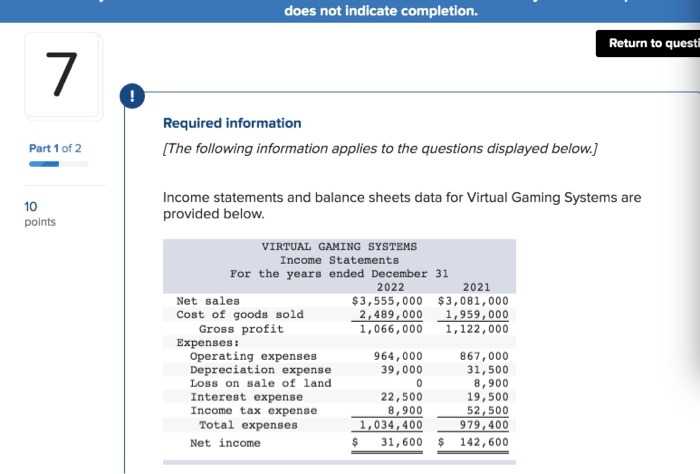

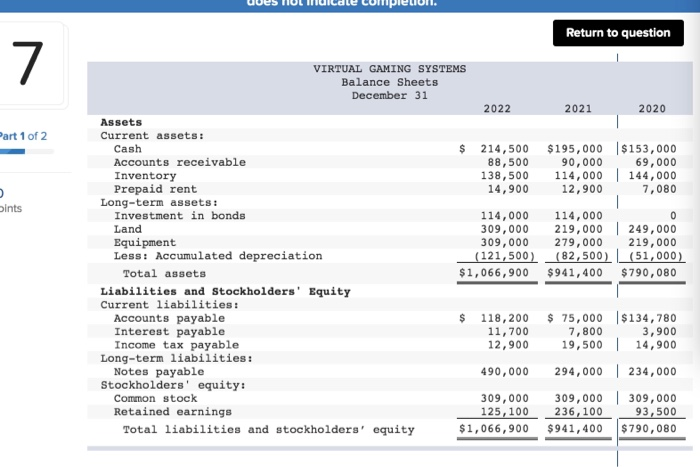

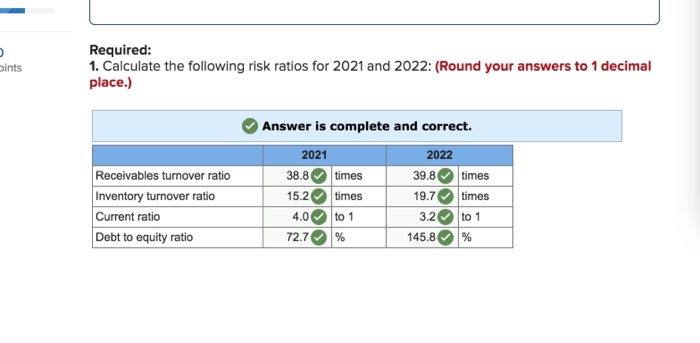

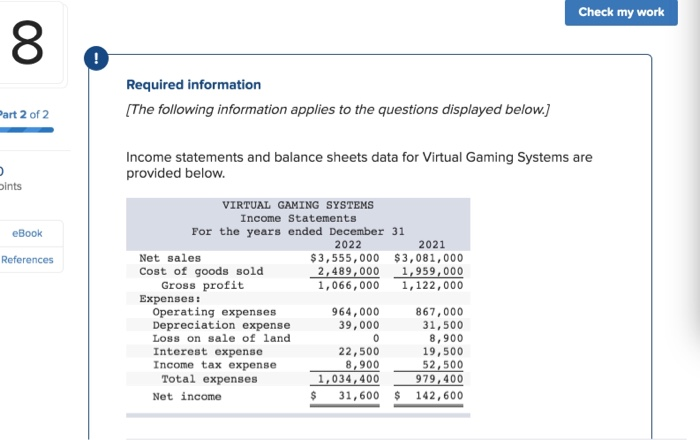

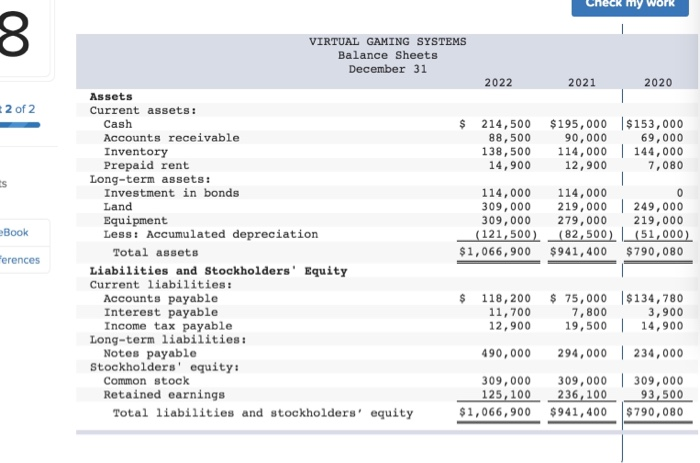

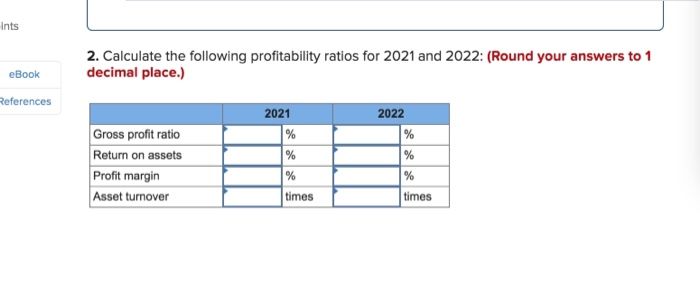

does not indicate completion. Return to questi Required information [The following information applies to the questions displayed below.] Part 1 of 2 10 points Income statements and balance sheets data for Virtual Gaming Systems are provided below. VIRTUAL GAMING SYSTEMS Income Statements For the years ended December 31 2022 2021 Net sales $3,555,000 $3,081,000 Cost of goods sold 2,489,000 1,959,000 Gross profit 1,066,000 1, 122,000 Expenses: Operating expenses 964,000 867,000 Depreciation expense 39,000 31,500 Loss on sale of land 8,900 Interest expense 22,500 19,500 Income tax expense 8,900 52,500 Total expenses 1,034,400 979,400 Net income $ 31,600 $ 142,600 uues HIUL Muilate CUMPielull. Return to question VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2022 2021 2020 Part 1 of 2 $ 214,500 88,500 138,500 14,900 $195,000 90,000 114,000 12,900 $153,000 69,000 144,000 7,080 Sints Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 114,000 309,000 309,000 (121,500). $1,066,900 114,000 219,000 279,000 (82,500) $941,400 249,000 219,000 (51,000) $ 790,080 $ 118,200 11,700 12,900 $ 75,000 7,800 19,500 $134,780 3,900 | 14,900 490,000 294,000 234,000 309,000 125,100 $1,066,900 309,000 236,100 $941,400 309,000 93,500 Dints Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) Answer is complete and correct. Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio 2021 38.8 15.2 4.0 72.7 times times to 1 % 2022 39.8 19.7 3.2 145.8 times times to 1 % Check my work Required information (The following information applies to the questions displayed below.) Part 2 of 2 Income statements and balance sheets data for Virtual Gaming Systems are provided below. pints eBook References VIRTUAL GAMING SYSTEMS Income Statements For the years ended December 31 2022 2021 Net sales $3,555,000 $3,081,000 Cost of goods sold 2,489,000 1,959,000 Gross profit 1,066,000 1,122,000 Expenses : Operating expenses 964,000 867,000 Depreciation expense 39,000 31,500 Loss on sale of land 0 8,900 Interest expense 22,500 19,500 Income tax expense 8,900 52,500 Total expenses 1,034,400 979,400 Net income $ 31,600 $ 142,600 Check my Work VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2022 2021 2020 2 of 2 $ 214,500 88,500 138,500 14,900 $195,000 90,000 114,000 12,900 $153,000 69,000 144,000 7,080 0 114,000 309,000 309,000 (121,500 $1,066,900 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity 114,000 219,000 279,000 (82,500 $941,400 eBook 249,000 219,000 (51,000) $790,080 Ferences $ 118,200 11,700 12,900 490,000 $ 75,000 $134,780 7,800 3,900 19,500 14,900 294,000 | 234,000 309,000 125,100 $1,066,900 309,000 236,100 $941,400 309,000 9 3,500 $ 790,080 Ints 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) eBook References 2021 2022 Gross profit ratio Return on assets Profit margin Asset turnover times times