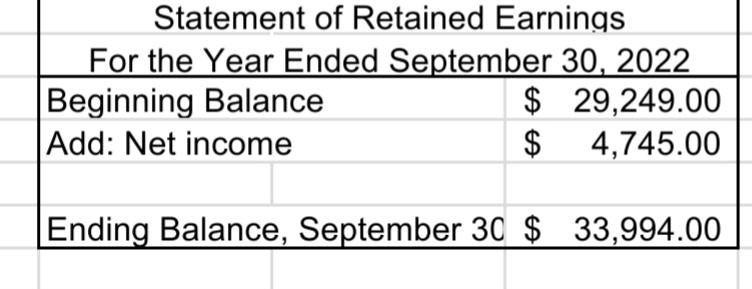

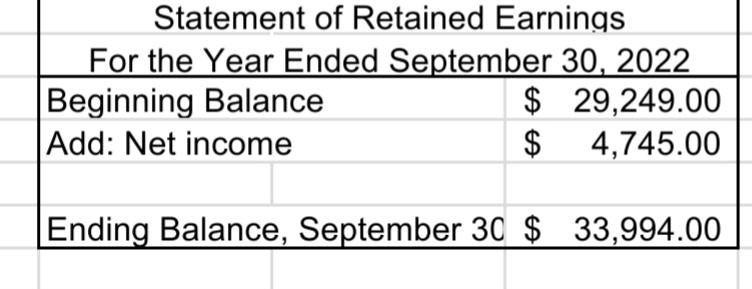

Does my statement of retained earning look correct?

