Answered step by step

Verified Expert Solution

Question

1 Approved Answer

done! Suppose that Sherman Co, a U.S,-based MNC is considering a plan to establsh a subsidiary in Singapore. The MNC would establish the subsidiary using

done!

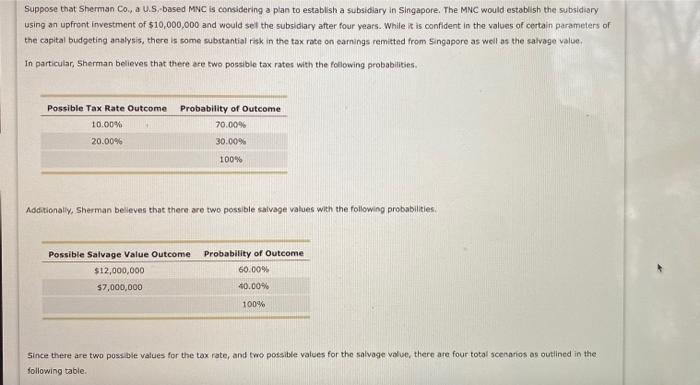

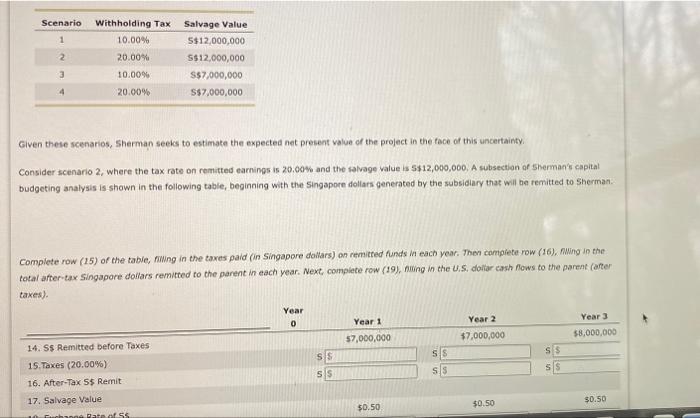

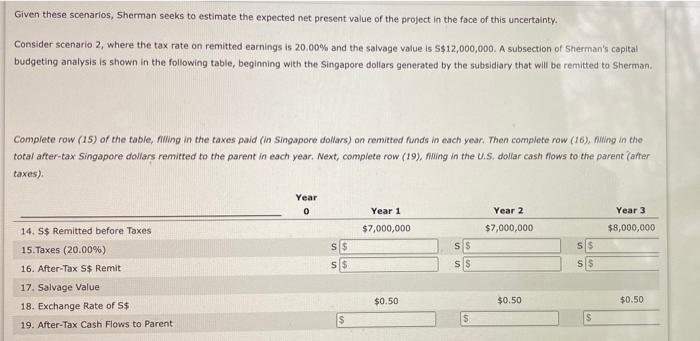

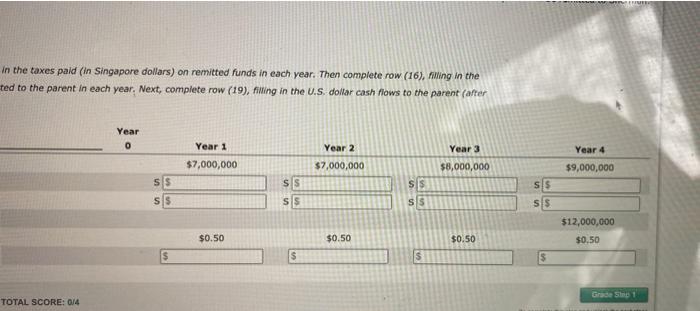

Suppose that Sherman Co, a U.S,-based MNC is considering a plan to establsh a subsidiary in Singapore. The MNC would establish the subsidiary using an upfront investment of $10,000,000 and would sel the subsidlary after four years. While in is confident in the values of certain parameters of the capital budgeting analysis, there is some substantial risk in the tax rate on earnings remitted from singapore as weil as the salvage value. In particular, Sherman believes that there are two possible tax rates with the following probabilities. Addionally, Sherman beleves that there are two possible salvage values with the following probabilities. Since there are two possbie values for the tax rate, and two possible values for the salvage volue, there are four total scenarios as outined in the following table. Given theie scenarios, Sherman seeis to estimate the expected net present value of the projact in the face of this uncertainty. Consider scenario 2. where the tax rate on remitted earnings is 20.00\% and the salvage value is 5112,000,000, A subsection of 5 herman's capital budgeting analysis is shown in the following table, beginning with the Singapore dollars generated by the subsidiary that will be remitted to Sherman. Compiete row (15) of the tabie, fming in the taxes paid (in Singapore dounars) on remitted funds in each vear. Then compiete row (16), fuming in the total after-tax Singapore doilars remitted to the parent in each year. Next complete row (19), fumng in the UiS, dollar cash fows to the parent (arter taxes). Given these scenarios, Sherman seeks to estimate the expected net present value of the project in the face of this uncertainty. Consider scenario 2 , where the tax rate on remitted earnings is 20.00% and the salvage value is 5$12,000,000. A subsection of Sherman's capital budgeting analysis is shown in the following table, beginning with the singapore dollars generated by the subsidiary that will be remitted to Sherman. Complete row (15) of the table, fiWing in the taxes paid (in Singapore dollars) on remitted funds in each year. Then complete row (16), nining in the total after-tax. Singapore dollars remitted to the parent in each year. Next, complete row (19), fining in the U.S. dollar cash flows to the parent (after taxes). in the taxes paid (in Singapore dollars) on remitted