Question

Dollar value LIFO is a technique to estimate inventory on the balance sheet based on physical inventory counts. It is not as used today due

Dollar value LIFO is a technique to estimate inventory on the balance sheet based on physical inventory counts. It is not as used today due to scanning technology, but in the old days, it was hard to keep track of which inventory remained unsold and which inventory was sold. Remember that the value of inventory on the balance sheet is based on cost, not market value (actually lower of cost or market).

Dollar Value LIFO starts with physical inventory. Count the physical inventory and estimate its value based on current wholesale market values. If there was no inflation, this would approximate cost. However, if there is inflation, we need to make additional calculations to estimate what we originally paid for the inventory at cost.

# Based on your answers to the previous question, what is the balance sheet value of the inventory at the end of year 2? Add year 1 inventory ($240,000) to the year 2 layer (at cost, answer 5 above) to get the ending inventory (at cost) for year This is the amount that goes on the balance sheet. Show work.

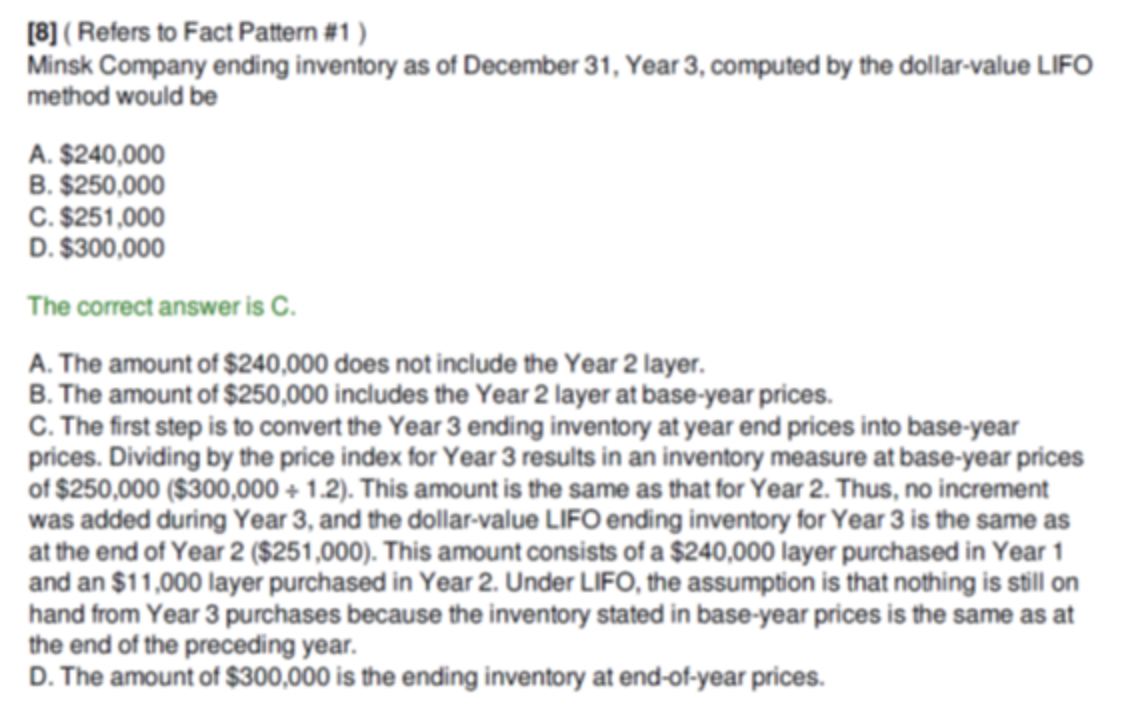

# Review the answer and explanation to question 8 copied below regarding the year 3 inventory on the balance sheet. Do you now understand the answer? If not, you may ask a SPECIFIC question about the explanation in the solution.

# What is this inventory calculation method called Dollar-Value?

Hello, could someone please help me out with those three questions please, I have been struggling to come up with the answer, thank you very much for your time and patience!