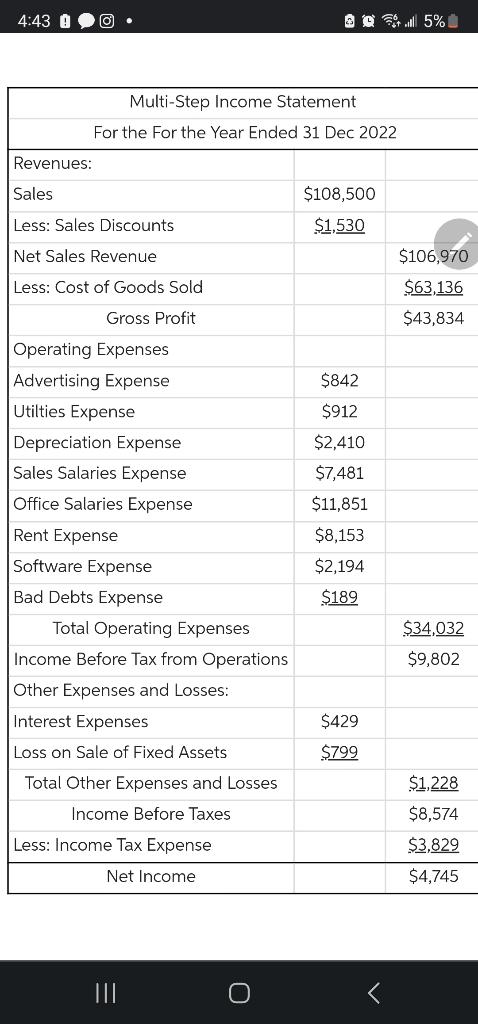

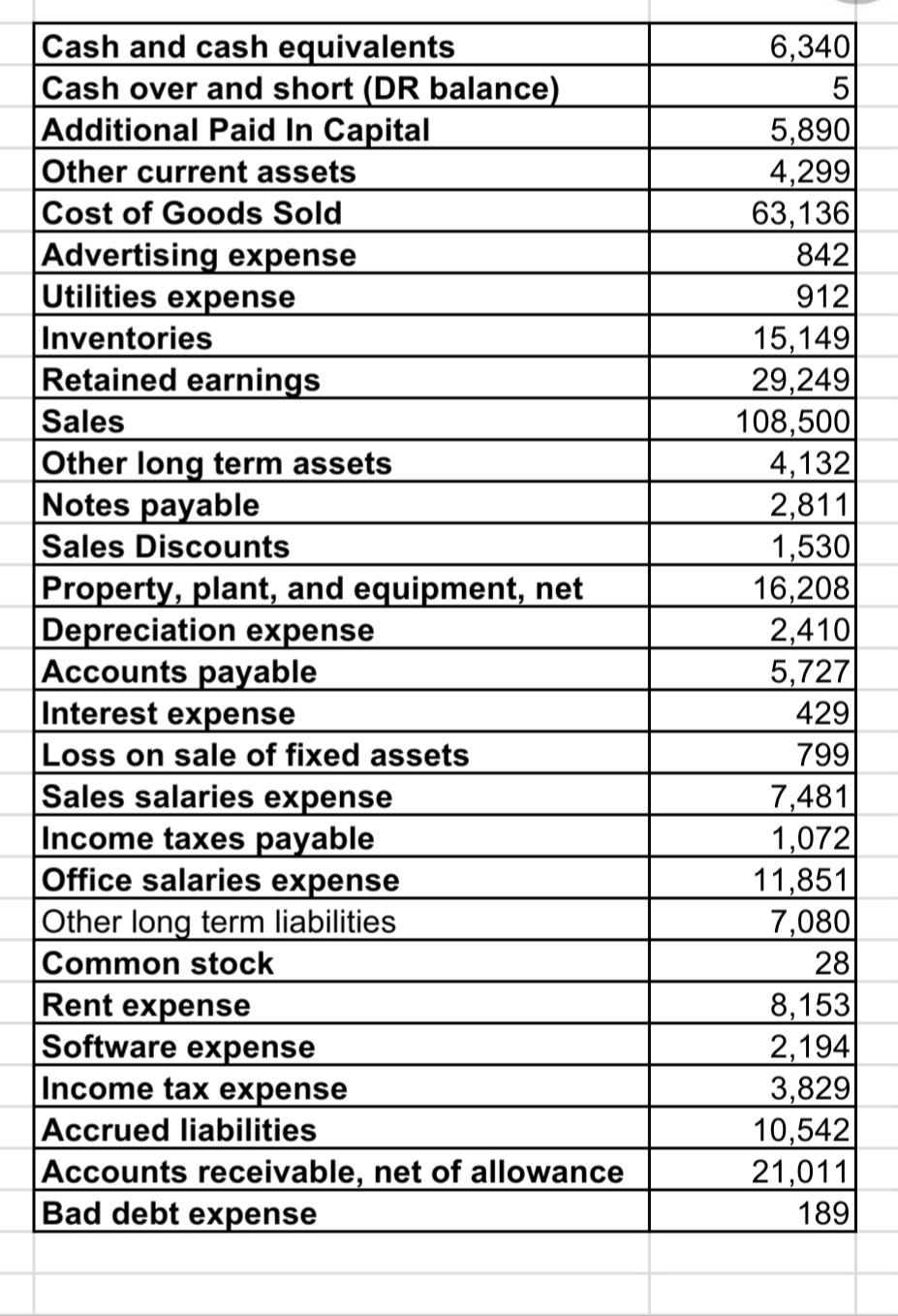

I used this information to complete it.

