Does someone know how to do this problem?

Will rate a thumb up if correct, thanks so much!

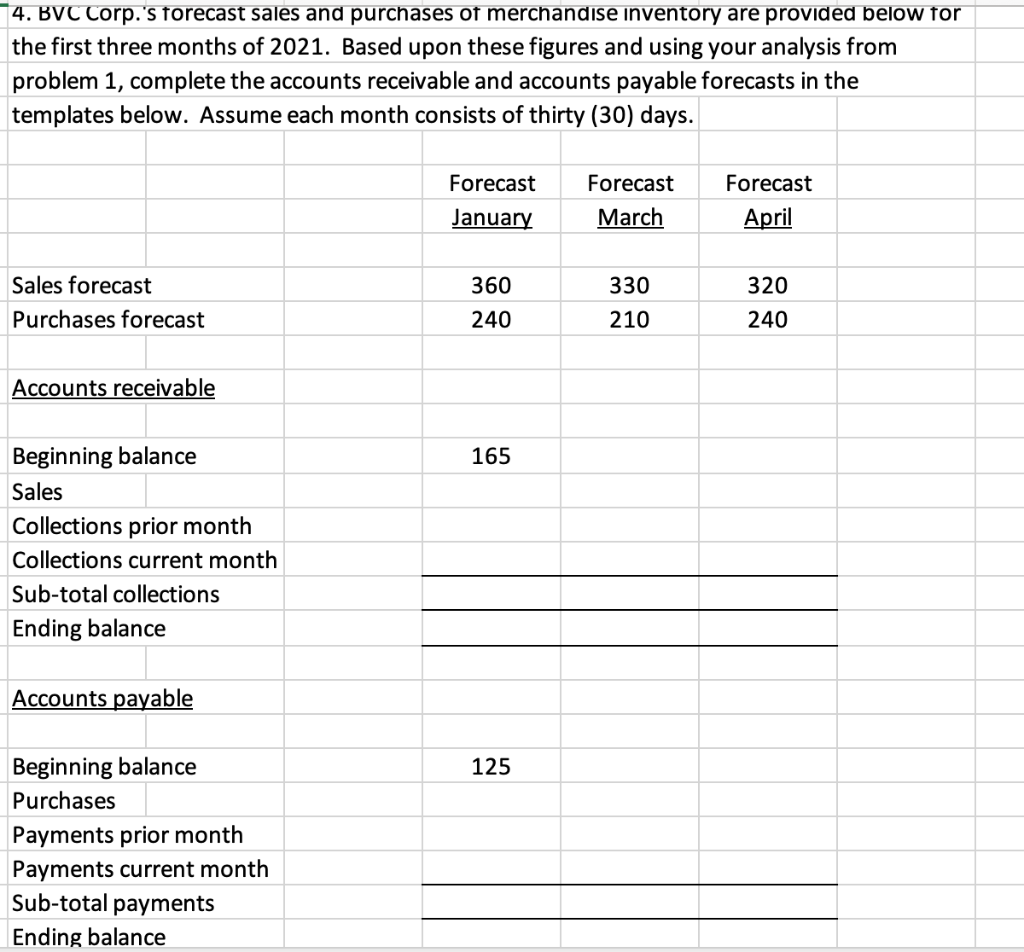

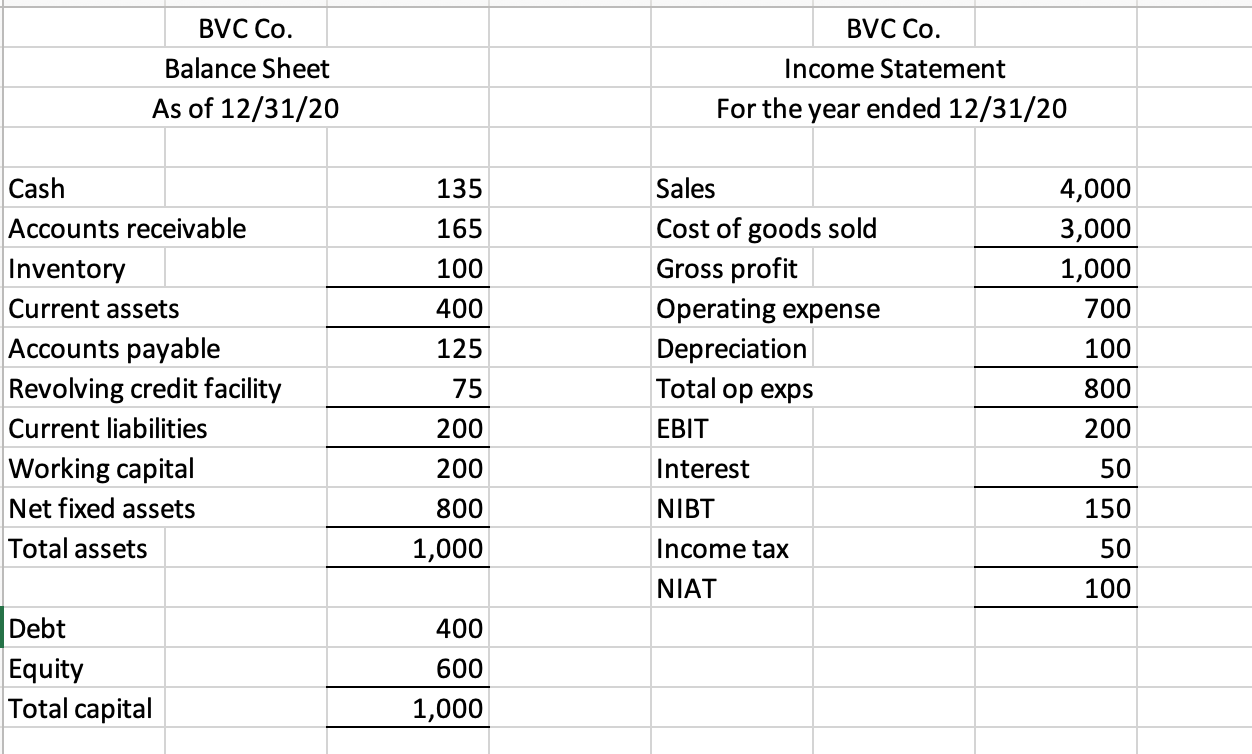

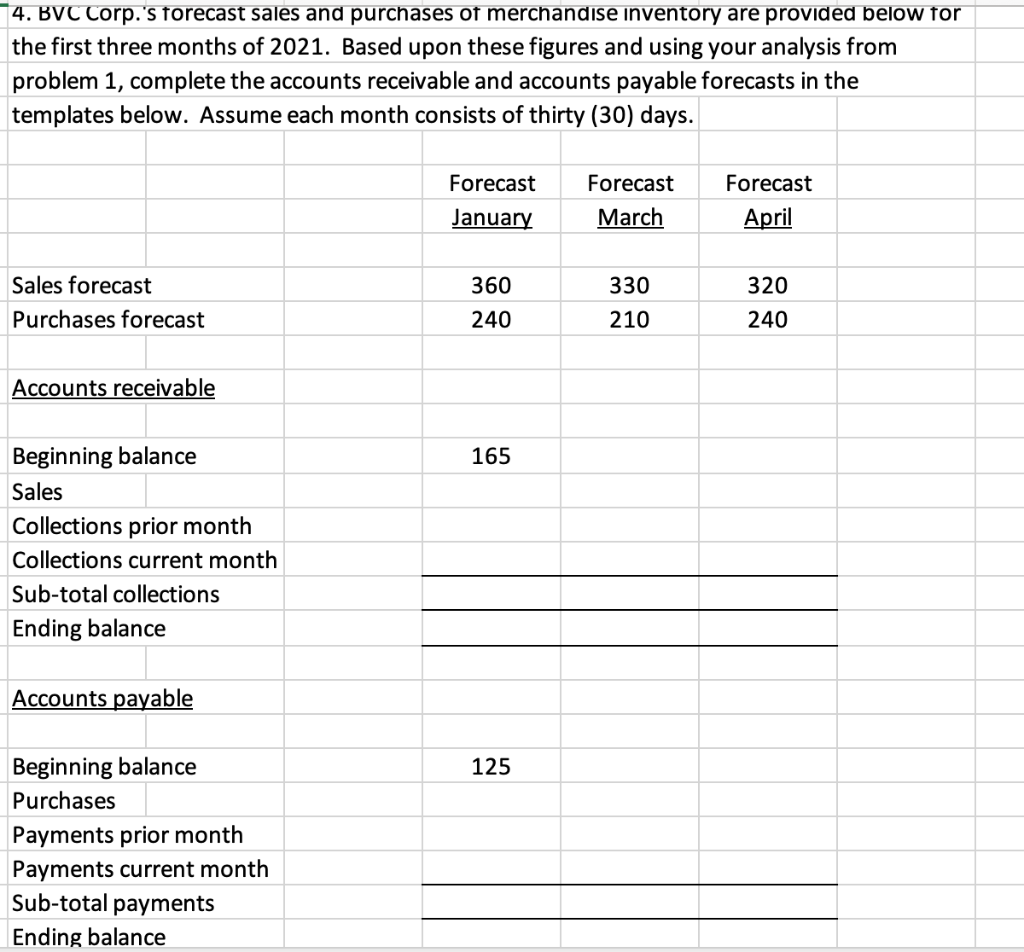

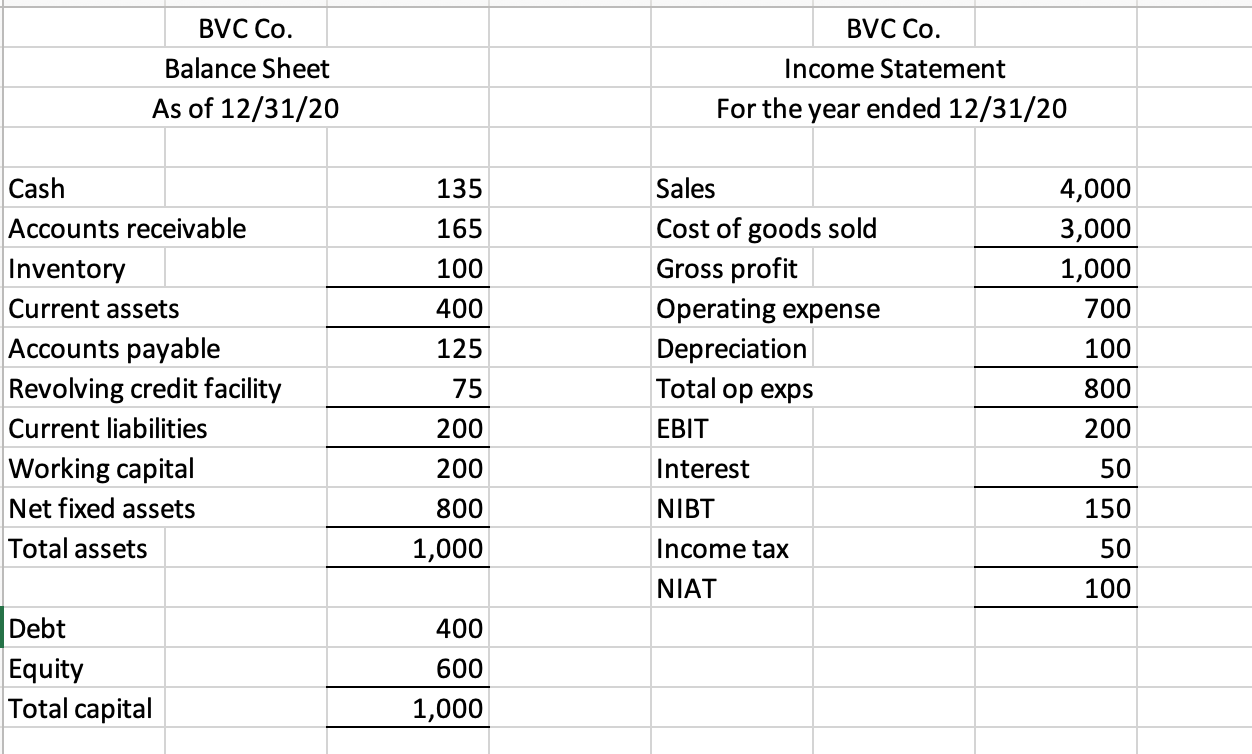

4. BVC Corp.'s forecast sales and purchases of merchandise inventory are provided below for the first three months of 2021. Based upon these figures and using your analysis from problem 1, complete the accounts receivable and accounts payable forecasts in the templates below. Assume each month consists of thirty (30) days. Forecast January Forecast March Forecast April 360 330 Sales forecast Purchases forecast 320 240 240 210 Accounts receivable 165 Beginning balance Sales Collections prior month Collections current month Sub-total collections Ending balance Accounts payable 125 Beginning balance Purchases