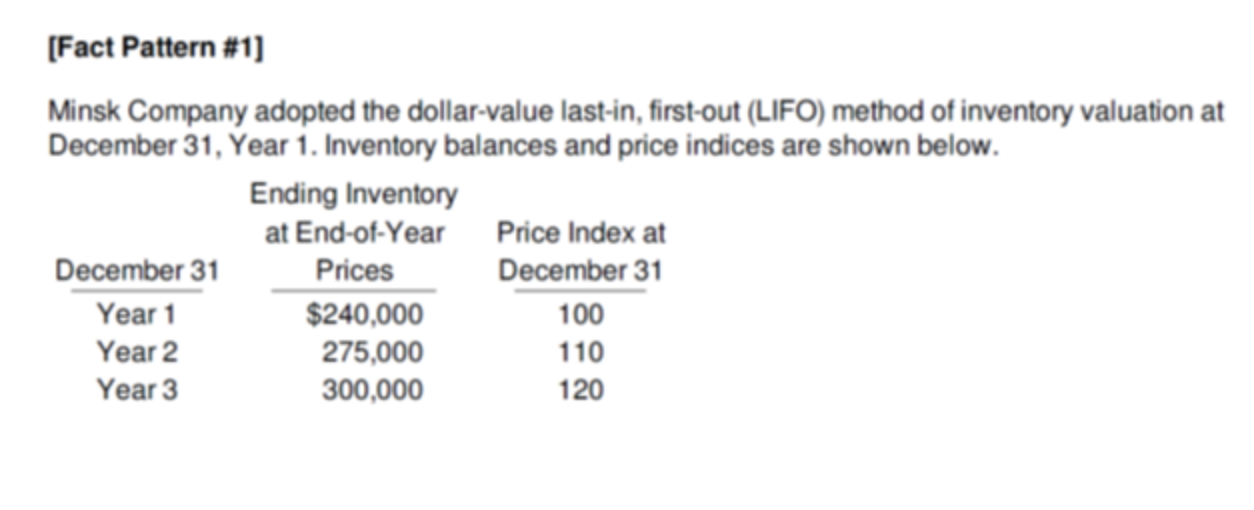

[Fact Pattern #1] Minsk Company adopted the dollar-value last-in, first-out (LIFO) method of inventory valuation at December 31, Year 1. Inventory balances and price indices are shown below. Ending Inventory at End-of-Year Price Index at December 31 Prices December 31 Year 1 $240,000 100 Year 2 275,000 110 Year 3 300,000 120 [8] (Refers to Fact Pattern #1) Minsk Company ending inventory as of December 31, Year 3, computed by the dollar-value LIFO method would be A. $240,000 B. $250,000 C. $251,000 D. $300,000 The correct answer is C. A. The amount of $240,000 does not include the Year 2 layer. B. The amount of $250,000 includes the Year 2 layer at base-year prices. C. The first step is to convert the Year 3 ending inventory at year end prices into base-year prices. Dividing by the price index for Year 3 results in an inventory measure at base-year prices of $250,000 ($300,000 + 1.2). This amount is the same as that for Year 2. Thus, no increment was added during Year 3, and the dollar-value LIFO ending inventory for Year 3 is the same as at the end of Year 2 ($251,000). This amount consists of a $240,000 layer purchased in Year 1 and an $11,000 layer purchased in Year 2. Under LIFO, the assumption is that nothing is still on hand from Year 3 purchases because the inventory stated in base-year prices is the same as at the end of the preceding year. D. The amount of $300,000 is the ending inventory at end-of-year prices. [Fact Pattern #1] Minsk Company adopted the dollar-value last-in, first-out (LIFO) method of inventory valuation at December 31, Year 1. Inventory balances and price indices are shown below. Ending Inventory at End-of-Year Price Index at December 31 Prices December 31 Year 1 $240,000 100 Year 2 275,000 110 Year 3 300,000 120 [8] (Refers to Fact Pattern #1) Minsk Company ending inventory as of December 31, Year 3, computed by the dollar-value LIFO method would be A. $240,000 B. $250,000 C. $251,000 D. $300,000 The correct answer is C. A. The amount of $240,000 does not include the Year 2 layer. B. The amount of $250,000 includes the Year 2 layer at base-year prices. C. The first step is to convert the Year 3 ending inventory at year end prices into base-year prices. Dividing by the price index for Year 3 results in an inventory measure at base-year prices of $250,000 ($300,000 + 1.2). This amount is the same as that for Year 2. Thus, no increment was added during Year 3, and the dollar-value LIFO ending inventory for Year 3 is the same as at the end of Year 2 ($251,000). This amount consists of a $240,000 layer purchased in Year 1 and an $11,000 layer purchased in Year 2. Under LIFO, the assumption is that nothing is still on hand from Year 3 purchases because the inventory stated in base-year prices is the same as at the end of the preceding year. D. The amount of $300,000 is the ending inventory at end-of-year pricesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started