Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dollin Inc. is incorporated under Virginia law and has its corporate headquarters in Richmond. Dollin is a distributor, it purchases tangible goods from manufacturers and

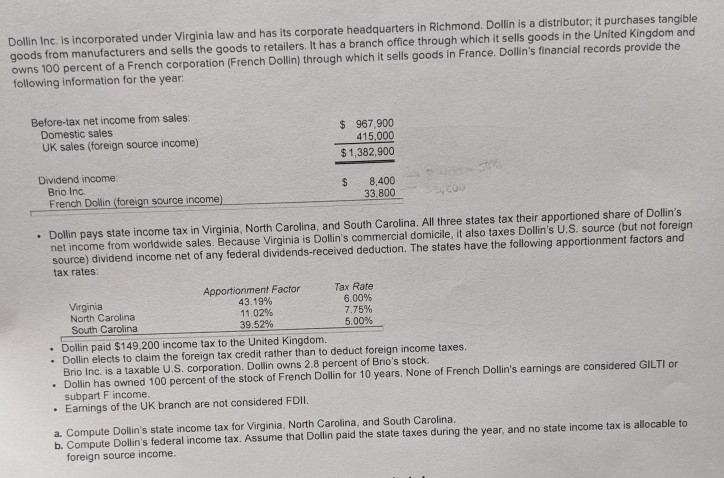

Dollin Inc. is incorporated under Virginia law and has its corporate headquarters in Richmond. Dollin is a distributor, it purchases tangible goods from manufacturers and sells the goods to retailers. It has a branch office through which it sells goods in the United Kingdom and owns 100 percent of a French corporation (French Dollin) through which it sells goods in France. Dollin's financial records provide the following information for the year: Before-tax net income from sales: Domestic sales UK sales (foreign source income) $ 967.900 415.000 $1,382,900 Dividend income Brio Inc French Dollin (foreign source income) $ 8,400 33 800 Dollin pays state income tax in Virginia, North Carolina, and South Carolina. All three states tax their apportioned share of Dollin's net income from worldwide sales. Because Virginia is Dollin's commercial domicile, it also taxes Dollin's U.S. source (but not foreign source) dividend income net of any federal dividends-received deduction. The states have the following apportionment factors and tax rates: Apportionment Factor Tax Rate Virginia 43.19% 6.00% North Carolina 11.02% 7.759 South Carolina 39.52% 5.00% Dollin paid $149,200 income tax to the United Kingdom. Dollin elects to claim the foreign tax credit rather than to deduct foreign income taxes. Brio Inc. is a taxable U.S. corporation. Dollin owns 2.8 percent of Brio's stock. Dollin has owned 100 percent of the stock of French Dollin for 10 years, None of French Dollin's earnings are considered GILTI or subpart F income. Earnings of the UK branch are not considered FDII. a. Compute Dollin's state income tax for Virginia, North Carolina, and South Carolina. b. Compute Dollin's federal income tax. Assume that Dollin paid the state taxes during the year, and no state income tax is allocable to foreign source income. Dollin Inc. is incorporated under Virginia law and has its corporate headquarters in Richmond. Dollin is a distributor, it purchases tangible goods from manufacturers and sells the goods to retailers. It has a branch office through which it sells goods in the United Kingdom and owns 100 percent of a French corporation (French Dollin) through which it sells goods in France. Dollin's financial records provide the following information for the year: Before-tax net income from sales: Domestic sales UK sales (foreign source income) $ 967.900 415.000 $1,382,900 Dividend income Brio Inc French Dollin (foreign source income) $ 8,400 33 800 Dollin pays state income tax in Virginia, North Carolina, and South Carolina. All three states tax their apportioned share of Dollin's net income from worldwide sales. Because Virginia is Dollin's commercial domicile, it also taxes Dollin's U.S. source (but not foreign source) dividend income net of any federal dividends-received deduction. The states have the following apportionment factors and tax rates: Apportionment Factor Tax Rate Virginia 43.19% 6.00% North Carolina 11.02% 7.759 South Carolina 39.52% 5.00% Dollin paid $149,200 income tax to the United Kingdom. Dollin elects to claim the foreign tax credit rather than to deduct foreign income taxes. Brio Inc. is a taxable U.S. corporation. Dollin owns 2.8 percent of Brio's stock. Dollin has owned 100 percent of the stock of French Dollin for 10 years, None of French Dollin's earnings are considered GILTI or subpart F income. Earnings of the UK branch are not considered FDII. a. Compute Dollin's state income tax for Virginia, North Carolina, and South Carolina. b. Compute Dollin's federal income tax. Assume that Dollin paid the state taxes during the year, and no state income tax is allocable to foreign source income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started