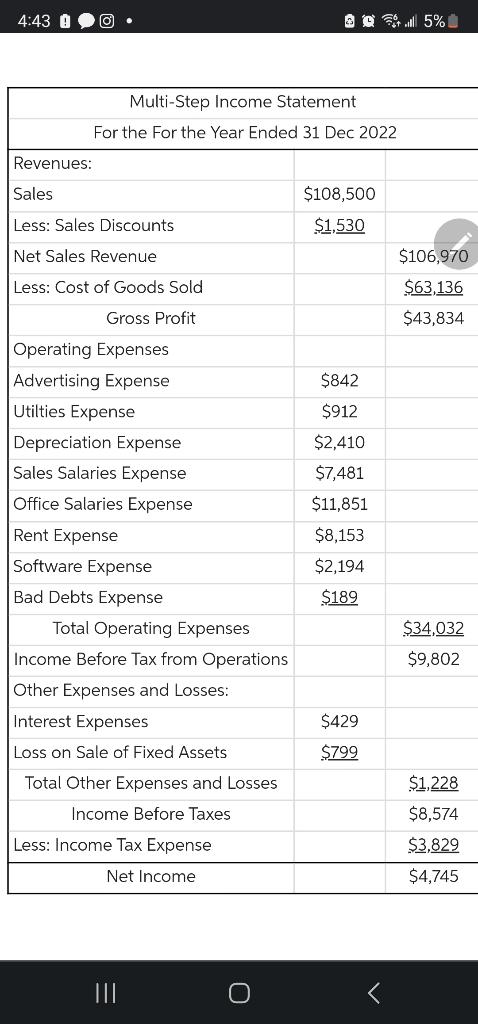

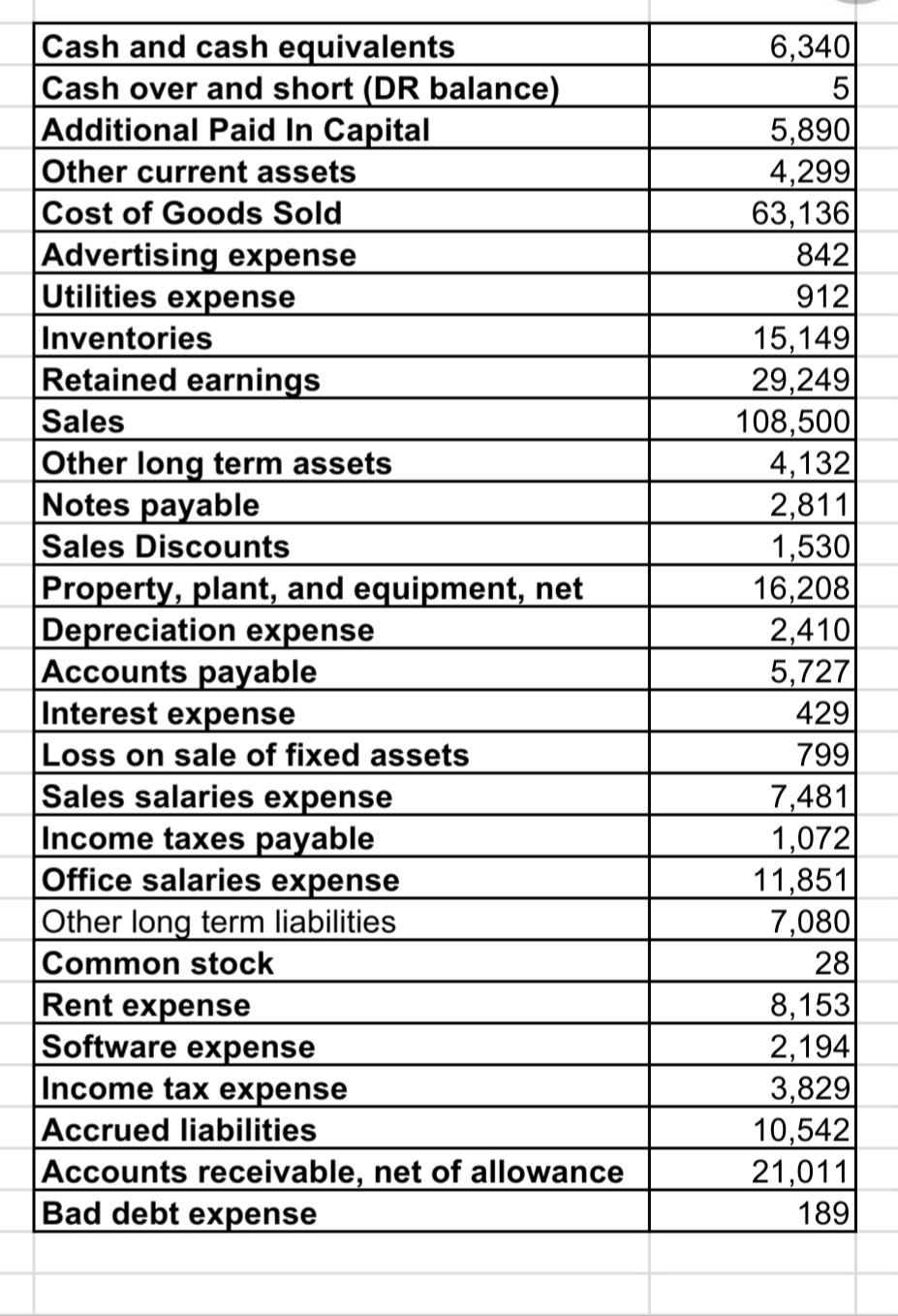

A list of accounts with balances and the income statement.

Statement of Retained Earnings For the Year Ended September 30, 2022 Beginning Balance Add: Net income $$29,249.004,745.00 Ending Balance, September 30$33,994.00 4:43 ! () Multi-Step Income Statement For the For the Year Ended 31 Dec 2022 Revenues: \begin{tabular}{|l|c|c|} \hline Sales & $108,500 & \\ \hline Less: Sales Discounts & $1,530 & \\ \hline Net Sales Revenue & & $106,970 \\ \hline Less: Cost of Goods Sold & & $63,136 \\ \hline Gross Profit & & $43,834 \\ \hline \end{tabular} Operating Expenses Advertising Expense Utilties Expense $842 Depreciation Expense $912 Sales Salaries Expense $2,410 Office Salaries Expense $7,481 Rent Expense $8,153 Software Expense $2,194 Bad Debts Expense $189 Total Operating Expenses $34,032 Income Before Tax from Operations $9,802 Other Expenses and Losses: \begin{tabular}{|c|c|c|} \hline Interest Expenses & $429 & \\ \hline Loss on Sale of Fixed Assets & $$99 & \\ \hline Total Other Expenses and Losses & & $1,228 \\ \hline Income Before Taxes & & $8,574 \\ \hline Less: Income Tax Expense & & $3,829 \\ \hline