Answered step by step

Verified Expert Solution

Question

1 Approved Answer

done in excel preferably disregard question 2.36 contracts for a particular year trade at $50 and $56, respectively? 2.36. What position is equivalent to a

done in excel preferably

disregard question 2.36

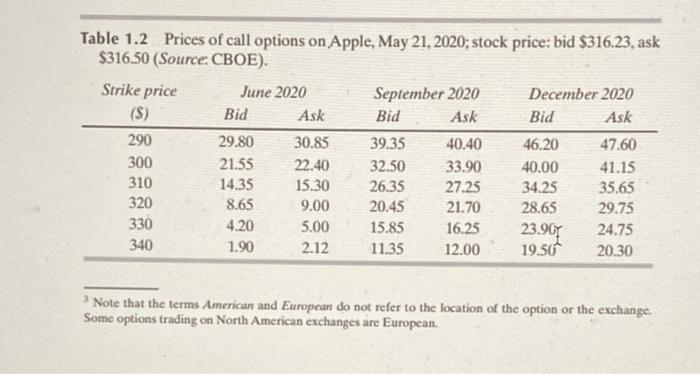

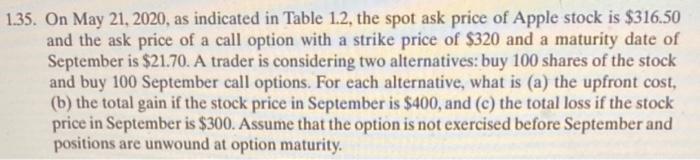

contracts for a particular year trade at $50 and $56, respectively? 2.36. What position is equivalent to a long forward contract to buy an asset at K on a certain date and a put option to sell it for K on that date. 2.37. A bank's derivatives transactions with a counter art are worth $10 million to the bank Table 1.2 Prices of call options on Apple, May 21, 2020; stock price: bid $316.23, ask $316.50 (Source: CBOE). Strike price June 2020 September 2020 December 2020 ($) Bid Ask Bid Ask Bid Ask 290 29.80 30.85 39.35 40.40 46.20 47.60 300 21.55 22.40 32.50 33.90 40.00 41.15 310 14.35 15.30 26.35 27.25 34.25 35.65 320 8.65 9.00 20.45 21.70 28.65 29.75 330 4.20 5.00 15.85 16.25 23.907 24.75 340 1.90 2.12 11.35 12.00 19.50 20.30 Note that the terms American and European do not refer to the location of the option or the exchange. Some options trading on North American exchanges are European. 1.35. On May 21, 2020, as indicated in Table 1.2, the spot ask price of Apple stock is $316.50 and the ask price of a call option with a strike price of $320 and a maturity date of September is $21.70. A trader is considering two alternatives: buy 100 shares of the stock and buy 100 September call options. For each alternative, what is (a) the upfront cost, (b) the total gain if the stock price in September is $400, and (c) the total loss if the stock price in September is $300. Assume that the option is not exercised before September and positions are unwound at option maturity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started