funds in each vear. Then complete row (16), filing in the ted to the parent in each year. Next, complete row (19), filing in the U.S. dollar cash flows to the pareint faffer Suppose that Sherman Co, a U.S,-based MNC is considering a plan to establsh a subsidiary in Singapore. The MNC would establish the subsidiary using an upfront investment of $10,000,000 and would sel the subsidlary after four years. While in is confident in the values of certain parameters of the capital budgeting analysis, there is some substantial risk in the tax rate on earnings remitted from singapore as weil as the salvage value. In particular, Sherman believes that there are two possible tax rates with the following probabilities. Addionally, Sherman beleves that there are two possible salvage values with the following probabilities. Since there are two possbie values for the tax rate, and two possible values for the salvage volue, there are four total scenarios as outined in the following table. Given theie scenarios, Sherman seeis to estimate the expected net present value of the projact in the face of this uncertainty. Consider scenario 2. where the tax rate on remitted earnings is 20.00\% and the salvage value is 5112,000,000, A subsection of 5 herman's capital budgeting analysis is shown in the following table, beginning with the Singapore dollars generated by the subsidiary that will be remitted to Sherman. Compiete row (15) of the tabie, fming in the taxes paid (in Singapore dounars) on remitted funds in each vear. Then compiete row (16), fuming in the total after-tax Singapore doilars remitted to the parent in each year. Next complete row (19), fumng in the UiS, dollar cash fows to the parent (arter taxes). Given these scenarios, Sherman seeks to estimate the expected net present value of the project in the face of this uncertainty. Consider scenario 2 , where the tax rate on remitted earnings is 20.00% and the salvage value is 5$12,000,000. A subsection of Sherman's capital budgeting analysis is shown in the following table, beginning with the singapore dollars generated by the subsidiary that will be remitted to Sherman. Complete row (15) of the table, fiWing in the taxes paid (in Singapore dollars) on remitted funds in each year. Then complete row (16), nining in the total after-tax. Singapore dollars remitted to the parent in each year. Next, complete row (19), fining in the U.S. dollar cash flows to the parent (after taxes). in the taxes paid (in Singapore dollars) on remitted funds in each vear. Then complete row (16), filing in the ted to the parent in each year. Next, complete row (19), filing in the U.S. dollar cash flows to the pareint faffer Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started