 ter Rahom 1644 SST 09-10 Part Additional Income 1 Table refunds, credits, or offsets of state and local income taxes 1 2a Alimony received 26 Date of original divorce Reparation agreement ontruction 3 Business come or for Attach Schedule 3 4 Other gain or Attach Form 4797 5 Petrostate, royati, partes corporation Trustee Attach Scho 5 Farmincome or ons Attach Schedule 6 7 Unemployment compensation 7 Other income List type and amount Combine the through Enter here and on Form 1040 1040-SR, or 1040 NR Part II Adjustments to Income 10 Expenses 11 Certain business expenses of reservists performing and bass government officials. Attach Form 2106 11 12 things account deduction Attach Form 12 13 Moving expenses for more of the Armed Forces Artech Form 3000 13 14 Deductie part of employment Attach Schedule 14 15 Self-employed SCP.SIMPLE Ind quoted plans 15 16 Selayed beth murano deduction 16 17 Pony on ewly withdrawal of sange 17 16 Aimony paid 18 Pepe's SON LES w 10 Det we www. De here to watch O CHEDULED OM 8949 Capital Gains and Losses Mitum , Wwwwww to you 20 Sales and Other Dispositions of Capital Assets Dowwwwwww wy 2020 9 Y ruction Part Short Term Captains and serally Asset Hold One Year or Loss BAC you - www you www Dal Short Term Tractions ingyo dyear em icon For long-teractions to page 2 Not You may regate short termination reported on Form 1090 showing reported to hand or which metod. Enter the forection hered: you won't foreoort the actor on Form 10 instruction Youth BORA on one tha your forach A100 on om www motor 1000 most te when whole che Th To con 5 wwwyout Loss Or Www shop DRO Put on the Long-Term Capital and Loss-Gary Asset Hold More Than One Years wwwrote be here to search o SCHEDULE 2 Form 100 Additional Taxes 100 www ono 1045, 01704 You - 5 Part Tax 1 Alternative minimum tax. Altach Form 6251 2. Excets dance premium tax credit repayment. Attach Form 1962 2 Add lines 1 and 2 Erter here and on Form 1040, 1040-SR OF 1040-NR 17 3 Part 1 Other Taxen 4 Self-employment tax. Attach Schedule SE 4 6 Ureported social security and Medicare tax from Forma 41378910 5 8 Additional tax on Bas, other qualified retirement plans, and other tax favored accounts. Attach Form 1829 at required 6 Ta Household employment tacs Attach Schedule 7a Repayment of first time homebuyer credit from Form 5405. Attach Form 5405 required 70 Taxo from a form 2009 b Form 1000 construction enter code Section 965 net tax liability installment from Form 985-A 10 Add line 4 through These are your total other taxes. Enter here and on Form 1010 01040-SR, line 23, or Form 1040 NR, line 23 10 th SCHEDULES For 1040 Additional Credits and Payments 2020 For 1000 www.info 00 ronom 10400 RON Your sumber Part No refundable Credits + Foreign tax credit. Attach Form 1116 required 1 2 Credit for child and dependent care expert Attach Form 2441 3 Education credits from Form 8863. ine 19 a Batement vos contributions credt Attach Form 3880 6 5 Residential energy credits Attach Form 5695 5 6 Other credits from Form 38000 ce 7 Addnes 1 throuche. Enthare and on Form 1010, 1040-SR. 1040- Nine 20 7 Part Other Payments and Refundable Credits Nepremium tax credit. Attach Form 1962 & 9 Amount paid the forecension to see netruction) 9 10 Excess social curity and ter 1 RRTA tax withheld 11 Credit for federal tax ontol Artech Form 4136 11 12 Other payments or refundable credits Form 2439 120 b Qualified sick and family leave credits from Schedule Hand For 7200 126 Health coverage tax credit from For 8885 12 d Other 126 Derfor certain Schedule HO SE Hersee natructions 12 Aadlines 12 through 12 121 13 Add lines though 12. Enter here and on Form 1040,1040-SP. or 1090-NR. 113 Por 10 Te here to watch o Testerom Cybe they she went home Calendrive Port X with her is watch that Oy 1, 2 in die heme to carry tory becawevery hot honor webu and send to entender owh wrote hedhuron wowother the method of toto wa For some to my pathe year Cathy pl what . 45 .. . ' c SS 53 50 $100 then he was won omo read the Dateso hache Price TAMOCION MITTARICE wo.com web TAMRON for tud, how $3,200 worth the Chwithao100 when they BA 40/18 VIW 7.50 55 w WII Sino SO US to show she thony to daycrew who wp.com Garded them the weaters Si Chrome 1 S 50 5 L SOM $ werwe 3 IA powered 5400 do tale om en Chemie tedations and to the need to the 200 why SUVO Dety . 