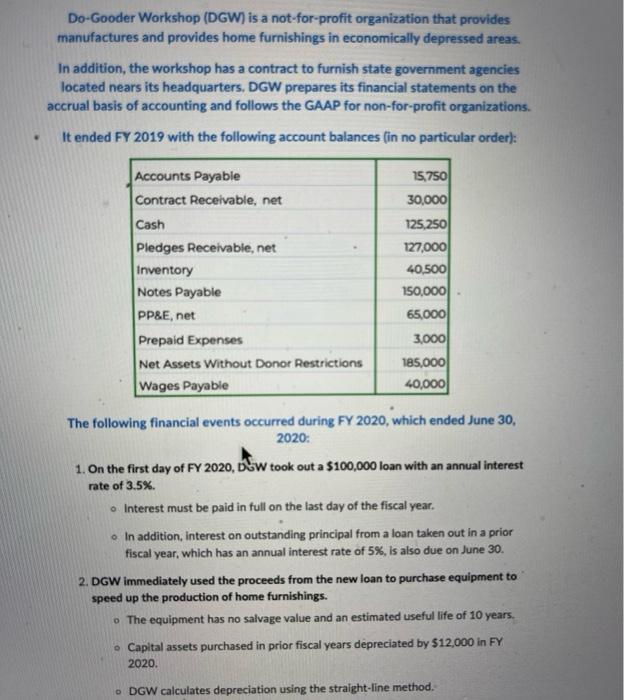

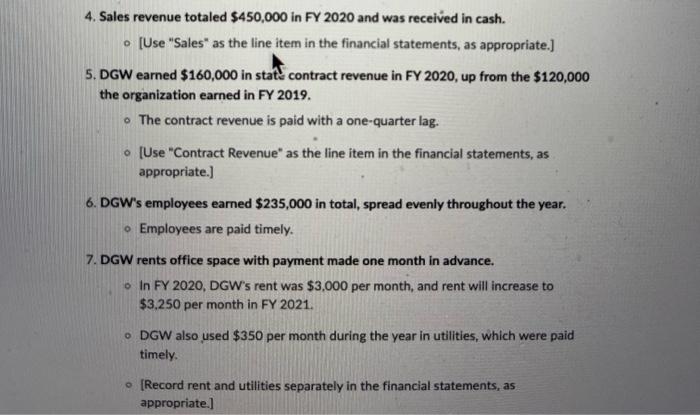

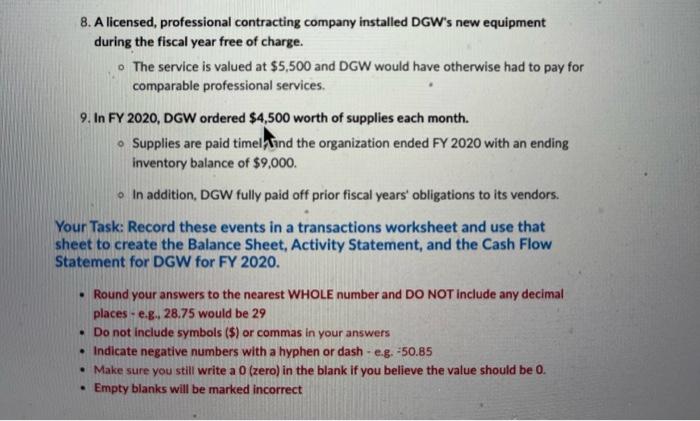

Do-Gooder Workshop (DGW) is a not-for-profit organization that provides manufactures and provides home furnishings in economically depressed areas. In addition, the workshop has a contract to furnish state government agencies located nears its headquarters. DGW prepares its financial statements on the accrual basis of accounting and follows the GAAP for non-for-profit organizations. It ended FY 2019 with the following account balances (in no particular order): Accounts Payable Contract Receivable, net Cash Pledges Receivable, net Inventory Notes Payable PP&E, net Prepaid Expenses Net Assets Without Donor Restrictions Wages Payable 15,750 30,000 125,250 127,000 40,500 150,000 65,000 3,000 185,000 40,000 The following financial events occurred during FY 2020, which ended June 30, 2020: 1. On the first day of FY 2020, DW took out a $100,000 loan with an annual interest rate of 3.5% o Interest must be paid in full on the last day of the fiscal year. . In addition, interest on outstanding principal from a loan taken out in a prior fiscal year, which has an annual interest rate of 5%, is also due on June 30. 2. DGW immediately used the proceeds from the new loan to purchase equipment to speed up the production of home furnishings. o The equipment has no salvage value and an estimated useful life of 10 years. Capital assets purchased in prior fiscal years depreciated by $12,000 in FY 2020. DGW calculates depreciation using the straight-line method. 4. Sales revenue totaled $450,000 in FY 2020 and was received in cash. . (Use "Sales" as the line item in the financial statements, as appropriate.) 5. DGW earned $160,000 in state contract revenue in FY 2020, up from the $120,000 the organization earned in FY 2019. The contract revenue is paid with a one-quarter lag. [Use "Contract Revenue" as the line item in the financial statements, as appropriate.) 6. DGW's employees earned $235,000 in total, spread evenly throughout the year. . Employees are paid timely. 7. DGW rents office space with payment made one month in advance. o In FY 2020, DGW's rent was $3,000 per month, and rent will increase to $3,250 per month in FY 2021. - DGW also used $350 per month during the year in utilities, which were paid timely . [Record rent and utilities separately in the financial statements, as appropriate.) 8. A licensed, professional contracting company installed DGW's new equipment during the fiscal year free of charge. The service is valued at $5,500 and DGW would have otherwise had to pay for comparable professional services. 9. In FY 2020, DGW ordered $4,500 worth of supplies each month. Supplies are paid time and the organization ended FY 2020 with an ending inventory balance of $9,000. In addition, DGW fully paid off prior fiscal years' obligations to its vendors. Your Task: Record these events in a transactions worksheet and use that sheet to create the Balance Sheet, Activity Statement, and the Cash Flow Statement for DGW for FY 2020. Round your answers to the nearest WHOLE number and DO NOT include any decimal places - e.g. 28.75 would be 29 Do not include symbols ($) or commas in your answers Indicate negative numbers with a hyphen or dash - e.g.