Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Donald Trunk, a married American residing in Florida U.S.A., died in 2021 leaving the following assets in the Philippines: a. Shares of stocks in

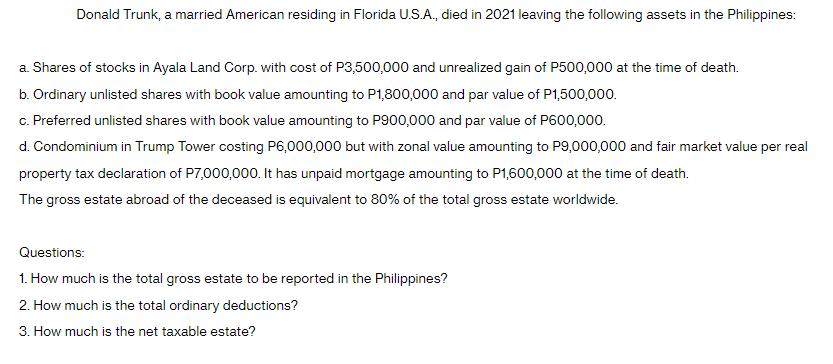

Donald Trunk, a married American residing in Florida U.S.A., died in 2021 leaving the following assets in the Philippines: a. Shares of stocks in Ayala Land Corp. with cost of P3,500,000 and unrealized gain of P500,000 at the time of death. b. Ordinary unlisted shares with book value amounting to P1,800,000 and par value of P1,500,000. c. Preferred unlisted shares with book value amounting to P900,000 and par value of P600,000. d. Condominium in Trump Tower costing P6,000,000 but with zonal value amounting to P9,000,000 and fair market value per real property tax declaration of P7,000,000. It has unpaid mortgage amounting to P1,600,000 at the time of death. The gross estate abroad of the deceased is equivalent to 80% of the total gross estate worldwide. Questions: 1. How much is the total gross estate to be reported in the Philippines? 2. How much is the total ordinary deductions? 3. How much is the net taxable estate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given Shares of stocks in Ayala Land Corp Cost P3500000 Unrealized gain P500000 Ordinary unlisted sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started