Question

Domestic Appliances Ltd plc manufacture low energy kettles and is listed in Germany as well as on UK stock exchanges.The Sales and Costs (Variable) have

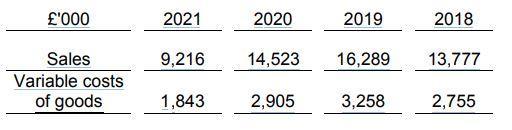

Domestic Appliances Ltd plc manufacture low energy kettles and is listed in Germany as well as on UK stock exchanges.The Sales and Costs (Variable) have been as follows:

Fixed operating costs, additionally, add to the cost of goods sold and have been £200,000 but due to the cost of energy crisis are set to rise by 20%. The finance manager has been quite concerned and wonders if they will be able to weather the storm. So far, the company has aimed to keep its net profit margin at least at 50% level and make a positive contribution to meet fixed costs, but the company wonders if this will still be possible. It may not be possible to make changes in the price of kettles due to the price elasticity of kettles.

The company has borrowed debt and its cost of borrowing is high at 10%. The financial manager is worried that reduced profits may put the company at financial risk. The company has a tax rate of 30%.

Due to Brexit, the company might face higher import costs in the future. The financial manager is concerned about the immediate impact but also the company with international exposure faces additional risks. There are, however, some positives for the company due to its product and use of debt (rather than equity).

Required:

Critically explain to the directors (some of whom are from a more technical rather than financial background) what risks and benefits the company faces.

'000 Sales Variable costs of goods 2021 9,216 1,843 2020 2019 14,523 16,289 2,905 3,258 2018 13,777 2,755

Step by Step Solution

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Domestic Appliances Ltd plc faces a number of risks and benefits that are related to its operations market financial position and macroeconomic environment These factors need to be understood by the c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started