Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Does not have to be in excel, as long as it is in the correct format that looks like the attached examples. Include all calculations

Does not have to be in excel, as long as it is in the correct format that looks like the attached examples.

Include all calculations and work please!

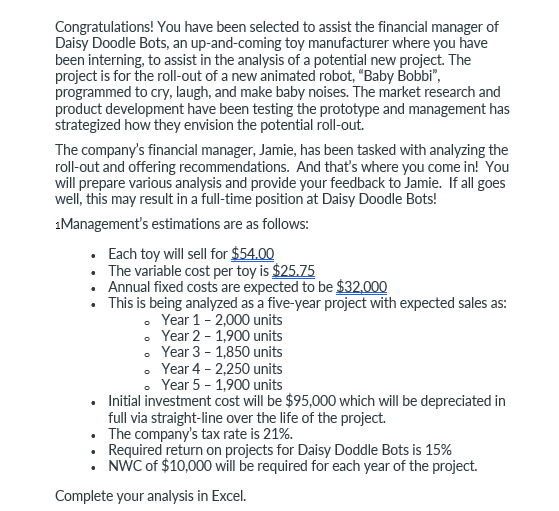

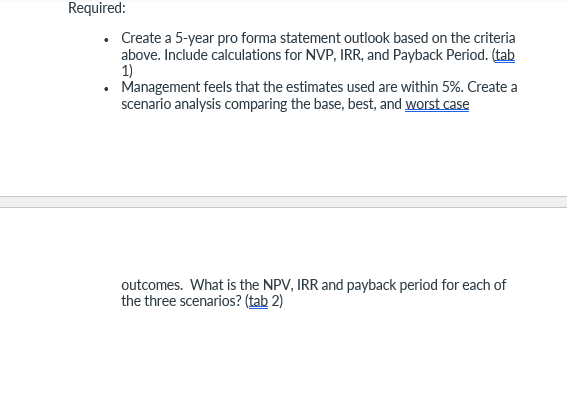

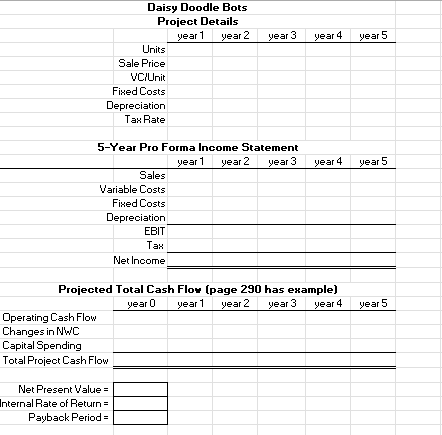

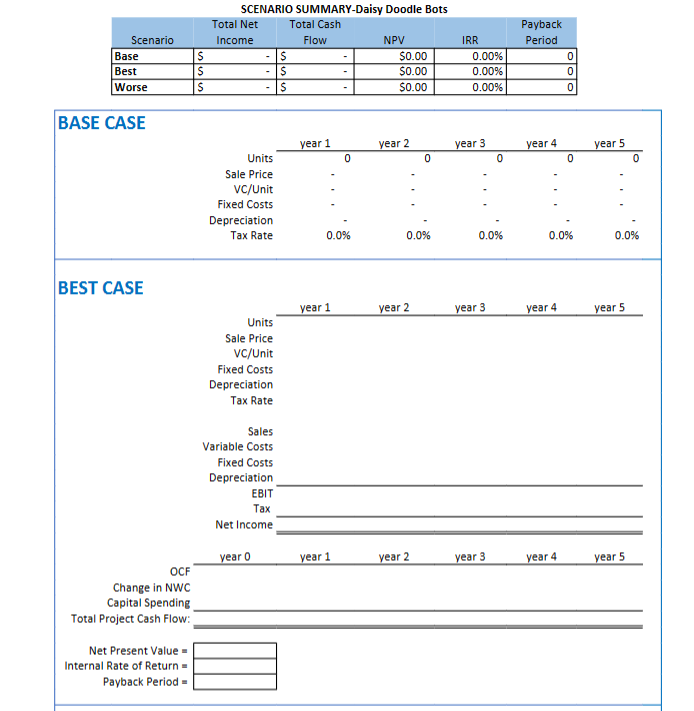

Congratulations! You have been selected to assist the financial manager of Daisy Doodle Bots, an up-and-coming toy manufacturer where you have been interning, to assist in the analysis of a potential new project. The project is for the roll-out of a new animated robot, "Baby Bobbi", programmed to cry, laugh, and make baby noises. The market research and product development have been testing the prototype and management has strategized how they envision the potential roll-out. The company's financial manager, Jamie, has been tasked with analyzing the roll-out and offering recommendations. And that's where you come in! You will prepare various analysis and provide your feedback to Jamie. If all goes well, this may result in a full-time position at Daisy Doodle Bots! 1 Management's estimations are as follows: - Each toy will sell for $54.00 - The variable cost per toy is $25.75 - Annual fixed costs are expected to be $32,000 - This is being analyzed as a five-year project with expected sales as: - Year 12,000 units - Year 21,900 units - Year 31,850 units - Year 42,250 units - Year 5-1,900 units - Initial investment cost will be $95,000 which will be depreciated in full via straight-line over the life of the project. - The company's tax rate is 21%. - Required return on projects for Daisy Doddle Bots is 15% - NWC of $10,000 will be required for each year of the project. Complete your analysis in Excel. Required: - Create a 5-year pro forma statement outlook based on the criteria above. Include calculations for NVP, IRR, and Payback Period. (tab 1) - Management feels that the estimates used are within 5%. Create a scenario analysis comparing the base, best, and worst case outcomes. What is the NPV, IRR and payback period for each of the three scenarios? ( (tab 2) Daisy Doodle Bots Project Details Units Sale Price WCirit Fined Costs Depreciation Tan Rate 5-Year Pro Forma Income Statement year 1 year 2 year 3 year 4 year 5 Sales Variable Costs Fined Costs Depreciation EBIT Tas Net Inoome Projected Total Cash Flon (page 290 has erample) \begin{tabular}{r|} Net Present Value = \\ InternalRate of Return = \\ Payback Period = \\ \end{tabular} SCENARIO SUMMARY-Daisy Doodle BotsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started