-50.85 Make sure you still write a 0 (zero) in the blank if you believe the value should be 0. Empty blanks will be marked incorrect . Do-Gooder Workshop (DGW) is a not-for-profit organization that provides manufactures and provides home furnishings in economically depressed areas. In addition, the workshop has a contract to furnish state government agencies located nears its headquarters. DGW prepares its financial statements on the accrual basis of accounting and follows the GAAP for non-for-profit organizations. It ended FY 2019 with the following account balances (in no particular order): Accounts Payable Contract Receivable, net Cash Pledges Receivable, net Inventory Notes Payable PP&E, net Prepaid Expenses Net Assets Without Donor Restrictions Wages Payable 15,750 30,000 125,250 127,000 40,500 150,000 65,000 3,000 185,000 40,000 The following financial events occurred during FY 2020, which ended June 30, 2020: 1. On the first day of FY 2020, DW took out a $100,000 loan with an annual interest rate of 3.5% o Interest must be paid in full on the last day of the fiscal year. . In addition, interest on outstanding principal from a loan taken out in a prior fiscal year, which has an annual interest rate of 5%, is also due on June 30. 2. DGW immediately used the proceeds from the new loan to purchase equipment to speed up the production of home furnishings. o The equipment has no salvage value and an estimated useful life of 10 years. Capital assets purchased in prior fiscal years depreciated by $12,000 in FY 2020. DGW calculates depreciation using the straight-line method. 4. Sales revenue totaled $450,000 in FY 2020 and was received in cash. . (Use "Sales" as the line item in the financial statements, as appropriate.) 5. DGW earned $160,000 in state contract revenue in FY 2020, up from the $120,000 the organization earned in FY 2019. The contract revenue is paid with a one-quarter lag. [Use "Contract Revenue" as the line item in the financial statements, as appropriate.) 6. DGW's employees earned $235,000 in total, spread evenly throughout the year. . Employees are paid timely. 7. DGW rents office space with payment made one month in advance. o In FY 2020, DGW's rent was $3,000 per month, and rent will increase to $3,250 per month in FY 2021. - DGW also used $350 per month during the year in utilities, which were paid timely . [Record rent and utilities separately in the financial statements, as appropriate.) 8. A licensed, professional contracting company installed DGW's new equipment during the fiscal year free of charge. The service is valued at $5,500 and DGW would have otherwise had to pay for comparable professional services. 9. In FY 2020, DGW ordered $4,500 worth of supplies each month. Supplies are paid time and the organization ended FY 2020 with an ending inventory balance of $9,000. In addition, DGW fully paid off prior fiscal years' obligations to its vendors. Your Task: Record these events in a transactions worksheet and use that sheet to create the Balance Sheet, Activity Statement, and the Cash Flow Statement for DGW for FY 2020. Round your answers to the nearest WHOLE number and DO NOT include any decimal places - e.g. 28.75 would be 29 Do not include symbols ($) or commas in your answers Indicate negative numbers with a hyphen or dash - e.g.-50.85 Make sure you still write a 0 (zero) in the blank if you believe the value should be 0. Empty blanks will be marked incorrect