5 10 con 5. Mateo 5 We done $125 More .000 Federer w 5790 Interest on Mastercard credit card $2,500 Cash contribution to the American Cancer Society $ 525 Cash contribution to the United Way $1,000 Cash contribution to First Baptist Church Corpus Christi $3,650 Cash contribution to Baylor University $ 350 Caitlyn wants to contribute to the Presidential election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check Instructions: 1. Complete the 2020 federal income tax return for Caitlyn Smith. If required information is missing, use reasonable assumptions to fill in the gaps. Schedules C (business income), SE (self- employment tax), and 8812 (child tax credits) and Forms 2441 (child and dependent care credits) and 8863 (education credits) may be helpful to you when completing the necessary calculations for these forms, but do not need to be submitted. In excel, document any calculations you used to fill in the following required forms and schedules: a. 1040 b. Schedule 1 C. Schedule d. Form 8949 e. Schedule 2 f. Schedule 3 I 2. Upload an excel file with your calculation of your tax liability. 3. Write a memo to Caitlyn explaining what her filing status is in 2020 and what it will be in 2021 assuming she does not remarry. Also explain to her why her standard deduction was used and how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? How should she expect her tax liability to change next year? Lastly, explain to her which Education Credit she was able to claim for Elizabeth and why, 099) Department of the Train Internal Revenue Service E1040 U.S. Individual Income Tax Retum 2020 OMB No. 1545-0074 IRS Use Only Do not worse this Filing Status Single Married filing jointly Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) Check only one box If you checked the MFS box, enter the name of your spouse. If you checked the HOH or CW box, enter the child's name it the qualitying person is a child but not your dependent Your fustname and middle initial Last name Your social security number Caitlyn Smith 1 9 4 3. B 4 5 28 I joint return, spouse's first name and middle initial Spouse's social security number Last name Home address number and street)If you have a PO box see instructions Apt.no Presidential Election Campaign 23 Freedom Road Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below State ZIP code spouself filing jointly, want $3 Portland TX 78374 to go to this fund. Checking a box below will not change Foreign country name Foreign province/stat/county Foreign postal code your tax or refund. El You Spouse At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual status alien Age/Blindness You Were born before January 2, 1956 Are blind Spouse: Was bom before January 2, 1956 Is blind Dependents (uee instructions) (2) Social security (9) Relationship V i qualifies for see instruction If more (1) First name Last name number to you Child tax credit Credit for other dependents than four Elizabeth Smith B4E 45.6 8 4 Daughter dependents, se instructions Joshua Smith 84 2484 9 5 Son and check Anthony Smith 84 26 8 4 2 9 Son here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 Attach 21 Tax-exempt interest 20 b Taxable interest 21 Sch. B 3a Qualified dividends 30 required b Ordinary dividends 3b 48 IRA distributions, 4a b Taxable amount 4b 5a Pensions and annuities b Taxable amount 5b Standard Sa Social security benefits b Taxable amount 6b Deduction for 7 Capital gain or (ons). Attach Schedule D if required. If not required, check here 7 Single or Married filing 8 Other income from Schedule 1, line 9 8 separately. 9 $12,400 Add lines 1, 2, 3, 4, 5, 6, 7, and 8. This is your total income 9 Married fing 10 Adjustments to income: jointly or Ouallying From Schedule 1, line 22 TO widower) b Charitable contributions if you take the standard deduction. See Instructions 10b $24,800 Head of C Add lines 10a and 10b. These are your total adjustments to income 100 household $18.650 Subtract line 10c from line 9. This is your adjusted gross income 11 - If you checked 12 Standard deduction or itemized deductions (from Schedule A) any box under 13 Qualified business income deduction. Attach Form 8995 or Form 1995-A 13 Standard Deduction 14 14 Add lines 12 and 13 ed instructions 9:51 PM 3/24/2021 from chapters 4, 5, 6, and 8) In 2018, Caitlyn Smith's husband Ben passed away. The next year she moved from Louisiana to Texas. Caitlyn has not remarried as of the end of 2020 and currently lives in Portland, TX with her three children (ages as of the end of the year): Elizabeth (23), Joshua (16), and Anthony (11). Caitlyn would like to determine her federal income tax under the filing status that