Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Donald and Melania are married and file a joint return. They maintain a home for their two dependent children. In addition, they have a

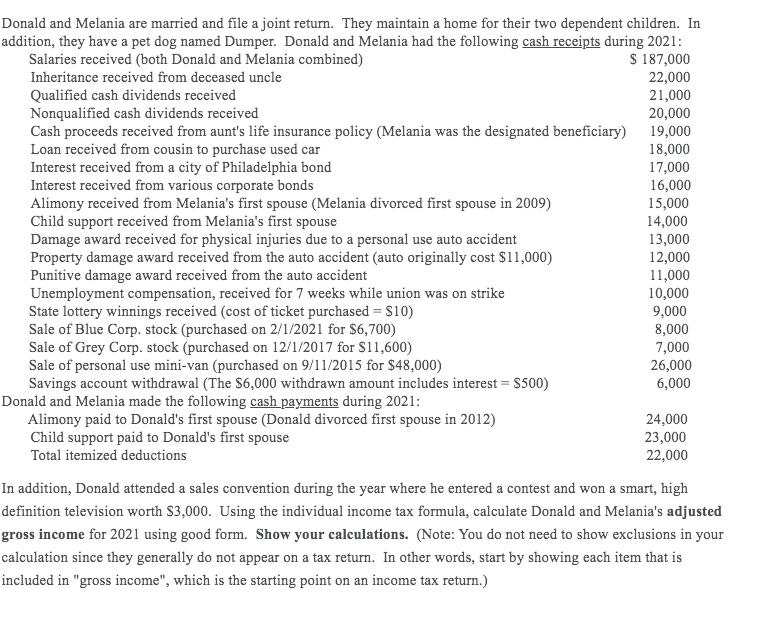

Donald and Melania are married and file a joint return. They maintain a home for their two dependent children. In addition, they have a pet dog named Dumper. Donald and Melania had the following cash receipts during 2021: Salaries received (both Donald and Melania combined) $ 187,000 Inheritance received from deceased uncle 22,000 Qualified cash dividends received 21,000 Nonqualified cash dividends received 20,000 19,000 Cash proceeds received from aunt's life insurance policy (Melania was the designated beneficiary) Loan received from cousin to purchase used car 18,000 Interest received from a city of Philadelphia bond 17,000 Interest received from various corporate bonds 16,000 15,000 Alimony received from Melania's first spouse (Melania divorced first spouse in 2009) Child support received from Melania's first spouse 14,000 Damage award received for physical injuries due to a personal use auto accident 13,000 12,000 Property damage award received from the auto accident (auto originally cost $11,000) Punitive damage award received from the auto accident 11,000 10,000 Unemployment compensation, received for 7 weeks while union was on strike State lottery winnings received (cost of ticket purchased = $10) 9,000 8,000 Sale of Blue Corp. stock (purchased on 2/1/2021 for $6,700) Sale of Grey Corp. stock (purchased on 12/1/2017 for $11,600) 7,000 Sale of personal use mini-van (purchased on 9/11/2015 for $48,000) 26,000 6,000 Savings account withdrawal (The $6,000 withdrawn amount includes interest = $500) Donald and Melania made the following cash payments during 2021: 24,000 Alimony paid to Donald's first spouse (Donald divorced first spouse in 2012) Child support paid to Donald's first spouse 23,000 22,000 Total itemized deductions In addition, Donald attended a sales convention during the year where he entered a contest and won a smart, high definition television worth $3,000. Using the individual income tax formula, calculate Donald and Melania's adjusted gross income for 2021 using good form. Show your calculations. (Note: You do not need to show exclusions in your calculation since they generally do not appear on a tax return. In other words, start by showing each item that is included in "gross income", which is the starting point on an income tax return.)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution As per given details please refer below answer AGI is adjusted gross incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started