Question

Don and Dale are in the retail business. They named their business: D & D Company. During 2020, they engaged a part-time bookkeeper who has

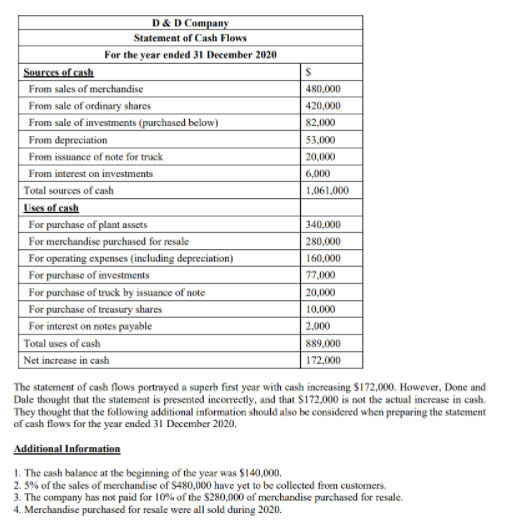

Don and Dale are in the retail business. They named their business: D & D Company. During 2020, they engaged a part-time bookkeeper who has limited accounting knowledge to keep records of their business transactions. The bookkeeper has drawn up the following statements of cash flows for their business for the year ended 31 December 2020.

Question:

(a) The bookkeeper has not drawn up the income statement for the year ended 2020. The only non-cash items in the income statement are depreciation, the gain from the sale of investments and certain items highlighted in the additional information. Prepare an income statement for 2020 to determine the amount of net income or loss (ignore income taxes).

(b) Using the data provided and the income statement from (a), prepare a statement of cash flows in proper form using the indirect method including a supplemental statement for non-cash investing and financing transactions.

(c) Do you agree with Don and Dale? Explain your position.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started