is most advantageous for her. Caitlyn reported the following information: Caitlyn's social security number is 194-38-4528 Elizabeth's social security number is 842-48-5684 Joshua's social security number is 842-43-8495 Anthony's social security number is 842-65-8429 Caitlyn's mailing address is 23 Freedom Road Portland, Texas, 78374 Elizabeth is single and enrolled as a full-time graduate student at TAMUCC (EIN 33-9654387). TAMUCC'S address is 6300 Ocean Dr., Corpus Christi, TX. 78412. She completed her bachelor's degree in 2019 and is in her fifth year of full-time higher education schooling. While at school, Elizabeth works part-time at TAMUCC to help with her living expenses earning $3,200. Caitlyn paid for Elizabeth's rent, books, tuition, food, clothes, medicine, and other support items which totaled over $16,200 of support for the year. TAMUCC provided Elizabeth with a Form 1098-T at year end. Elizabeth's higher education expenses for her university studies were as follows: Tuition $6,875 Books $2,225 In order to for Caitlyn to maintain a full-time job, she sends Anthony to a day care program after school five days a week paying $4,600 for his care. The day care details are as follows: Legacy Preschool 902 Moore Ave Portland, TX EIN: 34-8324659 Caitlyn's W-2s for the year reported the following: Employer Gross Wages Workforce Commission Portland Real Estate Federal income Tax Withholding $4,310 $290 $53,850 $2,800 Caitlyn's employers withheld all applicable and appropriate payroll taxes. On January 1, 2019 (prior year), Caitlyn started a side hustle selling Rodan and Fields. She dosso't have to carry inventory because everything is shipped directly from Corporate, but she does maintain a website and sends samples to her customers and potential customers. She also hosts an event each year to launch new products. This business has allowed her to earn additional money in her spare time to help support her daughter in college. She uses the cash method of accounting and did not have any obligation to file a Form 1099 to any payee during the year. Caitlyn reported the following revenue and expenses for her business this year: Gross Revenue $4,650 Sample supplies $ 375 New Product Launch Event $ 250 Web site hosting fee $ 300 Caitlyn sold a couple of stocks she had been holding in order to send her kids to visit their grandparents this past summer. The sales were reported on form 1099-B to her and their basis reported to the IRS: Asset Date Date Sold Purchase Selling Price Purchased Price Mohawk Industries stock 4/4/19 5/17/20 $7,550 $12,950 TXU Stock 9/15/19 5/17/20 $4,500 $3,250 Caitlyn also received the following amounts in 2020: Life Insurance Payment-Mutual Life (Father's passing) $182,000 Cash gift from her mom $ 9,500 Interest income-First Bank of Portland $ 550 Interest income-GE Bond $ 3,750 Interest income-G-PISD Municipal Bond $ 4,450 Interest income-San Pat County Improvement District Bond $ 1,250 LA state income tax refund S 400 *Refund was from state tax she paid in 2019. Caitlyn deducted all her state taxes as itemized deductions, and received full tax benefit for the deductions, on her 2019 federal tax return. Caitlyn made the following payments during 2020: Dentist (unreimbursed by insurance) $1,850 Doctors (unreimbursed by insurance) $ 625 Prescriptions (unreimbursed by insurance) $ 190 Real property taxes on residence $7,700 State sales tax paid $2,530 Vehicle registration fee based upon age of vehicle S 125 Mortgage interest on principal residence (Form 1098 received) $6,000 Interest on Mastercard credit card Cash contribution to the American Cancer Society Cash contribution to the United Way Cash contribution to First Baptist Church Corpus Christi Cash contribution to Baylor University $2,500 $ 525 $1,000 $3,650 $ 350 Caitlyn wants to contribute to the Presidential Election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check. Instructions: 1. Complete the 2020 federal income tax return for Caitlyn Smith. If required information is missing, use reasonable assumptions to fill in the gaps. Schedules C (business income), SE (self- employment tax), and 8812 (child tax credits) and Forms 2441 (child and dependent care credits) and 8863 (education credits) may be helpful to you when completing the necessary calculations for these forms, but do not need to be submitted. In excel, document any calculations you used to fill in the following required forms and schedules: a. 1040 b. Schedule 1 C. Schedule D d. Form 