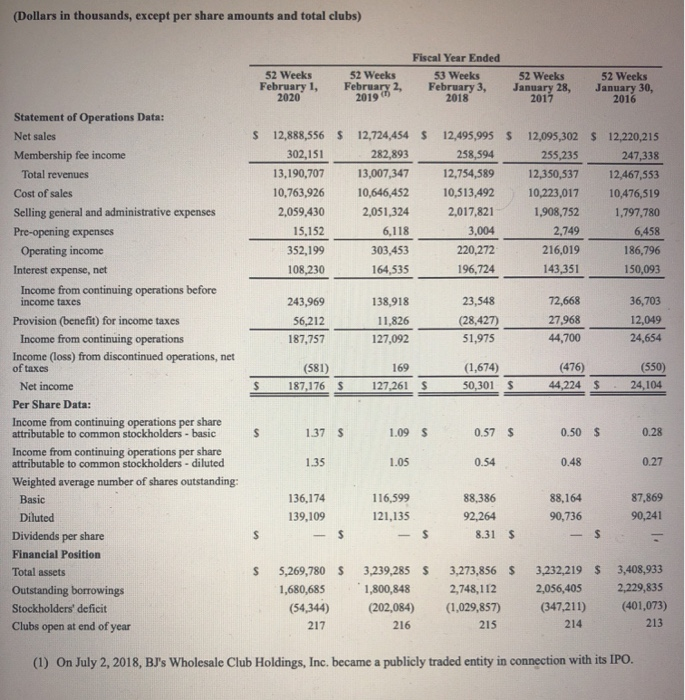

(Dollars in thousands, except per share amounts and total clubs) 52 Weeks February 1, 2020 52 Weeks February 2, Fiscal Year Ended 53 Weeks February 3, 2018 52 Weeks January 28, 2017 52 Weeks January 30, 2016 2019 $ 12,888,556 $ 302,151 13,190,707 10,763,926 2,059,430 15,152 352,199 108,230 12,724,454 $ 282,893 13,007,347 10,646,452 2,051,324 6,118 303,453 164,535 12,495,995 $ 12,095,302 $ 12,220,215 258,594 255,235 247,338 12,754,589 12,350,537 12,467,553 10,513,492 10,223,017 10,476,519 2,017,821 1,908,752 1,797,780 3,004 2,749 6,458 220,272 216,019 186,796 196,724 143,351 150,093 243,969 56,212 187,757 138,918 11,826 127,092 23,548 (28,427) 51,975 72,668 27,968 44,700 36,703 12,049 24,654 Statement of Operations Data: Net sales Membership fee income Total revenues Cost of sales Selling general and administrative expenses Pre-opening expenses Operating income Interest expense, net Income from continuing operations before income taxes Provision (benefit) for income taxes Income from continuing operations Income (loss) from discontinued operations, net of taxes Net income Per Share Data: Income from continuing operations per share attributable to common stockholders - basic Income from continuing operations per share attributable to common stockholders - diluted Weighted average number of shares outstanding: Basic Diluted Dividends per share Financial Position Total assets Outstanding borrowings Stockholders' deficit Clubs open at end of year (581) 187,176 $ 169 127.261 $ (1,674) 50,301 $ (476) 44,224 $ (550) 24,104 $ S 1.37 $ 1.09 $ 0.57 $ 0.50 $ 0.28 1.35 1.05 0.54 0.48 0.27 136,174 139,109 - S 116,599 121,135 - $ 88,386 92,264 8.31 $ 88,164 90,736 87,869 90,241 $ $ S 5,269,780 $ 1,680,685 (54,344) 217 3,239,285 $ 1,800,848 (202,084) 216 3,273,856 $ 2,748,112 (1,029,857) 215 3,232,219 $ 2,056,405 (347,211) 214 3,408,933 2,229,835 (401,073) 213 (1) On July 2, 2018, BJ's Wholesale Club Holdings, Inc. became a publicly traded entity in connection with its IPO. Indicate the formula to be used and insert the amounts used in computing each ratio. Express your answer in suitable units (percentages, decimals etc.) A. Current ratio B. Quick ratio 1 C. Receivable turnover D. Average days sales uncollected E. Inventory turnover I F. Profit margin G. Return on assets H. Return on Equity 1. Earnings per share Page 3 of 4 J. Debt to equity ratio K. Dividend yield L. Price earnings ratio (use price from question 1 and EPS from question 6-i) (Dollars in thousands, except per share amounts and total clubs) 52 Weeks February 1, 2020 52 Weeks February 2, Fiscal Year Ended 53 Weeks February 3, 2018 52 Weeks January 28, 2017 52 Weeks January 30, 2016 2019 $ 12,888,556 $ 302,151 13,190,707 10,763,926 2,059,430 15,152 352,199 108,230 12,724,454 $ 282,893 13,007,347 10,646,452 2,051,324 6,118 303,453 164,535 12,495,995 $ 12,095,302 $ 12,220,215 258,594 255,235 247,338 12,754,589 12,350,537 12,467,553 10,513,492 10,223,017 10,476,519 2,017,821 1,908,752 1,797,780 3,004 2,749 6,458 220,272 216,019 186,796 196,724 143,351 150,093 243,969 56,212 187,757 138,918 11,826 127,092 23,548 (28,427) 51,975 72,668 27,968 44,700 36,703 12,049 24,654 Statement of Operations Data: Net sales Membership fee income Total revenues Cost of sales Selling general and administrative expenses Pre-opening expenses Operating income Interest expense, net Income from continuing operations before income taxes Provision (benefit) for income taxes Income from continuing operations Income (loss) from discontinued operations, net of taxes Net income Per Share Data: Income from continuing operations per share attributable to common stockholders - basic Income from continuing operations per share attributable to common stockholders - diluted Weighted average number of shares outstanding: Basic Diluted Dividends per share Financial Position Total assets Outstanding borrowings Stockholders' deficit Clubs open at end of year (581) 187,176 $ 169 127.261 $ (1,674) 50,301 $ (476) 44,224 $ (550) 24,104 $ S 1.37 $ 1.09 $ 0.57 $ 0.50 $ 0.28 1.35 1.05 0.54 0.48 0.27 136,174 139,109 - S 116,599 121,135 - $ 88,386 92,264 8.31 $ 88,164 90,736 87,869 90,241 $ $ S 5,269,780 $ 1,680,685 (54,344) 217 3,239,285 $ 1,800,848 (202,084) 216 3,273,856 $ 2,748,112 (1,029,857) 215 3,232,219 $ 2,056,405 (347,211) 214 3,408,933 2,229,835 (401,073) 213 (1) On July 2, 2018, BJ's Wholesale Club Holdings, Inc. became a publicly traded entity in connection with its IPO. Indicate the formula to be used and insert the amounts used in computing each ratio. Express your answer in suitable units (percentages, decimals etc.) A. Current ratio B. Quick ratio 1 C. Receivable turnover D. Average days sales uncollected E. Inventory turnover I F. Profit margin G. Return on assets H. Return on Equity 1. Earnings per share Page 3 of 4 J. Debt to equity ratio K. Dividend yield L. Price earnings ratio (use price from question 1 and EPS from question 6-i)