Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dolphin Swimming Pools sells and installs above ground swimming pools as well as pool accessories. For the current year, they estimate that they would sell

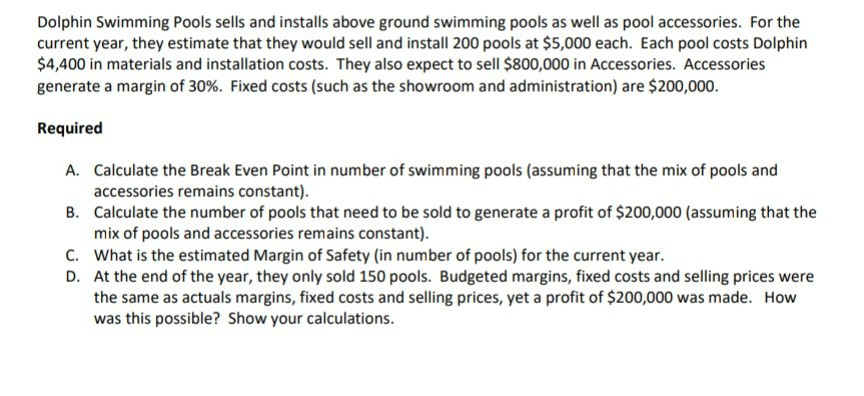

Dolphin Swimming Pools sells and installs above ground swimming pools as well as pool accessories. For the current year, they estimate that they would sell and install 200 pools at $5,000 each. Each pool costs Dolphin $4,400 in materials and installation costs. They also expect to sell $800,000 in Accessories. Accessories generate a margin of 30%. Fixed costs (such as the showroom and administration) are $200,000. Required A. Calculate the Break Even Point in number of swimming pools (assuming that the mix of pools and accessories remains constant). B. Calculate the number of pools that need to be sold to generate a profit of $200,000 (assuming that the mix of pools and accessories remains constant). C. What is the estimated Margin of Safety (in number of pools) for the current year. D. At the end of the year, they only sold 150 pools. Budgeted margins, fixed costs and selling prices were the same as actuals margins, fixed costs and selling prices, yet a profit of $200,000 was made. How was this possible? Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started