8949 e. Schedule 2 f. Schedule 3 2. Upload an excel file with your calculation of your tax liability, 3. Write a memo to Caitlyn explaining what her filing status is in 2020 and what it will be in 2021 assuming she does not remarry. Also explain to her why her standard deduction was used and how much more she would have had to spend in order to use her itemized deduction. If the standard deduction amount (and her spending) stays the same in 2021, should she expect to itemize? How should she expect her tax liability to change next year? Lastly, explain to her which Education Credit she was able to claim for Elizabeth and why. I + 1040 us. Individual Income Tax Retum 2020 why show 20 www Yo 4 andard duction we rendente SCHEDULE: Form 1040 Additional Income and Adjustments to Income 14,45 ter Rahom 1644 SST 09-10 Part Additional Income 1 Table refunds, credits, or offsets of state and local income taxes 1 2a Alimony received 26 Date of original divorce Reparation agreement ontruction 3 Business come or for Attach Schedule 3 4 Other gain or Attach Form 4797 5 Petrostate, royati, partes corporation Trustee Attach Scho 5 Farmincome or ons Attach Schedule 6 7 Unemployment compensation 7 Other income List type and amount Combine the through Enter here and on Form 1040 1040-SR, or 1040 NR Part II Adjustments to Income 10 Expenses 11 Certain business expenses of reservists performing and bass government officials. Attach Form 2106 11 12 things account deduction Attach Form 12 13 Moving expenses for more of the Armed Forces Artech Form 3000 13 14 Deductie part of employment Attach Schedule 14 15 Self-employed SCP.SIMPLE Ind quoted plans 15 16 Selayed beth murano deduction 16 17 Pony on ewly withdrawal of sange 17 16 Aimony paid 18 Pepe's SON LES w 10 Det we www. De here to watch O CHEDULED OM 8949 Capital Gains and Losses Mitum , Wwwwww to you 20 Sales and Other Dispositions of Capital Assets Dowwwwwww wy 2020 9 Y ruction Part Short Term Captains and serally Asset Hold One Year or Loss BAC you - www you www Dal Short Term Tractions ingyo dyear em icon For long-teractions to page 2 Not You may regate short termination reported on Form 1090 showing reported to hand or which metod. Enter the forection hered: you won't foreoort the actor on Form 10 instruction Youth BORA on one tha your forach A100 on om www motor 1000 most te when whole che Th To con 5 wwwyout Loss Or Www shop DRO Put on the Long-Term Capital and Loss-Gary Asset Hold More Than One Years wwwrote be here to search o SCHEDULE 2 Form 100 Additional Taxes 100 www ono 1045, 01704 You - 5 Part Tax 1 Alternative minimum tax. Altach Form 6251 2. Excets dance premium tax credit repayment. Attach Form 1962 2 Add lines 1 and 2 Erter here and on Form 1040, 1040-SR OF 1040-NR 17 3 Part 1 Other Taxen 4 Self-employment tax. Attach Schedule SE 4 6 Ureported social security and Medicare tax from Forma 41378910 5 8 Additional tax on Bas, other qualified retirement plans, and other tax favored accounts. Attach Form 1829 at required 6 Ta Household employment tacs Attach Schedule 7a Repayment of first time homebuyer credit from Form 5405. Attach Form 5405 required 70 Taxo from a form 2009 b Form 1000 construction enter code Section 965 net tax liability installment from Form 985-A 10 Add line 4 through These are your total other taxes. Enter here and on Form 1010 01040-SR, line 23, or Form 1040 NR, line 23 10 th SCHEDULES For 1040 Additional Credits and Payments 2020 For 1000 www.info 00 ronom 10400 RON Your sumber Part No refundable Credits + Foreign tax credit. Attach Form 1116 required 1 2 Credit for child and dependent care expert Attach Form 2441 3 Education credits from Form 8863. ine 19 a Batement vos contributions credt Attach Form 3880 6 5 Residential energy credits Attach Form 5695 5 6 Other credits from Form 38000 ce 7 Addnes 1 throuche. Enthare and on Form 1010, 1040-SR. 1040- Nine 20 7 Part Other Payments and Refundable Credits Nepremium tax credit. Attach Form 1962 & 9 Amount paid the forecension to see netruction) 9 10 Excess social curity and ter 1 RRTA tax withheld 11 Credit for federal tax ontol Artech Form 4136 11 12 Other payments or refundable credits Form 2439 120 b Qualified sick and family leave credits from Schedule Hand For 7200 126 Health coverage tax credit from For 8885 12 d Other 126 Derfor certain Schedule HO SE Hersee natructions 12 Aadlines 12 through 12 121 13 Add lines though 12. Enter here and on Form 1040,1040-SP. or 1090-NR. 113 Por 10 Te here to watch o