Net Income & & $4,745 \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline Cash and cash equivalents & 6,340 \\ \hline Cash over and short (DR balance) & 5 \\ \hline Additional Paid In Capital & 5,890 \\ \hline Other current assets & 4,299 \\ \hline Cost of Goods Sold & 63,136 \\ \hline Advertising expense & 842 \\ \hline Utilities expense & 912 \\ \hline Inventories & 15,149 \\ \hline Retained earnings & 29,249 \\ \hline Sales & 108,500 \\ \hline Other long term assets & 4,132 \\ \hline Notes payable & 2,811 \\ \hline Sales Discounts & 1,530 \\ \hline Property, plant, and equipment, net & 16,208 \\ \hline Depreciation expense & 2,410 \\ \hline Accounts payable & 5,727 \\ \hline Interest expense & 429 \\ \hline Loss on sale of fixed assets & 799 \\ \hline Sales salaries expense & 7,481 \\ \hline Income taxes payable & 1,072 \\ \hline Office salaries expense & 11,851 \\ \hline Other long term liabilities & 7,080 \\ \hline Common stock & 28 \\ \hline Rent expense & 8,153 \\ \hline Software expense & 2,194 \\ \hline Income tax expense & 3,829 \\ \hline Accrued liabilities & 21,011 \\ \hline Accounts receivable, net of allowance & 189 \\ \hline Bad debt expense & 84 \\ \hline \end{tabular}