Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Donna Maxwell works at College of El Paso and is paid 515 per hour for a 40-hour workweek and time and a half for hours

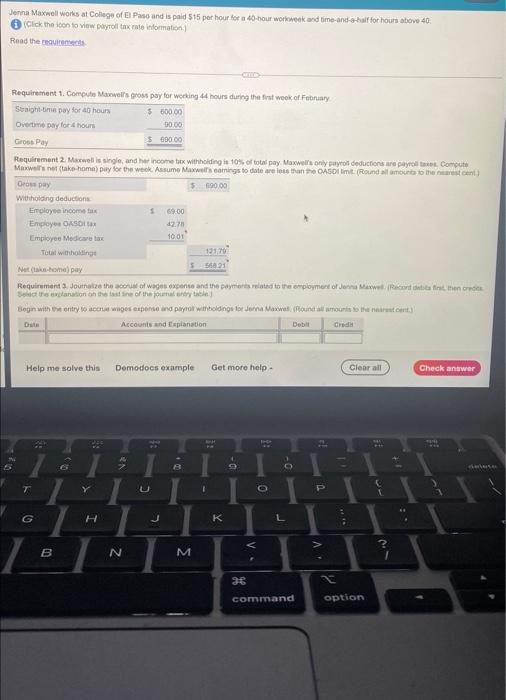

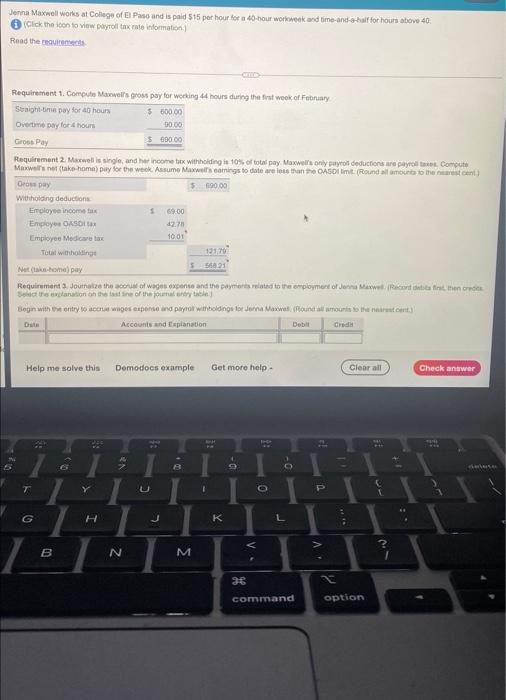

Donna Maxwell works at College of El Paso and is paid 515 per hour for a 40-hour workweek and time and a half for hours above 40. (Click then to view payroll tax rate information) Read their Requirement 1. Compute Marvel's Gross pay for working hours during the first week of February Straight-time pay for 4 hours $ 600.00 Overtime pay for 4 hours 90.00 Gross Pay $ 600,00 Requirement 2. Marwellissing and income tax withholding is 10% of total pay. Maxwell's only yo deductions are payroll Compute Maxwell's not take home) pay for the week. Assume Maxwels camins to date areas an OASI mt (Round out to the cent) Gay 5690.00 Withholding deductions Employee income $ 69.00 Employee ORSO 42.70 1001 Employee Medicare la Total with holding 121.70 5621 Net (kebome) pay Requirements. Joutrotz the of wagesponse and the payments related to the employment of Jenna Maxwelcofit then we Seit eration on the best of the journal Begin with entry to get expense and payroll with boldings for Jena Maxwelround all amounts to the nortet De Accounts and explanation Debat Help me solve this Demodocs example Get more help Clear all Check answer 1 . A T Y u 0 P G H J L V ? B N M command option Donna Maxwell works at College of El Paso and is paid 515 per hour for a 40-hour workweek and time and a half for hours above 40. (Click then to view payroll tax rate information) Read their Requirement 1. Compute Marvel's Gross pay for working hours during the first week of February Straight-time pay for 4 hours $ 600.00 Overtime pay for 4 hours 90.00 Gross Pay $ 600,00 Requirement 2. Marwellissing and income tax withholding is 10% of total pay. Maxwell's only yo deductions are payroll Compute Maxwell's not take home) pay for the week. Assume Maxwels camins to date areas an OASI mt (Round out to the cent) Gay 5690.00 Withholding deductions Employee income $ 69.00 Employee ORSO 42.70 1001 Employee Medicare la Total with holding 121.70 5621 Net (kebome) pay Requirements. Joutrotz the of wagesponse and the payments related to the employment of Jenna Maxwelcofit then we Seit eration on the best of the journal Begin with entry to get expense and payroll with boldings for Jena Maxwelround all amounts to the nortet De Accounts and explanation Debat Help me solve this Demodocs example Get more help Clear all Check answer 1 . A T Y u 0 P G H J L V ? B N M command option

Donna Maxwell works at College of El Paso and is paid 515 per hour for a 40-hour workweek and time and a half for hours above 40. (Click then to view payroll tax rate information) Read their Requirement 1. Compute Marvel's Gross pay for working hours during the first week of February Straight-time pay for 4 hours $ 600.00 Overtime pay for 4 hours 90.00 Gross Pay $ 600,00 Requirement 2. Marwellissing and income tax withholding is 10% of total pay. Maxwell's only yo deductions are payroll Compute Maxwell's not take home) pay for the week. Assume Maxwels camins to date areas an OASI mt (Round out to the cent) Gay 5690.00 Withholding deductions Employee income $ 69.00 Employee ORSO 42.70 1001 Employee Medicare la Total with holding 121.70 5621 Net (kebome) pay Requirements. Joutrotz the of wagesponse and the payments related to the employment of Jenna Maxwelcofit then we Seit eration on the best of the journal Begin with entry to get expense and payroll with boldings for Jena Maxwelround all amounts to the nortet De Accounts and explanation Debat Help me solve this Demodocs example Get more help Clear all Check answer 1 . A T Y u 0 P G H J L V ? B N M command option Donna Maxwell works at College of El Paso and is paid 515 per hour for a 40-hour workweek and time and a half for hours above 40. (Click then to view payroll tax rate information) Read their Requirement 1. Compute Marvel's Gross pay for working hours during the first week of February Straight-time pay for 4 hours $ 600.00 Overtime pay for 4 hours 90.00 Gross Pay $ 600,00 Requirement 2. Marwellissing and income tax withholding is 10% of total pay. Maxwell's only yo deductions are payroll Compute Maxwell's not take home) pay for the week. Assume Maxwels camins to date areas an OASI mt (Round out to the cent) Gay 5690.00 Withholding deductions Employee income $ 69.00 Employee ORSO 42.70 1001 Employee Medicare la Total with holding 121.70 5621 Net (kebome) pay Requirements. Joutrotz the of wagesponse and the payments related to the employment of Jenna Maxwelcofit then we Seit eration on the best of the journal Begin with entry to get expense and payroll with boldings for Jena Maxwelround all amounts to the nortet De Accounts and explanation Debat Help me solve this Demodocs example Get more help Clear all Check answer 1 . A T Y u 0 P G H J L V ? B N M command option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started