Payments prior month Payments current month Sub-total payments Ending balance BVC Co. BVC Co. Balance Sheet As of 12/31/20 Income Statement For the year ended 12/31/20 135 165 4,000 3,000 1,000 700 100 400 Sales Cost of goods sold Gross profit Operating expense Depreciation Total op exps EBIT 125 Cash Accounts receivable Inventory Current assets Accounts payable Revolving credit facility Current liabilities Working capital Net fixed assets Total assets 100 75 800 200 200 50 200 800 1,000 Interest NIBT 150 50 Income tax NIAT 100 400 Debt Equity Total capital 600 1,000 4. BVC Corp.'s forecast sales and purchases of merchandise inventory are provided below for the first three months of 2021. Based upon these figures and using your analysis from problem 1, complete the accounts receivable and accounts payable forecasts in the templates below. Assume each month consists of thirty (30) days. Forecast January Forecast March Forecast April 360 330 Sales forecast Purchases forecast 320 240 240 210 Accounts receivable 165 Beginning balance Sales Collections prior month Collections current month Sub-total collections Ending balance Accounts payable 125 Beginning balance Purchases Payments prior month Payments current month Sub-total payments Ending balance BVC Co. BVC Co. Balance Sheet As of 12/31/20 Income Statement For the year ended 12/31/20 135 165 4,000 3,000 1,000 700 100 400 Sales Cost of goods sold Gross profit Operating expense Depreciation Total op exps EBIT 125 Cash Accounts receivable Inventory Current assets Accounts payable Revolving credit facility Current liabilities Working capital Net fixed assets Total assets 100 75 800 200 200 50 200 800 1,000 Interest NIBT 150 50 Income tax NIAT 100 400 Debt Equity Total capital 600 1,000